US Consumer Prices Increase In June: Inflation Remains Elevated

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Consumer Prices Increase in June: Inflation Remains Elevated, Raising Concerns

Headline: US Inflation Holds Steady in June, Keeping Pressure on Fed

Introduction: The US Consumer Price Index (CPI) rose 0.2% in June, according to the latest data released by the Bureau of Labor Statistics (BLS), signaling that inflation remains stubbornly elevated despite the Federal Reserve's aggressive interest rate hikes. This persistent inflation continues to pose a significant challenge to the US economy and adds pressure on the central bank to further tighten monetary policy. While the monthly increase was smaller than some economists predicted, the underlying trend suggests that bringing inflation back down to the Fed's 2% target remains a complex and lengthy process.

Key Findings from the June CPI Report:

-

0.2% Monthly Increase: The headline CPI rose by 0.2% in June, matching May's increase and slightly below market expectations. This suggests a potential slowing of the inflation rate, but experts caution against reading too much into a single month's data.

-

3% Year-Over-Year Increase: More concerning is the annual inflation rate, which remains significantly above the Fed's target. The CPI increased by 3% compared to June 2022, demonstrating that the battle against inflation is far from won.

-

Shelter Costs Remain a Major Driver: Shelter costs, a significant component of the CPI, continued to contribute heavily to the overall increase. This reflects the lingering impact of elevated housing prices and rents, which are notoriously slow to adjust. Experts predict shelter costs will continue to impact inflation figures for the coming months.

-

Core Inflation Holds Steady: Core inflation, which excludes volatile food and energy prices, also showed a modest increase, indicating broad-based price pressures across the economy. This persistence of core inflation underscores the challenges facing the Fed in its efforts to tame inflation.

What Does This Mean for the Economy?

The persistent inflation poses several challenges to the US economy:

-

Continued Pressure on Consumers: Elevated prices continue to squeeze household budgets, reducing consumer spending and potentially slowing economic growth. Many consumers are relying on savings and credit to maintain their lifestyles, a factor that could have significant long-term consequences.

-

Uncertainty for the Federal Reserve: The Fed faces a difficult balancing act. Further interest rate hikes could stifle economic growth and potentially trigger a recession, while maintaining current rates risks allowing inflation to become entrenched. Future interest rate decisions will depend heavily on incoming economic data and assessments of inflation’s trajectory.

-

Impact on the Labor Market: While the labor market remains relatively strong, persistent inflation could lead to wage stagnation or slow wage growth as businesses struggle to manage rising costs. This could further impact consumer spending and overall economic health.

Looking Ahead:

The ongoing inflation battle is likely to shape economic policy and consumer behavior for the foreseeable future. The coming months will be critical in determining whether the recent slowdown in inflation is a temporary blip or a sign of a more sustainable trend. Economists and investors will be closely scrutinizing future CPI reports and other economic indicators for clues about the direction of inflation and the Federal Reserve's next move. Further analysis from organizations like the Federal Reserve Bank of St. Louis and the Congressional Budget Office will be crucial in understanding the longer-term implications of these trends.

Call to Action: Stay informed about economic developments by following reputable news sources and government reports. Understanding inflation's impact is crucial for making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Consumer Prices Increase In June: Inflation Remains Elevated. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Consumer Prices Increase In June Inflation Remains Elevated

Aug 18, 2025

Us Consumer Prices Increase In June Inflation Remains Elevated

Aug 18, 2025 -

Essential Grocery Item Price Shifts Whats Getting More Expensive

Aug 18, 2025

Essential Grocery Item Price Shifts Whats Getting More Expensive

Aug 18, 2025 -

From Trumps Photo To Bulldozer My Unexpected Camping Trip

Aug 18, 2025

From Trumps Photo To Bulldozer My Unexpected Camping Trip

Aug 18, 2025 -

Update Investigation Continues Following Sundays Motorcycle Crash In Beloit

Aug 18, 2025

Update Investigation Continues Following Sundays Motorcycle Crash In Beloit

Aug 18, 2025 -

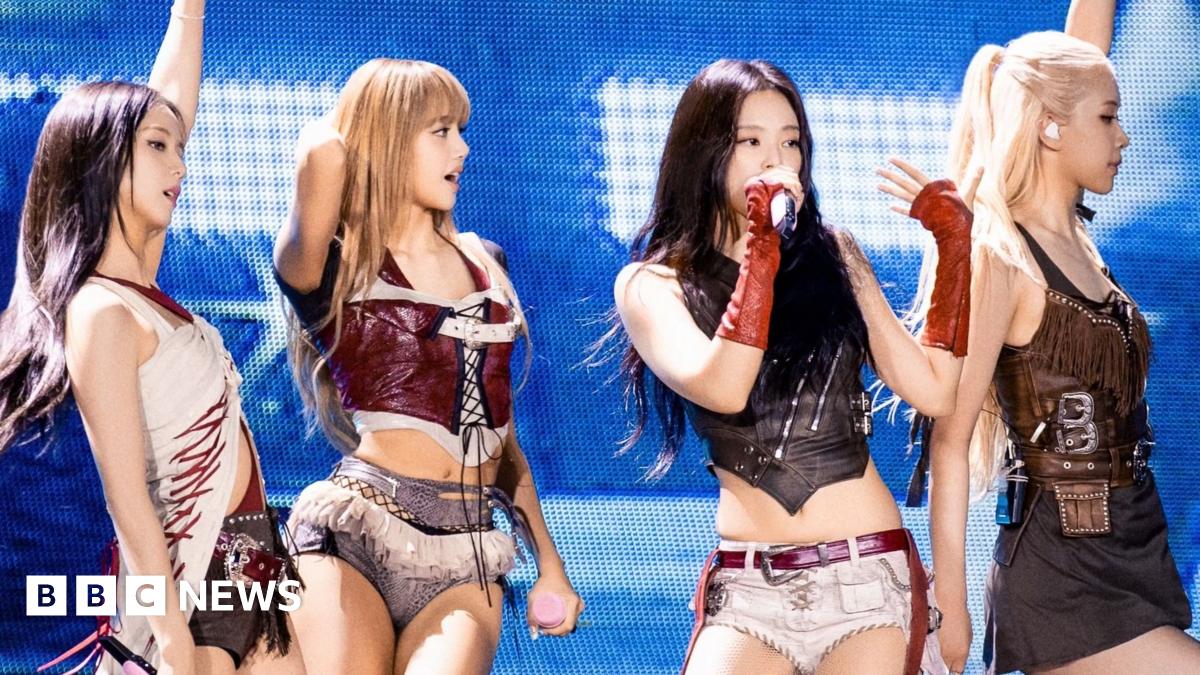

K Pop Sensation Blackpink Fulfill Wembley Stadium Dream

Aug 18, 2025

K Pop Sensation Blackpink Fulfill Wembley Stadium Dream

Aug 18, 2025

Latest Posts

-

Putins Land Demand For Peace A New Chapter In The Ukraine Conflict

Aug 18, 2025

Putins Land Demand For Peace A New Chapter In The Ukraine Conflict

Aug 18, 2025 -

Update Investigation Into Sunday Motorcycle Crash In Beloit

Aug 18, 2025

Update Investigation Into Sunday Motorcycle Crash In Beloit

Aug 18, 2025 -

From Claires To Shein Exploring The Evolution Of Girls Fashion And Accessory Trends

Aug 18, 2025

From Claires To Shein Exploring The Evolution Of Girls Fashion And Accessory Trends

Aug 18, 2025 -

From Cars To Cuisine Michelin Starred Chef Launches Restaurant In Singapore Car Factory

Aug 18, 2025

From Cars To Cuisine Michelin Starred Chef Launches Restaurant In Singapore Car Factory

Aug 18, 2025 -

Frustration Mounts Ketel Martes Absence And Day Off Requests Strain D Backs Team Dynamic

Aug 18, 2025

Frustration Mounts Ketel Martes Absence And Day Off Requests Strain D Backs Team Dynamic

Aug 18, 2025