The Student Loan Bubble: How Close Are We To A Pop? Expert Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Student Loan Bubble: How Close Are We to a Pop? Expert Analysis

The soaring cost of higher education has created a massive student loan debt bubble in the United States, leaving many wondering: how close are we to a bursting point? The sheer scale of the problem is staggering, with trillions of dollars in outstanding student loan debt impacting millions of Americans. This isn't just a financial concern; it's a societal one, affecting everything from homeownership rates to economic growth. Let's delve into the expert analysis and explore the potential consequences.

The Current State of Student Loan Debt:

The total amount of student loan debt in the US currently exceeds $1.7 trillion, surpassing both auto loan and credit card debt. This represents a significant increase over the past two decades, fueled by rising tuition costs that have outpaced inflation. The average student loan borrower graduates with over $37,000 in debt, a figure that places immense pressure on their financial futures. This burden is particularly acute for those pursuing advanced degrees, such as Master's or PhD programs, where debt levels can reach six figures.

Factors Contributing to the "Bubble":

Several factors have contributed to this precarious situation:

- Rising Tuition Costs: College tuition has increased dramatically faster than wages, making it increasingly difficult for students and families to afford higher education without incurring substantial debt.

- Easy Access to Loans: The relatively easy access to federal and private student loans has encouraged borrowing, often without a full understanding of the long-term financial implications.

- Limited Transparency: The complex system of student loans, repayment plans, and loan forgiveness programs can be difficult for borrowers to navigate, leading to poor financial decisions.

- Declining Value of a College Degree: In certain fields, the return on investment for a college degree has diminished, raising questions about the overall value of higher education in relation to the debt incurred.

Expert Opinions and Predictions:

Experts hold varying perspectives on the likelihood of a student loan bubble bursting. Some argue that the current system is unsustainable and predict a major crisis. Others believe that government intervention, such as loan forgiveness programs or income-driven repayment plans, will prevent a catastrophic collapse. However, even with these interventions, the long-term impact on the economy remains a subject of debate. The ongoing discussion surrounding loan forgiveness highlights the political and economic complexities surrounding this issue. [Link to relevant government website on student loan forgiveness].

Potential Consequences of a "Pop":

A significant disruption in the student loan market could have far-reaching consequences:

- Economic Slowdown: Reduced consumer spending due to high debt burdens could stifle economic growth.

- Increased Defaults: A wave of defaults could destabilize the financial system and impact lenders.

- Reduced Homeownership: High student loan debt can make it difficult for borrowers to qualify for mortgages, impacting the housing market.

- Social Inequality: The burden of student loan debt disproportionately affects low-income and minority students, exacerbating existing inequalities.

What Can Be Done?

Addressing the student loan crisis requires a multi-pronged approach:

- Tuition Reform: Exploring ways to control the rising cost of college tuition is paramount.

- Increased Financial Literacy: Educating students and families about responsible borrowing and financial planning is crucial.

- Loan Forgiveness and Repayment Reform: Developing more effective and equitable loan forgiveness and repayment programs is necessary.

- Alternative Funding Models: Exploring alternative funding models for higher education, such as income-share agreements, could alleviate the pressure on students.

Conclusion:

The student loan bubble represents a significant challenge to the US economy and society. While the exact timing and impact of a potential "pop" remain uncertain, the issue demands urgent attention. The need for comprehensive reform is undeniable, and proactive measures are crucial to mitigate the potential consequences of this looming crisis. The future of higher education and the financial well-being of millions depend on it. Stay informed and engage in the conversation – your voice matters.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Student Loan Bubble: How Close Are We To A Pop? Expert Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beijings Military Might A Deep Dive Into The New Weapons Displayed At The Parade

Sep 05, 2025

Beijings Military Might A Deep Dive Into The New Weapons Displayed At The Parade

Sep 05, 2025 -

Dramatic Escape Attempt Rear Axle Failure Halts Stolen Car

Sep 05, 2025

Dramatic Escape Attempt Rear Axle Failure Halts Stolen Car

Sep 05, 2025 -

Ethics Controversy Bondis Dismissal Of Top Doj Adviser Sparks Debate

Sep 05, 2025

Ethics Controversy Bondis Dismissal Of Top Doj Adviser Sparks Debate

Sep 05, 2025 -

Are Student Loans An Affordable Path To The American Dream A Critical Look

Sep 05, 2025

Are Student Loans An Affordable Path To The American Dream A Critical Look

Sep 05, 2025 -

Remembering Xena Warrior Princess 30 Years Of A Cultural Icon

Sep 05, 2025

Remembering Xena Warrior Princess 30 Years Of A Cultural Icon

Sep 05, 2025

Latest Posts

-

Brother Weases Abrupt Departure A Wave Of Fan Reactions

Sep 06, 2025

Brother Weases Abrupt Departure A Wave Of Fan Reactions

Sep 06, 2025 -

Brother Weases Lasting Legacy On Rochester Radio

Sep 06, 2025

Brother Weases Lasting Legacy On Rochester Radio

Sep 06, 2025 -

Buckingham Palace Confirms Death Of Duchess Of Kent At Age 92

Sep 06, 2025

Buckingham Palace Confirms Death Of Duchess Of Kent At Age 92

Sep 06, 2025 -

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025 -

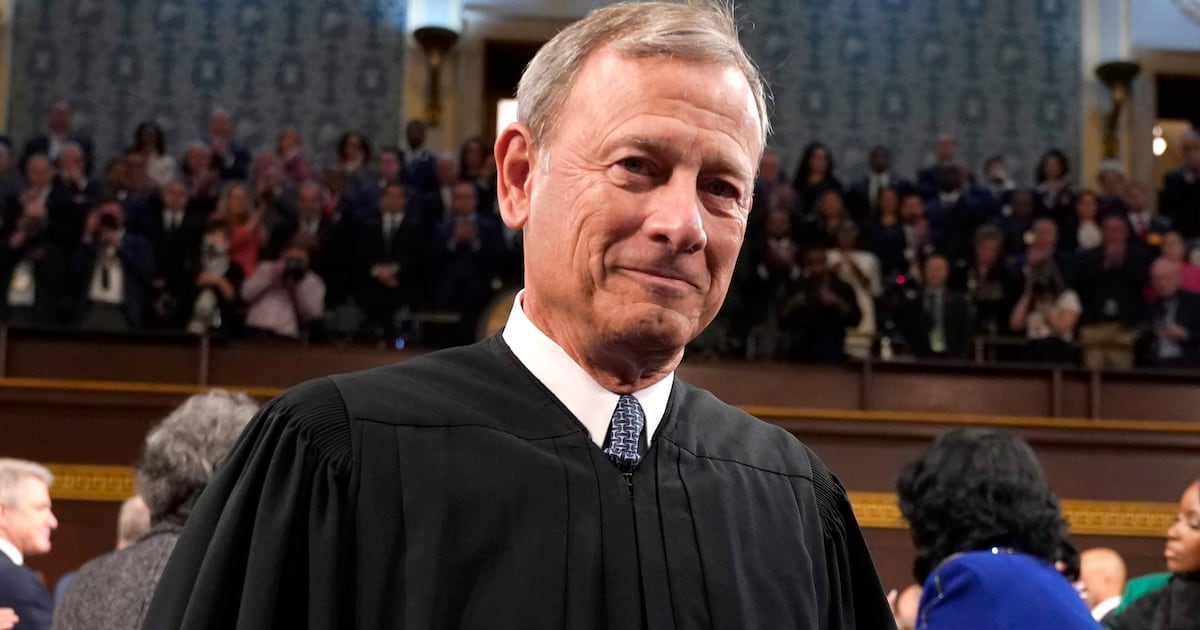

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025