Are Student Loans An Affordable Path To The American Dream? A Critical Look.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Student Loans an Affordable Path to the American Dream? A Critical Look.

The American dream: a home, a family, financial security. For many, higher education is seen as the key to unlocking this dream. But with the soaring cost of tuition and the ever-increasing reliance on student loans, is this path truly affordable? This critical look examines the realities of student loan debt and its impact on the pursuit of the American dream.

The narrative surrounding higher education often paints a rosy picture. A college degree equals a higher-paying job, leading to financial stability and a comfortable life. While this can be true for some, the reality for many graduates is far more complex, burdened by crippling student loan debt. The average student loan debt for the Class of 2022 was a staggering $37,000 – a figure that continues to climb.

The Mounting Burden of Student Loan Debt:

The sheer amount of student loan debt in the United States is staggering, exceeding $1.7 trillion. This represents a significant financial burden for millions of Americans, impacting their ability to achieve key milestones of the American dream. These milestones include:

- Homeownership: High student loan payments can make saving for a down payment and managing monthly mortgage payments extremely difficult, pushing homeownership further out of reach.

- Starting a Family: The financial strain of student loans can delay or prevent the decision to have children, significantly impacting family planning.

- Retirement Savings: With a large portion of income dedicated to loan repayment, saving for retirement often takes a backseat, potentially jeopardizing financial security in later life.

- Entrepreneurship: The fear of debt often discourages individuals from pursuing entrepreneurial ventures, limiting opportunities for financial growth and independence.

Is Higher Education Still Worth the Investment?

The question of whether higher education is still a worthwhile investment is a complex one. While a college degree can significantly increase earning potential over a lifetime, the rising cost of tuition and the accompanying debt necessitate a careful cost-benefit analysis. Factors to consider include:

- Choosing the Right Program: Not all degrees are created equal. Certain fields offer higher earning potential and better job prospects, making the investment in education more justifiable. Researching in-demand careers and aligning your educational path accordingly is crucial.

- Exploring Affordable Options: Consider community colleges, online learning platforms, and scholarships to reduce the overall cost of education and minimize loan dependence. The offers valuable resources for navigating financial aid options.

- Developing a Realistic Budget: Before taking out student loans, create a detailed budget outlining tuition costs, living expenses, and potential loan repayment amounts. This will help you make informed decisions and avoid overwhelming debt.

Navigating the Student Loan Landscape:

Understanding different types of student loans, repayment plans, and potential forgiveness programs is crucial. The government offers several repayment options, including income-driven repayment plans that adjust monthly payments based on income. Additionally, certain professions may qualify for loan forgiveness programs. Explore resources like the to understand your loan details and available options.

Conclusion:

The pursuit of the American dream shouldn't be synonymous with insurmountable debt. While higher education can be a valuable asset, it's crucial to approach it strategically. By carefully weighing the costs and benefits, exploring affordable options, and understanding the complexities of student loan repayment, individuals can strive towards achieving their goals without being shackled by overwhelming debt. A critical and informed approach to higher education is vital to ensuring that it truly serves as a pathway to a brighter future, rather than a significant obstacle.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Student Loans An Affordable Path To The American Dream? A Critical Look.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Open 2025 Semifinals Get Results Watch Live And See The Schedule

Sep 05, 2025

Us Open 2025 Semifinals Get Results Watch Live And See The Schedule

Sep 05, 2025 -

Underwater Exploration Reveals Captain Scotts Terra Nova Wreckage

Sep 05, 2025

Underwater Exploration Reveals Captain Scotts Terra Nova Wreckage

Sep 05, 2025 -

Replica Trophy For Fifa Champs Trump Holds Original Gold Cup

Sep 05, 2025

Replica Trophy For Fifa Champs Trump Holds Original Gold Cup

Sep 05, 2025 -

Silent Killer Parasitic Disease Spreads Across The Us Expert Warning

Sep 05, 2025

Silent Killer Parasitic Disease Spreads Across The Us Expert Warning

Sep 05, 2025 -

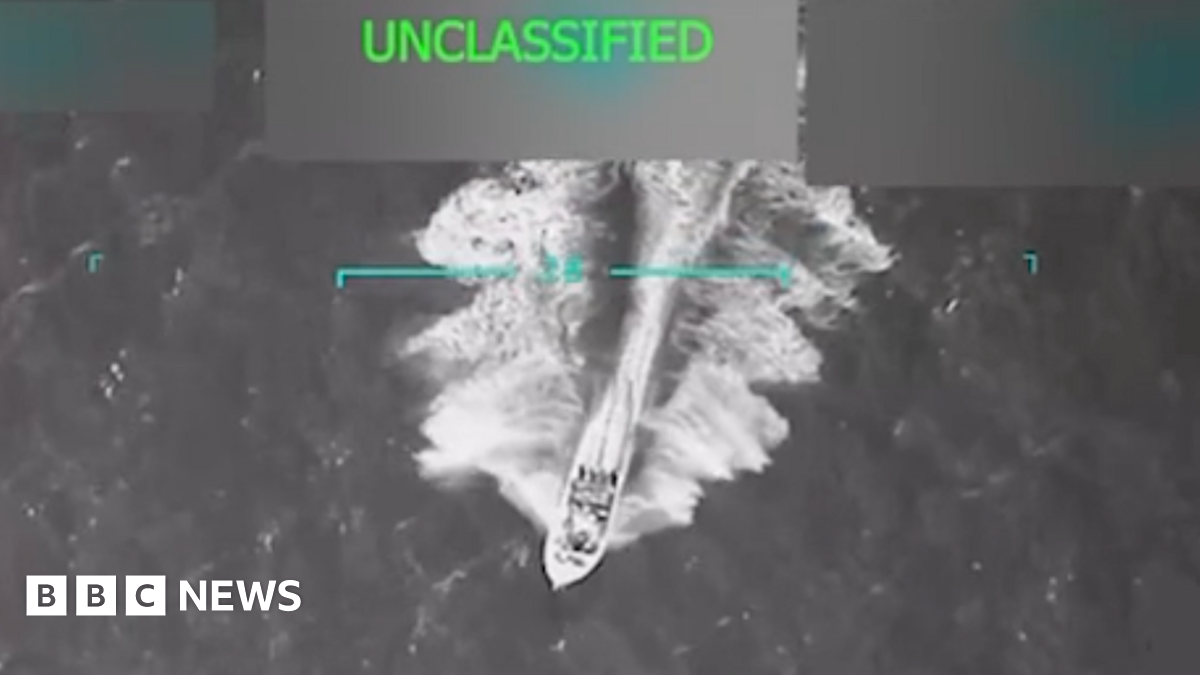

Eleven Killed In Us Airstrike On Venezuelan Drug Smuggling Vessel Trump

Sep 05, 2025

Eleven Killed In Us Airstrike On Venezuelan Drug Smuggling Vessel Trump

Sep 05, 2025