Expected Rise In U.S. Consumer Prices Confirmed: June Inflation Data Released

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expected Rise in U.S. Consumer Prices Confirmed: June Inflation Data Released

The U.S. Department of Labor's release of June's Consumer Price Index (CPI) data has confirmed economists' predictions: inflation remains stubbornly high. While the rate of increase slowed slightly compared to May, the numbers still paint a picture of persistent inflationary pressures impacting American households and fueling ongoing economic uncertainty. This news will undoubtedly influence the Federal Reserve's upcoming decisions on interest rates.

June CPI Data: A Closer Look

The June CPI data showed a 3% increase year-over-year, a slight deceleration from May's 4% jump. However, this seemingly positive trend is tempered by the core CPI, which excludes volatile food and energy prices. Core CPI rose by 0.2% for the month and 4.8% year-over-year – a figure that indicates underlying inflationary pressures are far from dissipating. This persistent inflation continues to erode purchasing power and poses a significant challenge for consumers struggling with rising costs of living.

Key Factors Contributing to Inflationary Pressures

Several factors contribute to the ongoing inflation, creating a complex economic landscape:

- Supply Chain Disruptions: While supply chain bottlenecks have eased somewhat, lingering disruptions continue to impact the availability and cost of goods. This is particularly evident in certain sectors, leading to higher prices for consumers.

- Strong Consumer Demand: Robust consumer spending, fueled by a still-strong labor market, continues to put upward pressure on prices. This increased demand outpaces supply in several areas, exacerbating inflationary pressures.

- Energy Prices: Although energy prices saw a slight dip in June, they remain elevated compared to previous years, contributing significantly to overall inflation. The volatility in global energy markets adds further uncertainty.

- Housing Costs: Shelter costs, a significant component of the CPI, continue to rise sharply, reflecting increasing rents and home prices. This persistent upward trend significantly impacts the overall inflation rate.

The Federal Reserve's Response and Future Outlook

The persistent inflation, despite a slight slowdown, is likely to influence the Federal Reserve's monetary policy decisions. Many economists anticipate another interest rate hike in the coming months to curb inflation. The effectiveness of these measures in cooling the economy without triggering a recession remains a key concern. The Fed will be carefully monitoring upcoming economic indicators, including employment data and future CPI releases, to inform its future actions.

What Does This Mean for Consumers?

For American consumers, the ongoing inflation means continued pressure on household budgets. Rising prices for essential goods and services, from groceries to housing, necessitate careful financial planning and budgeting. Consumers may need to adjust their spending habits and explore strategies for mitigating the impact of inflation. Seeking financial advice and exploring resources for managing personal finances could prove beneficial during this period of economic uncertainty.

Looking Ahead:

The June inflation data provides a mixed picture. While the headline inflation number decreased slightly, the core inflation rate remains stubbornly high, highlighting the persistent challenges the US economy faces. The Federal Reserve’s next moves and the evolution of global economic conditions will ultimately determine whether the current inflationary pressures will ease or persist in the coming months. Staying informed about economic developments and adjusting financial strategies accordingly is crucial for navigating these uncertain times. [Link to reliable economic news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expected Rise In U.S. Consumer Prices Confirmed: June Inflation Data Released. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

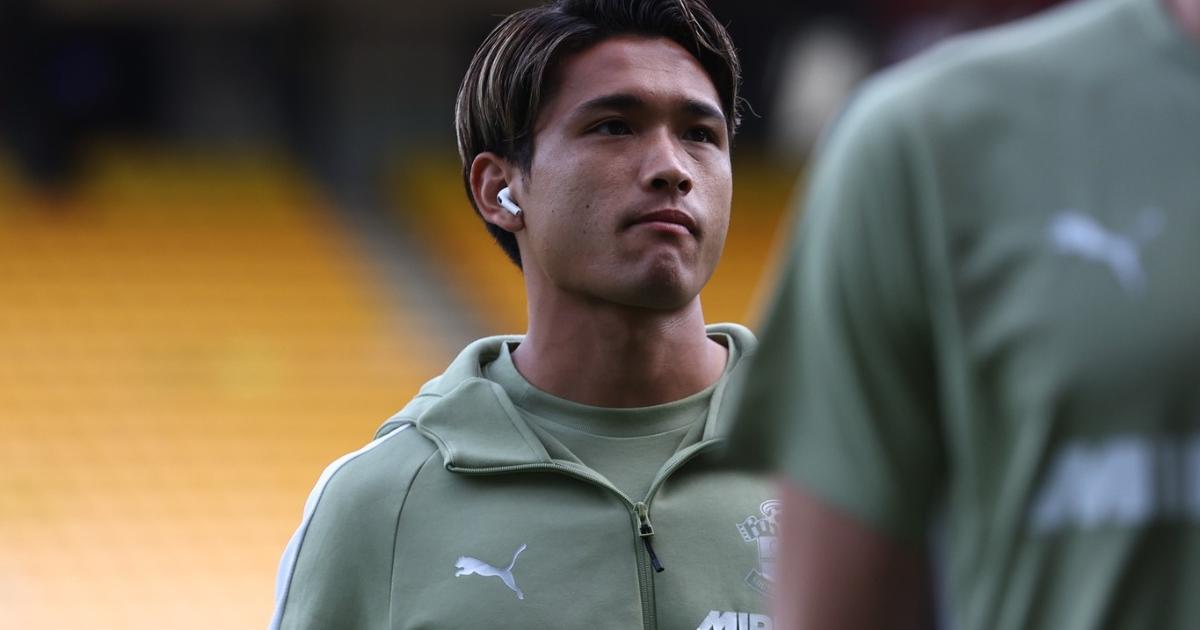

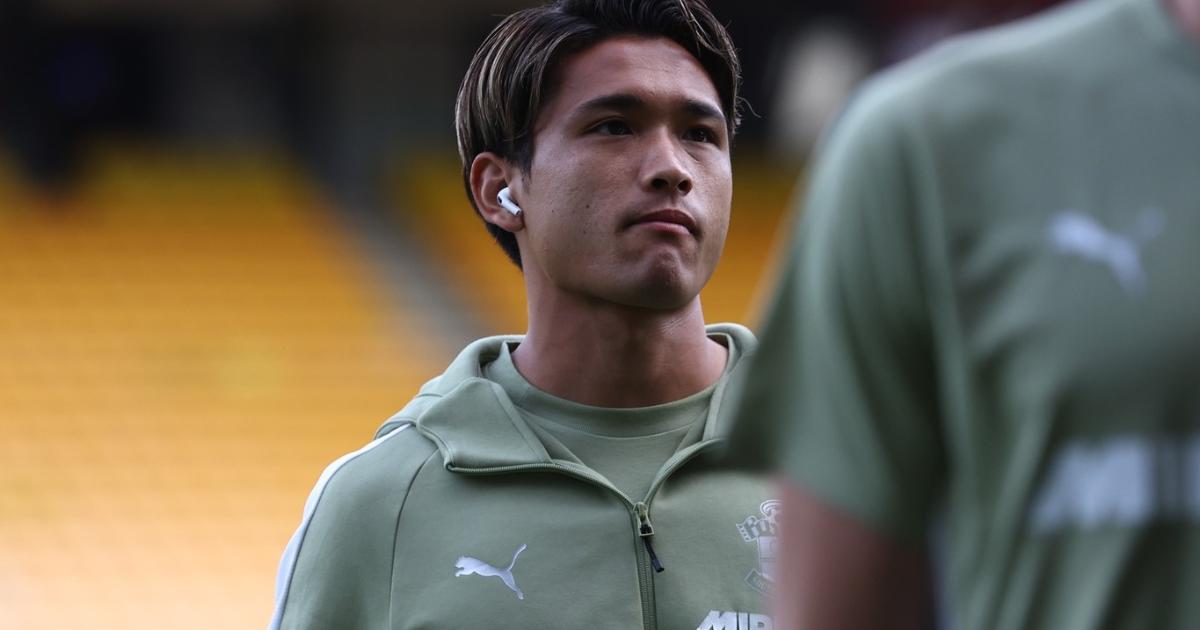

Southampton Manager Defends Matsuki Still Growing Into Something

Aug 28, 2025

Southampton Manager Defends Matsuki Still Growing Into Something

Aug 28, 2025 -

Ai Deepfake Senator Amy Klobuchars Voice Used In False Sydney Sweeney Ad Attack

Aug 28, 2025

Ai Deepfake Senator Amy Klobuchars Voice Used In False Sydney Sweeney Ad Attack

Aug 28, 2025 -

Assessing Trumps 4 Trillion Debt Reduction Claim A Deeper Dive Into The Tariffs

Aug 28, 2025

Assessing Trumps 4 Trillion Debt Reduction Claim A Deeper Dive Into The Tariffs

Aug 28, 2025 -

Public Opinion Shifts Senator Collins Meets Resistance In Searsport

Aug 28, 2025

Public Opinion Shifts Senator Collins Meets Resistance In Searsport

Aug 28, 2025 -

Alexander Isak Snubs Newcastle North East Trip Yields No Transfer Breakthrough

Aug 28, 2025

Alexander Isak Snubs Newcastle North East Trip Yields No Transfer Breakthrough

Aug 28, 2025

Latest Posts

-

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025 -

Dexter Original Sins Shocking Cancellation After Season 2 Renewal

Aug 28, 2025

Dexter Original Sins Shocking Cancellation After Season 2 Renewal

Aug 28, 2025 -

Trumps Tariffs And The National Debt Separating Fact From Fiction

Aug 28, 2025

Trumps Tariffs And The National Debt Separating Fact From Fiction

Aug 28, 2025 -

Taylor Swift And Travis Kelces Relationship Is Marriage On The Cards

Aug 28, 2025

Taylor Swift And Travis Kelces Relationship Is Marriage On The Cards

Aug 28, 2025 -

Matsukis Growth At Southampton Manager Defends Young Players Progress

Aug 28, 2025

Matsukis Growth At Southampton Manager Defends Young Players Progress

Aug 28, 2025