Assessing Trump's $4 Trillion Debt Reduction Claim: A Deeper Dive Into The Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Assessing Trump's $4 Trillion Debt Reduction Claim: A Deeper Dive into the Tariffs

Donald Trump's presidency was marked by bold pronouncements, and his claim of achieving a $4 trillion reduction in the national debt stands out as particularly contentious. While the administration touted significant economic growth and lower deficits, a closer examination reveals a more nuanced reality, especially regarding the role of tariffs in this equation. This article delves into the complexities of Trump's claim, focusing on the impact of his trade policies on the national debt.

The Claim and the Counterarguments:

Trump frequently cited his administration's economic policies as responsible for substantial debt reduction. However, independent analyses paint a different picture. Many economists argue that the apparent deficit reduction was primarily due to existing economic trends and pre-existing legislation, rather than solely the result of Trump's policies. Furthermore, the COVID-19 pandemic significantly impacted the national debt, overshadowing any potential long-term effects of the Trump administration's fiscal policies.

The Role of Tariffs:

A crucial component of Trump's economic strategy was the imposition of significant tariffs on imported goods, particularly from China. The stated aim was to protect American industries and renegotiate trade deals. While some domestic industries might have experienced short-term benefits, the overall economic impact is complex and debated.

- Increased Prices for Consumers: Tariffs often lead to higher prices for consumers, reducing disposable income and potentially hindering overall economic growth. This can indirectly increase the national debt by slowing economic activity and reducing tax revenues.

- Retaliatory Tariffs: China and other countries responded to Trump's tariffs with their own, leading to trade wars that disrupted global supply chains and negatively impacted American businesses reliant on international trade. These disruptions further complicated the economic landscape and likely impacted debt levels.

- Limited Long-Term Impact: While some industries might have seen temporary gains, the long-term sustainability of this approach remains questionable. The overall economic costs associated with trade wars likely outweigh any short-term benefits for specific sectors.

Beyond Tariffs: Other Contributing Factors:

It's crucial to acknowledge that the national debt is influenced by numerous factors beyond tariffs. These include:

- Tax Cuts: The Tax Cuts and Jobs Act of 2017 significantly reduced corporate and individual income taxes, leading to a substantial increase in the national deficit. This counteracted any potential positive effects of the tariffs on debt reduction.

- Government Spending: Government spending on various programs also plays a major role in influencing the national debt. Increases in spending without corresponding increases in revenue will naturally lead to higher deficits.

- Economic Growth: Strong economic growth can lead to increased tax revenue, helping to reduce the deficit. However, the relationship between specific policies and economic growth is often complex and difficult to isolate.

Conclusion:

Assessing the validity of Trump's $4 trillion debt reduction claim requires a comprehensive analysis of various economic factors, not just the impact of tariffs. While tariffs played a role in his administration's economic strategy, their overall effect on the national debt remains a subject of ongoing debate among economists. The interplay of tax cuts, government spending, and global economic conditions all significantly contribute to the complexities of this issue. A deeper dive into these interconnected factors provides a more accurate understanding of the national debt's trajectory during this period. Further research and analysis are needed to definitively assess the long-term impact of Trump's policies on the U.S. national debt.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Assessing Trump's $4 Trillion Debt Reduction Claim: A Deeper Dive Into The Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Poundland Averted From Administration Rescue Deal Secures Future

Aug 28, 2025

Poundland Averted From Administration Rescue Deal Secures Future

Aug 28, 2025 -

Assessing Trumps 4 Trillion Debt Reduction Claim A Deeper Dive Into The Tariffs

Aug 28, 2025

Assessing Trumps 4 Trillion Debt Reduction Claim A Deeper Dive Into The Tariffs

Aug 28, 2025 -

Norwich City Vs Southampton Saints Secure Comfortable Carabao Cup Win

Aug 28, 2025

Norwich City Vs Southampton Saints Secure Comfortable Carabao Cup Win

Aug 28, 2025 -

Real Or Replica Trumps Possession Of Fifa Trophy Raises Questions

Aug 28, 2025

Real Or Replica Trumps Possession Of Fifa Trophy Raises Questions

Aug 28, 2025 -

Long Lost Nazi Looted Artwork An Estate Agents Unexpected Discovery

Aug 28, 2025

Long Lost Nazi Looted Artwork An Estate Agents Unexpected Discovery

Aug 28, 2025

Latest Posts

-

Alcarazs Hair Transformation A Quick Recovery Documented

Aug 28, 2025

Alcarazs Hair Transformation A Quick Recovery Documented

Aug 28, 2025 -

Us Open 2025 Recap Of Thrilling Second Round Encounters

Aug 28, 2025

Us Open 2025 Recap Of Thrilling Second Round Encounters

Aug 28, 2025 -

Proof Carlos Alcarazs Hair Is Growing Back Fast

Aug 28, 2025

Proof Carlos Alcarazs Hair Is Growing Back Fast

Aug 28, 2025 -

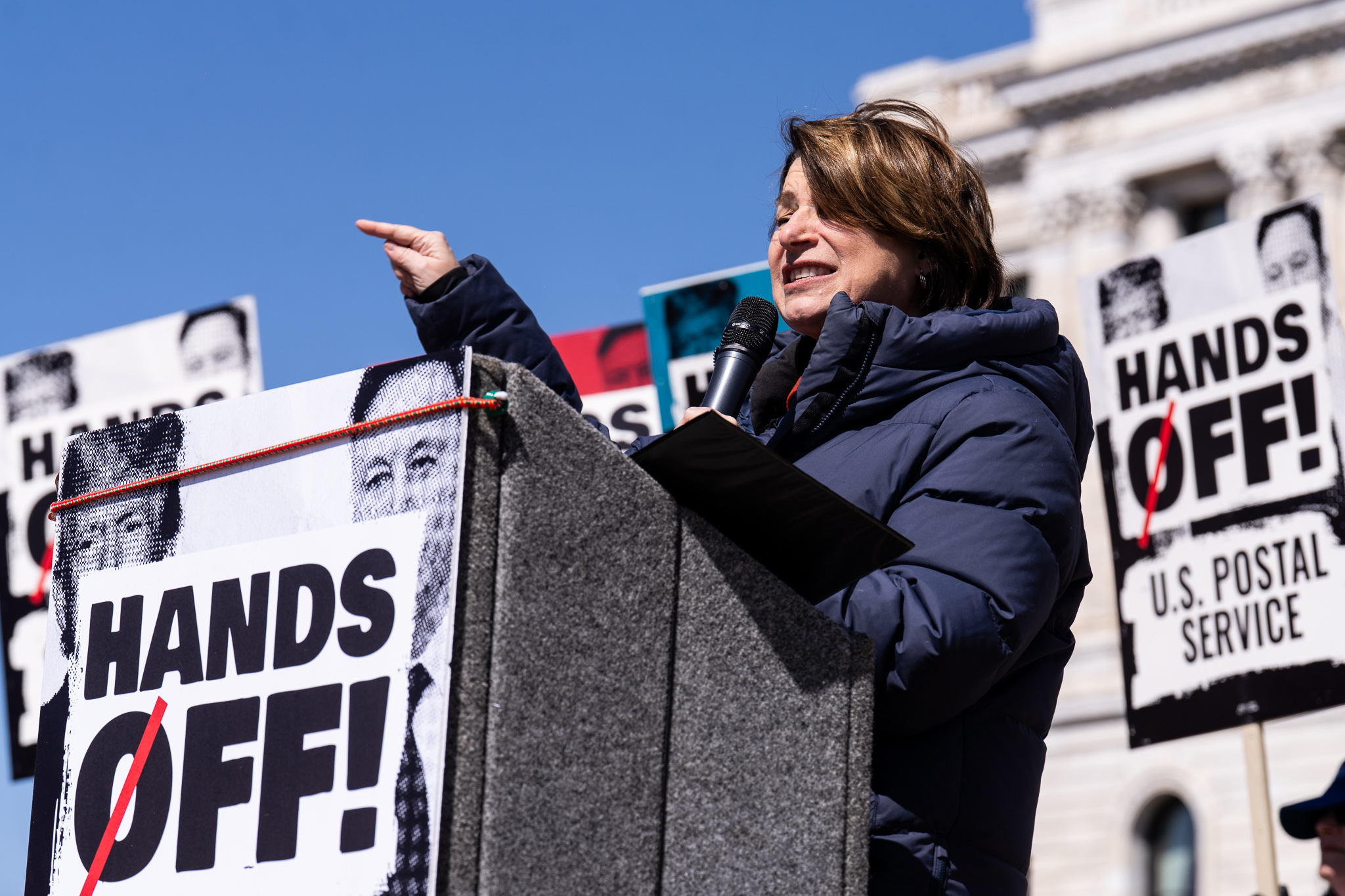

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025 -

Devon Walker Exposes Toxic Work Culture At Saturday Night Live

Aug 28, 2025

Devon Walker Exposes Toxic Work Culture At Saturday Night Live

Aug 28, 2025