CoreWeave Stock Crash: A Buying Opportunity? (NASDAQ:CRWV)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave Stock Crash: A Buying Opportunity? (NASDAQ:CRWV)

The recent plunge in CoreWeave's stock price (NASDAQ:CRWV) has sent shockwaves through the tech sector, leaving many investors wondering: is this a buying opportunity, or a sign of deeper trouble? The dramatic fall, following a strong initial public offering (IPO), raises crucial questions about the future of this rapidly growing cloud computing company specializing in AI infrastructure. Let's delve into the details and explore whether this dip presents a chance to capitalize on a potentially undervalued asset.

The CoreWeave Stock Plunge: What Happened?

CoreWeave's stock experienced a significant downturn following its IPO, largely attributed to several factors. One key contributor is the broader market downturn affecting the technology sector, with investors exhibiting increased risk aversion. The rise in interest rates and concerns about a potential recession have negatively impacted growth stocks like CoreWeave, pushing investors towards safer investments.

Furthermore, the intense competition within the cloud computing market plays a significant role. Established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) pose considerable challenges to newcomers like CoreWeave. The company's ability to differentiate itself and carve out a sustainable market share remains a crucial factor impacting investor sentiment.

Analyzing the Fundamentals: Is CoreWeave Fundamentally Sound?

Despite the recent crash, CoreWeave boasts impressive technology and a strong foothold in the burgeoning AI infrastructure market. Their specialized infrastructure, optimized for AI workloads, positions them uniquely within a sector experiencing exponential growth. This focus on AI could prove a long-term advantage, as demand for powerful AI computing resources continues to surge.

However, profitability remains a concern. Like many fast-growing technology companies, CoreWeave is currently operating at a loss. Investors will need to carefully assess the company's path to profitability and its ability to manage its operating expenses effectively. Analyzing CoreWeave's financial statements, including revenue growth, operating margins, and cash flow, is crucial before making any investment decisions.

Is Now the Time to Buy CoreWeave Stock?

The question of whether to buy CoreWeave stock after its significant drop is complex and depends on individual risk tolerance and investment strategies. While the recent price decline may present a potential buying opportunity for long-term investors with a high-risk tolerance, it's essential to proceed with caution.

Things to Consider Before Investing:

- Market Volatility: The tech sector remains volatile. Any further market downturn could exacerbate CoreWeave's stock price decline.

- Competition: The competitive landscape is fierce. CoreWeave needs to demonstrate its ability to compete effectively against established giants.

- Profitability: CoreWeave's current lack of profitability is a significant risk factor.

- Long-Term Growth Potential: The long-term potential of the AI infrastructure market is substantial, but CoreWeave needs to capitalize on it effectively.

Conclusion:

The CoreWeave stock crash presents a complex scenario for investors. While the potential for long-term growth in the AI sector is undeniable, the significant risks associated with the company's current financial situation and the competitive market cannot be ignored. Thorough due diligence, including careful analysis of financial statements and future projections, is crucial before considering any investment. Remember to consult with a qualified financial advisor before making any investment decisions. This analysis is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave Stock Crash: A Buying Opportunity? (NASDAQ:CRWV). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Economic Impact Of Floridas Vaccine Mandate Rescission A Scientific Perspective

Sep 11, 2025

Economic Impact Of Floridas Vaccine Mandate Rescission A Scientific Perspective

Sep 11, 2025 -

Krugmans Critique Dissecting The Central Flaw In Trumps Immigration Approach

Sep 11, 2025

Krugmans Critique Dissecting The Central Flaw In Trumps Immigration Approach

Sep 11, 2025 -

Trump Gate Crash Chelsea Clintons Photo And The Art Of The Subtle Jab

Sep 11, 2025

Trump Gate Crash Chelsea Clintons Photo And The Art Of The Subtle Jab

Sep 11, 2025 -

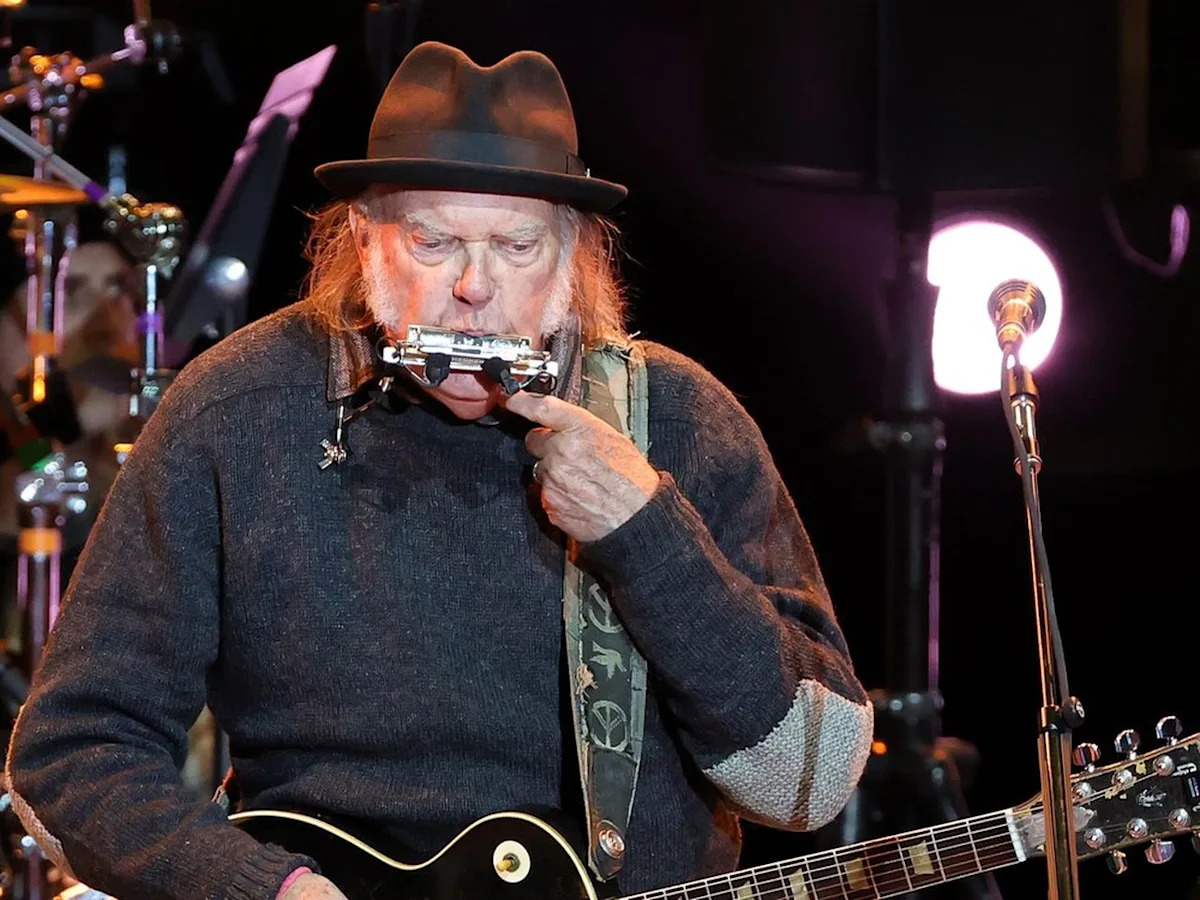

Fighting Ticket Resale Price Gouging Neil Young And The Face Value Exchange

Sep 11, 2025

Fighting Ticket Resale Price Gouging Neil Young And The Face Value Exchange

Sep 11, 2025 -

Core Weave Stock Crash A Buying Opportunity Nasdaq Crwv

Sep 11, 2025

Core Weave Stock Crash A Buying Opportunity Nasdaq Crwv

Sep 11, 2025

Latest Posts

-

Following Recent Scandals Bbc Chief Davie Stresses No One Is Irreplaceable

Sep 11, 2025

Following Recent Scandals Bbc Chief Davie Stresses No One Is Irreplaceable

Sep 11, 2025 -

Bbc Chief Davie No One Irreplaceable After Recent Scandals

Sep 11, 2025

Bbc Chief Davie No One Irreplaceable After Recent Scandals

Sep 11, 2025 -

Superman Sequel Man Of Tomorrows July 2027 Release Date Announced

Sep 11, 2025

Superman Sequel Man Of Tomorrows July 2027 Release Date Announced

Sep 11, 2025 -

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025 -

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025