Will Social Security Benefits Be Cut In 2034? The Urgent Need For Congressional Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Social Security Benefits Be Cut in 2034? The Urgent Need for Congressional Action

Facing a looming crisis: The Social Security Administration (SSA) has projected a significant shortfall in its trust funds by 2034. This doesn't mean Social Security will disappear entirely, but it does mean benefit cuts are a very real possibility without congressional intervention. The urgency of the situation cannot be overstated. Millions of Americans rely on Social Security for their retirement income, and the potential impact of benefit reductions would be devastating.

This article explores the current state of Social Security, the projected shortfall, and the crucial need for immediate action from Congress to prevent benefit cuts in 2034 and beyond.

Understanding the Social Security Funding Crisis

The Social Security system faces a financial challenge due to several converging factors:

- Aging Population: The post-World War II baby boomer generation is now entering retirement, leading to a surge in the number of beneficiaries.

- Declining Birth Rate: Fewer younger workers are entering the workforce to contribute to the system, creating an imbalance between contributors and recipients.

- Increased Life Expectancy: People are living longer, which means they receive benefits for a longer period, placing additional strain on the system.

These factors combined contribute to a projected depletion of the Social Security trust funds. The SSA projects that the trust funds will be unable to pay 100% of scheduled benefits by 2034. Without legislative action, this could lead to across-the-board benefit cuts of approximately 20%.

What Could Happen in 2034 and Beyond?

If Congress fails to act, the consequences could be severe:

- Benefit Reductions: A 20% reduction in benefits would significantly impact the financial security of millions of retirees, many of whom rely heavily on Social Security for their living expenses. This could push many seniors into poverty.

- Increased Financial Strain: The reduction in benefits would ripple through the economy, impacting spending and potentially slowing economic growth.

- Erosion of Public Trust: Failure to address the issue would further erode public confidence in the government's ability to manage vital social programs.

Potential Solutions and Congressional Action

Several solutions have been proposed to address the Social Security shortfall:

- Raising the Retirement Age: Gradually increasing the full retirement age could help to extend the solvency of the system. However, this could disproportionately impact lower-income workers who often have shorter lifespans and may not be able to work until a later age.

- Increasing the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes could generate additional revenue. This would require a careful analysis to ensure it doesn't disproportionately burden higher-income earners.

- Adjusting Benefit Formulas: Modifying the benefit calculation formulas could help to manage costs without significantly impacting current beneficiaries. This would require careful consideration to ensure fairness and equity.

- Investing in the Social Security Trust Funds: This may involve exploring alternative investment strategies to generate higher returns on the trust funds.

- A Combination of Approaches: Most experts agree that a multi-pronged approach combining several of these strategies would be the most effective solution.

Currently, bipartisan discussions are underway in Congress to address the looming crisis. However, finding common ground on complex issues like Social Security reform is proving challenging. The longer Congress waits to act, the more drastic the measures needed to avert benefit cuts will be.

The Urgent Need for Engagement

The future of Social Security rests on the actions taken by Congress. It is crucial for citizens to contact their elected officials, urging them to prioritize finding a sustainable solution before the 2034 deadline. Delaying action only exacerbates the problem and risks a significantly greater impact on future retirees. The time to act is now.

Call to Action: Learn more about the Social Security crisis and contact your representatives to voice your concerns. Visit the for more information and resources. Your voice matters. The future of Social Security depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Social Security Benefits Be Cut In 2034? The Urgent Need For Congressional Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Social Security Funding Crisis 2034 Payment Cuts Looming

Jun 20, 2025

Social Security Funding Crisis 2034 Payment Cuts Looming

Jun 20, 2025 -

Wta Grass Court History Serena Venus And Navratilovas Winning Percentages Compared

Jun 20, 2025

Wta Grass Court History Serena Venus And Navratilovas Winning Percentages Compared

Jun 20, 2025 -

Jalen Williams Courageous Play Key To Thunders Game 5 Win

Jun 20, 2025

Jalen Williams Courageous Play Key To Thunders Game 5 Win

Jun 20, 2025 -

The Iran Deal And A Trump Tweet A Look Back At 2013 And Its 2024 Implications

Jun 20, 2025

The Iran Deal And A Trump Tweet A Look Back At 2013 And Its 2024 Implications

Jun 20, 2025 -

2025 Nba Finals Game 6 Thunder Vs Pacers Free Nba Picks And Odds

Jun 20, 2025

2025 Nba Finals Game 6 Thunder Vs Pacers Free Nba Picks And Odds

Jun 20, 2025

Latest Posts

-

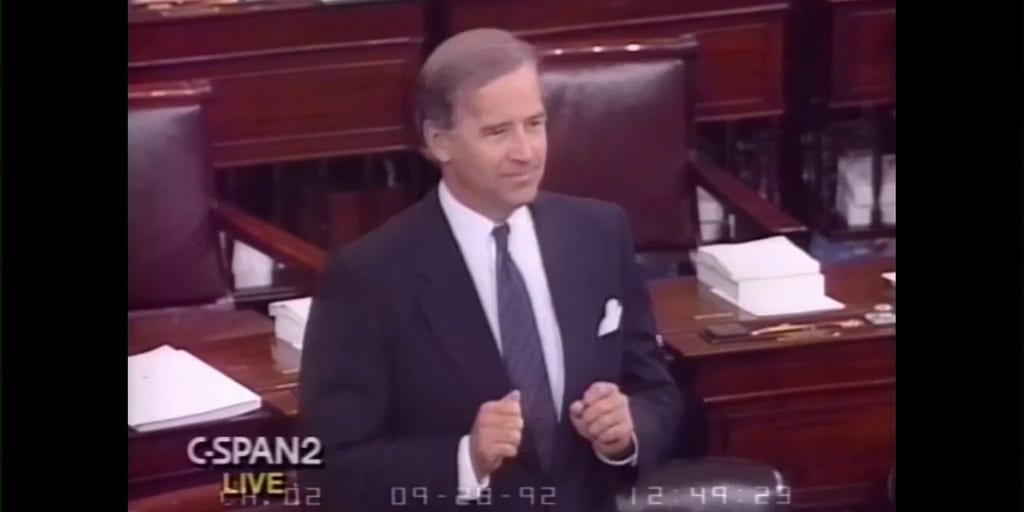

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025