Why Did Lucid Stock Fall More Than 4% Today? Investors React

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Did Lucid Stock Fall More Than 4% Today? Investors React

Lucid Group (LCID) stock experienced a significant downturn on [Date of Stock Drop], plunging more than 4% amidst a broader market correction and investor concerns. This decline follows a period of fluctuating performance for the electric vehicle (EV) maker, leaving many investors wondering about the underlying causes and future implications. Let's delve into the potential reasons behind this sharp drop and explore investor reactions.

Market Volatility and Sector-Wide Downturn:

The overall market climate played a significant role in Lucid's stock performance. A general sell-off in the technology and growth sectors, fueled by [mention specific macroeconomic factors, e.g., rising interest rates, inflation concerns], negatively impacted numerous stocks, including Lucid. The EV sector, known for its volatility, is particularly susceptible to these broader market trends. Investors often react swiftly to macroeconomic shifts, leading to amplified price swings in high-growth, speculative stocks like LCID.

Production Challenges and Delivery Concerns:

Lucid has faced production challenges in the past, and any news or speculation regarding delays or difficulties in meeting production targets can significantly impact investor sentiment. While the company has reported progress in ramping up production, consistent execution remains crucial to maintaining investor confidence. Any hint of production bottlenecks or slower-than-anticipated deliveries could fuel selling pressure. Furthermore, concerns about the overall demand for luxury EVs in the current economic climate may also contribute to negative sentiment.

Competition in the EV Market:

The electric vehicle market is increasingly competitive, with established automakers and new entrants vying for market share. Lucid faces stiff competition from industry giants like Tesla, as well as other emerging EV players. Any news highlighting the competitive landscape, such as aggressive pricing strategies from competitors or the launch of new, compelling EV models, can impact investor perception of Lucid's future prospects.

Analyst Ratings and Price Target Adjustments:

Changes in analyst ratings and price targets can also influence stock prices. If prominent analysts downgrade Lucid's stock or lower their price targets, it can trigger a sell-off as investors reassess their valuations. It's crucial to monitor analyst reports and understand the rationale behind any changes in their outlook on the company's performance.

Investor Reactions and Sentiment:

The market reaction to Lucid's stock drop reflects a mix of anxieties. Some investors might be taking profits after recent gains, while others might be expressing concern about the aforementioned challenges. Social media and financial news outlets are often flooded with discussions about the stock's performance, providing insights into investor sentiment. Many are closely monitoring future production updates, financial reports, and any further announcements from the company.

Looking Ahead:

The long-term success of Lucid hinges on consistent execution of its production plans, effective management of its supply chain, and successful navigation of the intensely competitive EV market. Investors will be closely watching the company's progress in these areas to gauge its future potential.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you should conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Keywords: Lucid Stock, LCID, Electric Vehicle, EV, Stock Market, Stock Drop, Investor Sentiment, Market Volatility, Production Challenges, Competition, Analyst Ratings, Investment, Stock Prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Did Lucid Stock Fall More Than 4% Today? Investors React. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Belichicks College Coaching Debut Ends In Disappointment Uncs Heavy Loss To Tcu

Sep 03, 2025

Belichicks College Coaching Debut Ends In Disappointment Uncs Heavy Loss To Tcu

Sep 03, 2025 -

Espn Cleveland Quinshon Judkins Ohio State Star Faces Nflpa Suspension

Sep 03, 2025

Espn Cleveland Quinshon Judkins Ohio State Star Faces Nflpa Suspension

Sep 03, 2025 -

Transfer News Gianluigi Donnarumma Moves To Manchester City

Sep 03, 2025

Transfer News Gianluigi Donnarumma Moves To Manchester City

Sep 03, 2025 -

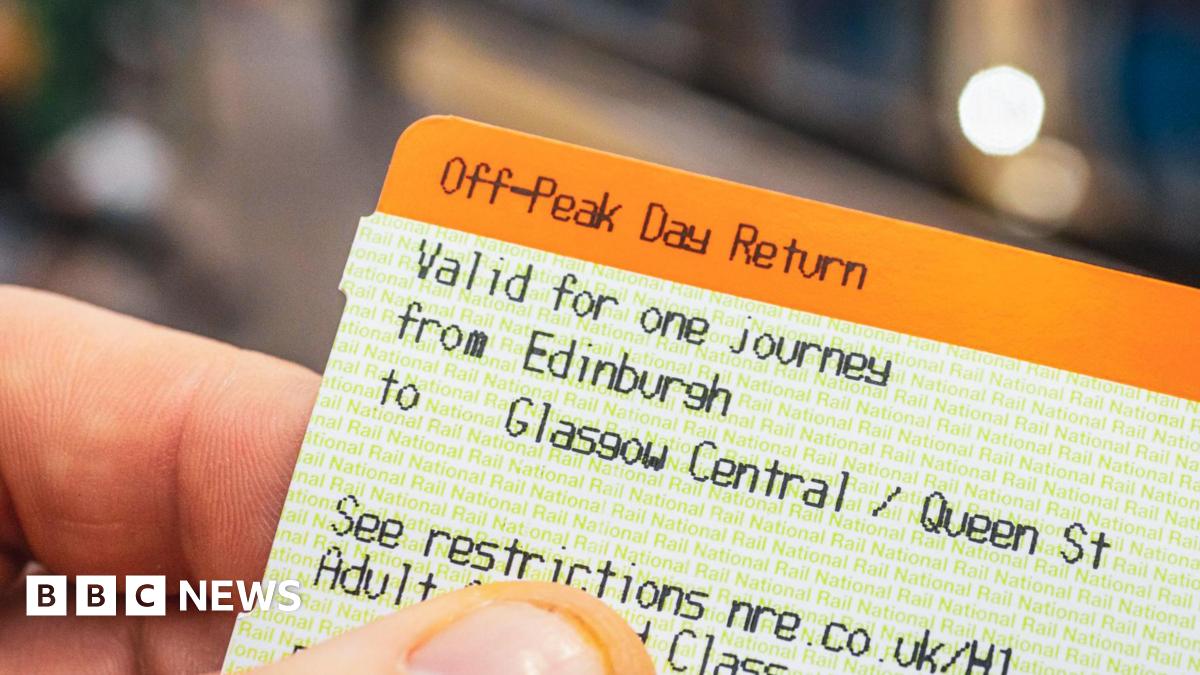

Scot Rail Scraps Peak Rail Fares What This Means For Passengers

Sep 03, 2025

Scot Rail Scraps Peak Rail Fares What This Means For Passengers

Sep 03, 2025 -

Powerball Lottery 1 3 Billion Jackpot Up For Grabs After No Winner

Sep 03, 2025

Powerball Lottery 1 3 Billion Jackpot Up For Grabs After No Winner

Sep 03, 2025

American Dream Deferred The High Cost Of Student Loans

American Dream Deferred The High Cost Of Student Loans

Sept 2 2025 West Virginia Lottery Mega Millions And Daily 3 Results

Sept 2 2025 West Virginia Lottery Mega Millions And Daily 3 Results

How To Spot And Avoid Parking Fine Scams

How To Spot And Avoid Parking Fine Scams

California Gold Rush Town Devastated Wildfire Burns Multiple Homes

California Gold Rush Town Devastated Wildfire Burns Multiple Homes