US Inflation Report: Consumer Prices Climb In June, Aligning With Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Inflation Report: Consumer Prices Climb in June, Fueling Fed Rate Hike Speculation

Headline: US Inflation Remains Stubbornly High in June, Exceeding Expectations and Raising Interest Rate Hike Concerns

Introduction: The latest inflation report from the Bureau of Labor Statistics (BLS) sent ripples through financial markets, revealing a persistent rise in consumer prices during June. While largely in line with economists' forecasts, the data solidifies expectations of continued interest rate hikes by the Federal Reserve (Fed) in its ongoing battle against inflation. This persistent upward pressure on prices raises concerns about the potential for a prolonged period of economic uncertainty.

Key Findings of the June Inflation Report:

The BLS reported a 0.2% increase in the Consumer Price Index (CPI) for June, following a 0.1% rise in May. This translates to a year-over-year increase of 3%, slightly above the anticipated 2.9% and significantly higher than the Fed's 2% target. Core inflation, which excludes volatile food and energy prices, also rose by 0.2% for the month, matching expectations and suggesting underlying inflationary pressures remain.

- Headline CPI: Increased by 0.2% month-over-month, 3% year-over-year.

- Core CPI: Increased by 0.2% month-over-month.

- Food Prices: Saw a slight increase, contributing to the overall CPI rise.

- Energy Prices: Experienced a moderate decrease, partially offsetting the impact of other price increases.

Impact on the Federal Reserve's Monetary Policy:

The June inflation figures strengthen the case for the Fed to continue raising interest rates in the coming months. While recent data showed some slowing in inflation, the persistence of elevated prices suggests that further tightening of monetary policy is necessary to bring inflation back down to the target level. Many economists now predict at least one more rate hike before the end of the year, potentially impacting borrowing costs for consumers and businesses.

What This Means for Consumers:

The persistent inflation means that consumers continue to face higher prices for essential goods and services. This could lead to reduced purchasing power and potentially impact consumer spending, potentially slowing down economic growth. Careful budgeting and financial planning are crucial for navigating this inflationary environment. Consider exploring resources like [link to a reputable personal finance website] for tips on managing your finances during times of high inflation.

Looking Ahead:

The ongoing battle against inflation remains a significant challenge for the US economy. The next few months will be crucial in determining the effectiveness of the Fed's monetary policy. Further inflation reports will be closely scrutinized by economists and investors alike, providing insights into the trajectory of price increases and the potential for future interest rate adjustments.

Conclusion:

The June inflation report paints a picture of stubbornly persistent price increases, exceeding some expectations and fueling speculation of further interest rate hikes by the Federal Reserve. The continued upward pressure on consumer prices highlights the challenges faced by both policymakers and consumers navigating the current economic landscape. Staying informed about economic developments and adapting financial strategies accordingly is crucial for individuals and businesses alike.

Keywords: US Inflation, CPI, Inflation Report, Consumer Price Index, Federal Reserve, Interest Rates, Monetary Policy, Economic Growth, Inflation Forecast, June Inflation, BLS, Economic Uncertainty, High Inflation, Price Increases, Consumer Spending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Inflation Report: Consumer Prices Climb In June, Aligning With Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Camilla Uses Shoe To Defend Against Attacker Royal Protection Detail Investigated

Sep 03, 2025

Camilla Uses Shoe To Defend Against Attacker Royal Protection Detail Investigated

Sep 03, 2025 -

Dancing With The Stars Season 34 What We Know So Far

Sep 03, 2025

Dancing With The Stars Season 34 What We Know So Far

Sep 03, 2025 -

Beijing Military Parade Kim Jong Uns Missile Inspection Raises Questions

Sep 03, 2025

Beijing Military Parade Kim Jong Uns Missile Inspection Raises Questions

Sep 03, 2025 -

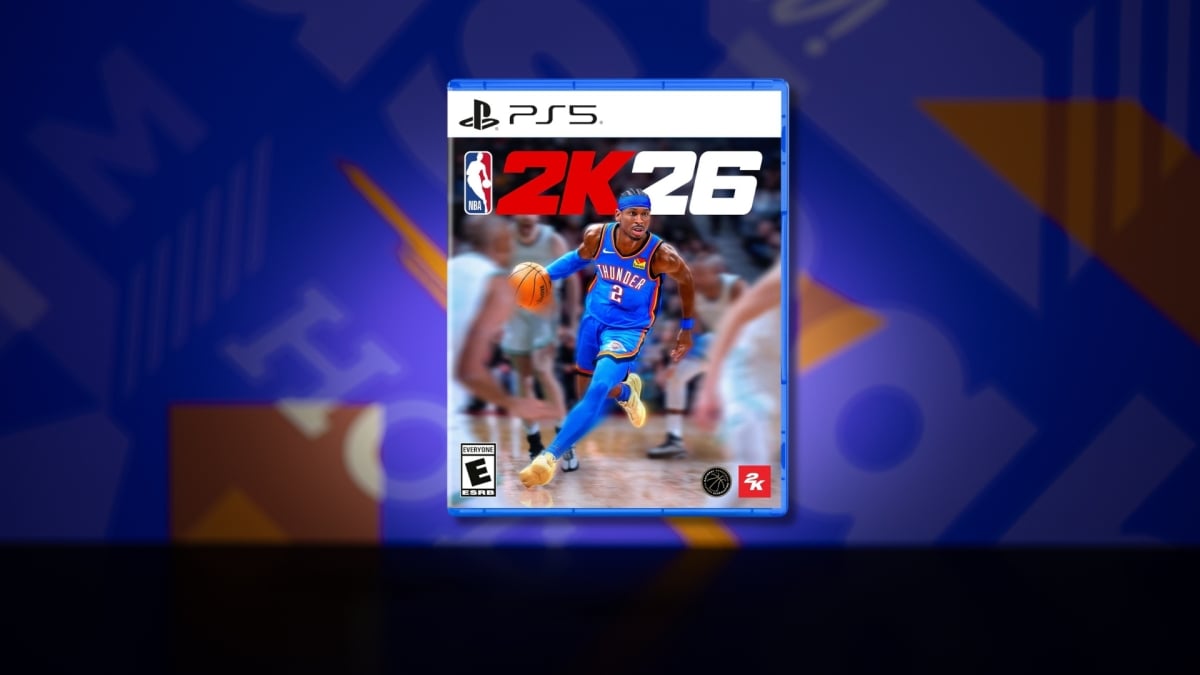

Nba 2 K26 A Complete Guide To Early Access Editions And Virtual Currency

Sep 03, 2025

Nba 2 K26 A Complete Guide To Early Access Editions And Virtual Currency

Sep 03, 2025 -

Xi And Putins Shanghai Cooperation Organization Summit A New World Order Emerges

Sep 03, 2025

Xi And Putins Shanghai Cooperation Organization Summit A New World Order Emerges

Sep 03, 2025

Latest Posts

-

Metal Eden Cgi Trailer A First Look At Gameplay

Sep 03, 2025

Metal Eden Cgi Trailer A First Look At Gameplay

Sep 03, 2025 -

Labours Asylum Plan And The Latest Developments At Number 10

Sep 03, 2025

Labours Asylum Plan And The Latest Developments At Number 10

Sep 03, 2025 -

Is Metal Eden Worth Playing A Critical Fps Review

Sep 03, 2025

Is Metal Eden Worth Playing A Critical Fps Review

Sep 03, 2025 -

Humanitarian Crisis Deepens Families And Children Flee Gaza Citys Growing Conflict

Sep 03, 2025

Humanitarian Crisis Deepens Families And Children Flee Gaza Citys Growing Conflict

Sep 03, 2025 -

Playing The 1 3 Billion Powerball In Sc Debit Card Purchases And Lottery Rules

Sep 03, 2025

Playing The 1 3 Billion Powerball In Sc Debit Card Purchases And Lottery Rules

Sep 03, 2025