US Import Tax Nightmare: UK Companies Struggle With Small Parcel Surcharges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Import Tax Nightmare: UK Companies Struggle with Small Parcel Surcharges

The transatlantic trade relationship is facing increasing friction as UK businesses grapple with unexpected and substantial import tax surcharges on small parcels shipped to the US. This escalating issue is causing significant financial headaches and operational disruptions for many companies, particularly small and medium-sized enterprises (SMEs) who often lack the resources to navigate the complex US customs system. The situation highlights the challenges of post-Brexit trade and the need for greater clarity and transparency in cross-border shipping.

H2: The Sting in the Tail: Unexpected Surcharges

Many UK businesses, accustomed to relatively straightforward shipping to the US before Brexit, are now finding themselves hit with unexpected and substantial surcharges. These aren't just the standard import duties and taxes; they're additional fees levied by US customs brokers and freight forwarders, often for seemingly minor discrepancies in documentation or labelling. These often seemingly arbitrary charges can easily double or even triple the original shipping cost, turning a profitable transaction into a loss-making one.

- Lack of Transparency: One of the biggest complaints is the lack of transparency surrounding these surcharges. Businesses often receive invoices with little explanation of the additional fees, leaving them struggling to understand the charges and challenge them effectively.

- Increased Processing Times: The complexities of US customs regulations and the increased scrutiny of shipments since Brexit are leading to significantly longer processing times. This delays the delivery of goods and impacts sales, potentially damaging relationships with US customers.

- Hidden Costs: These additional fees are often hidden until the very last moment, catching businesses off guard and impacting cash flow. This lack of predictability makes it difficult for companies to accurately price their products and plan their budgets.

H2: The Impact on UK Businesses

The impact of these surcharges is particularly acute for SMEs, who may lack the dedicated resources and expertise to deal with the complexities of US import regulations. Larger companies may have the resources to dedicate staff to navigate these issues, but smaller businesses often bear the brunt of these unexpected costs. This uneven playing field puts UK SMEs at a significant disadvantage when competing in the US market.

Many are now reconsidering their US export strategies, with some even pausing or completely halting their shipments to the US, fearing the financial fallout from unexpected surcharges. This is a significant blow to UK businesses seeking to expand into the lucrative US market. The situation underlines the need for better support and guidance for businesses navigating the complexities of international trade.

H2: Seeking Solutions: Advocacy and Improved Communication

Several UK business organizations are actively lobbying the government and US authorities for greater clarity and transparency in the import process. They are advocating for:

- Simplified documentation requirements: To reduce the risk of errors and associated surcharges.

- Improved communication: More transparent and upfront communication from customs brokers and freight forwarders regarding potential costs.

- Dedicated support: Increased support and resources for SMEs struggling to navigate the complexities of US import regulations.

H3: What can UK businesses do?

Businesses can proactively mitigate these risks by:

- Thoroughly researching US import regulations: Understanding the requirements for labeling, documentation, and customs declarations is crucial.

- Selecting reputable shipping partners: Choosing experienced freight forwarders with a proven track record of handling US import shipments can significantly reduce the risk of unexpected surcharges.

- Building strong relationships with US customs brokers: A good relationship with a customs broker can help navigate the complexities of the US customs system and minimize the risk of delays and additional charges.

- Keeping detailed records: Maintaining meticulous records of all shipments, including documentation and invoices, is essential for tracking costs and addressing any disputes.

The US import tax situation for UK businesses remains a challenging and evolving landscape. Proactive measures, coupled with advocacy for regulatory reform, are crucial for navigating this complex issue and ensuring the continued success of UK businesses trading with the US. For further information and support, consult resources like [link to UK government export advice website] and [link to relevant business organization website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Import Tax Nightmare: UK Companies Struggle With Small Parcel Surcharges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Businesses Sound Alarm Over New Us Small Parcel Tax

Aug 30, 2025

Uk Businesses Sound Alarm Over New Us Small Parcel Tax

Aug 30, 2025 -

Watch Canelo Alvarez Vs Terence Crawford On Netflix Predictions And More

Aug 30, 2025

Watch Canelo Alvarez Vs Terence Crawford On Netflix Predictions And More

Aug 30, 2025 -

Fury In Europe 21 Killed Eu Building Hit In Fresh Russian Attacks

Aug 30, 2025

Fury In Europe 21 Killed Eu Building Hit In Fresh Russian Attacks

Aug 30, 2025 -

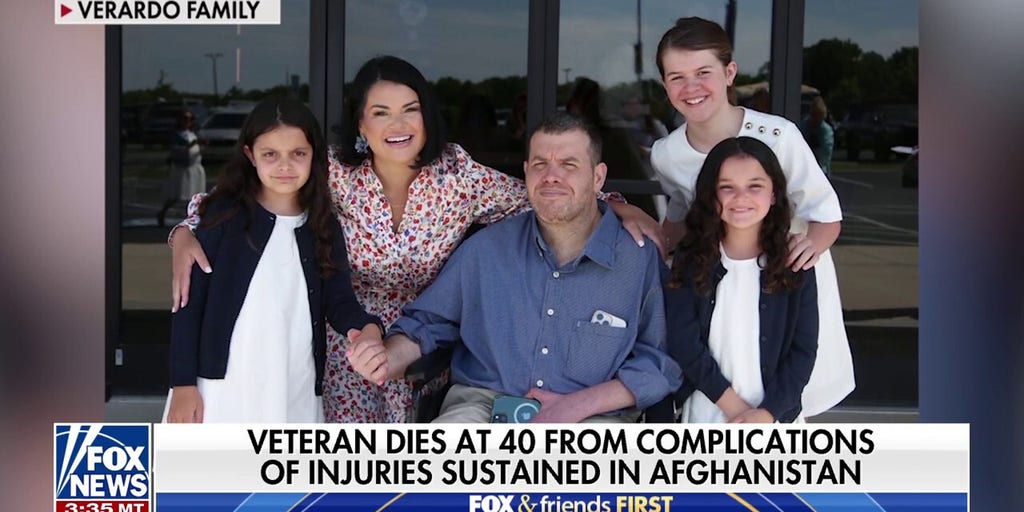

True American Hero President Trump Commemorates Fallen Afghanistan Veteran

Aug 30, 2025

True American Hero President Trump Commemorates Fallen Afghanistan Veteran

Aug 30, 2025 -

Stress Hektik Leistungsdruck Von Ruhe Keine Spur Was Tun

Aug 30, 2025

Stress Hektik Leistungsdruck Von Ruhe Keine Spur Was Tun

Aug 30, 2025

Video Australian Lawmakers Threat To Punch Journalist Causes Public Outrage

Video Australian Lawmakers Threat To Punch Journalist Causes Public Outrage

Impact Of Trumps Proposed Affordable Housing Cuts On Rural America

Impact Of Trumps Proposed Affordable Housing Cuts On Rural America