US CPI Report: June Inflation Figures Confirm Expected Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US CPI Report: June Inflation Figures Confirm Expected Increase, But Offer Glimmers of Hope

The latest Consumer Price Index (CPI) report from the Bureau of Labor Statistics (BLS) confirmed economists' predictions: inflation rose in June, continuing a trend that has plagued the US economy for over a year. While the increase solidified concerns about persistent price pressures, the report also offered some subtle signs that the worst may be behind us. Understanding these nuances is crucial for both consumers and investors navigating the current economic landscape.

Headline Inflation Remains Elevated:

The June CPI report revealed a 3% year-over-year increase, slightly higher than the anticipated 2.9% rise. This marks a noticeable jump from the 4% year-over-year increase seen in May, however, the month-over-month increase was a more modest 0.2%. This seemingly conflicting data highlights the complexity of interpreting current inflation trends. The persistence of elevated inflation continues to pressure household budgets and fuels ongoing concerns about the Federal Reserve's monetary policy. Experts caution against reading too much into single-month fluctuations and emphasize the need for a longer-term perspective.

Core Inflation Shows Signs of Slowing:

While headline inflation remained stubbornly high, the core CPI – which excludes volatile food and energy prices – showed a more encouraging picture. The core CPI rose 0.2% month-over-month, matching May's figure, but suggesting a potential plateauing of price increases in key sectors. This deceleration in core inflation is a key factor that the Federal Reserve will likely scrutinize closely in its future decisions regarding interest rate hikes. The consistent moderation in core inflation provides a glimmer of hope that the current inflationary pressures are beginning to ease.

What Drove the June Increase?

Several factors contributed to the June inflation increase. Shelter costs continued to be a major driver, reflecting the lingering impact of increased housing costs across the country. Used car prices also saw a slight uptick, adding to the overall inflation picture. However, energy prices actually declined slightly, offering a small counterbalance to other inflationary pressures. Analyzing these specific components provides valuable context for understanding the broader inflation trends.

Implications for the Federal Reserve:

The June CPI report will undoubtedly influence the Federal Reserve's next steps. While the persistent inflation may necessitate further interest rate hikes to cool the economy, the signs of moderation in core inflation could lead to a more cautious approach. The Fed will carefully weigh these competing factors before making any decisions about future monetary policy adjustments. Market analysts are currently split on whether further increases are likely, underscoring the uncertainty surrounding the inflation outlook. [Link to Federal Reserve website]

Looking Ahead:

The battle against inflation is far from over. Continued monitoring of the CPI and other economic indicators will be crucial in assessing the effectiveness of current monetary policy and predicting future economic trends. Consumers should remain vigilant about managing their finances, and businesses need to adapt to the evolving economic environment. The coming months will be critical in determining whether the current slowdown in core inflation represents a sustained trend or simply a temporary blip. Further analysis of the employment situation and consumer spending will provide additional clarity on the overall economic trajectory.

Keywords: US CPI, inflation, Consumer Price Index, BLS, Federal Reserve, interest rates, economic outlook, June CPI report, core inflation, headline inflation, monetary policy, economic indicators, inflation rate, price pressures.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US CPI Report: June Inflation Figures Confirm Expected Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Toddler Milk Controversy Parents Sue Over Deceptive Marketing

Aug 23, 2025

The Toddler Milk Controversy Parents Sue Over Deceptive Marketing

Aug 23, 2025 -

Hong Kongs Legal System On Screen Analyzing Popular Courtroom Dramas

Aug 23, 2025

Hong Kongs Legal System On Screen Analyzing Popular Courtroom Dramas

Aug 23, 2025 -

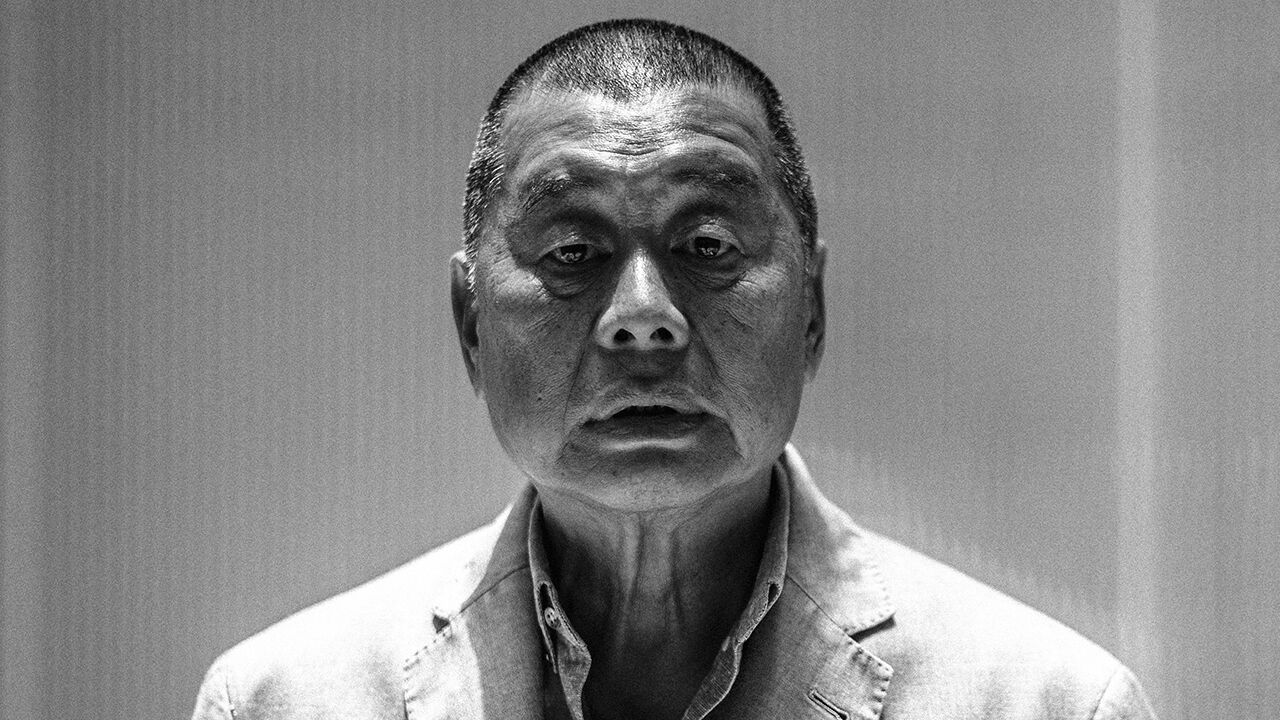

Freedom Of Expression Defense Key Moments From Jimmy Lais Case

Aug 23, 2025

Freedom Of Expression Defense Key Moments From Jimmy Lais Case

Aug 23, 2025 -

The 2024 School Year Navigating Education Under A Renewed Trump Administration

Aug 23, 2025

The 2024 School Year Navigating Education Under A Renewed Trump Administration

Aug 23, 2025 -

The Unspoken Message Chelsea Clintons Photo Response To Trumps Event Disruption

Aug 23, 2025

The Unspoken Message Chelsea Clintons Photo Response To Trumps Event Disruption

Aug 23, 2025

Latest Posts

-

Highlander Movie Reboot Gillan And Cavill Lead The Cast

Aug 23, 2025

Highlander Movie Reboot Gillan And Cavill Lead The Cast

Aug 23, 2025 -

Orlando Weather Forecast Stormy Weekend Predicted For Central Florida

Aug 23, 2025

Orlando Weather Forecast Stormy Weekend Predicted For Central Florida

Aug 23, 2025 -

Proposed Ukraine Land Concessions A Dangerous Gambit

Aug 23, 2025

Proposed Ukraine Land Concessions A Dangerous Gambit

Aug 23, 2025 -

2025 Nascar On Nbc Meet The Announcers Covering The Races

Aug 23, 2025

2025 Nascar On Nbc Meet The Announcers Covering The Races

Aug 23, 2025 -

Hypersonic Missile Technology A Growing Gap Between East And West

Aug 23, 2025

Hypersonic Missile Technology A Growing Gap Between East And West

Aug 23, 2025