Understanding The Implications Of The Property Tax Shake-Up And Its Impact On Professionals

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Implications of the Property Tax Shake-Up and its Impact on Professionals

The recent changes to property tax laws have sent shockwaves through communities nationwide, leaving many homeowners and, particularly, professionals, grappling with the implications. This shake-up, driven by [mention specific legislative changes or events, e.g., reassessment programs, new tax brackets, etc.], promises significant shifts in the financial landscape for countless individuals, especially those whose livelihoods are intertwined with property ownership or value. This article delves into the key aspects of this property tax overhaul and its specific impact on professionals.

H2: How the Property Tax Changes Affect Professionals

The consequences of the property tax changes aren't uniform. Their impact varies greatly depending on a professional's specific circumstances, including their profession, location, and type of property ownership. Here's a breakdown of some key areas:

-

Real Estate Professionals: Real estate agents, brokers, and appraisers are on the front lines of this change. Fluctuations in property values directly affect their commission structures and the overall market activity. The new tax rates could lead to shifts in buyer demand, impacting sales volume and potentially their income. Furthermore, understanding the new tax implications is crucial for providing accurate advice to clients.

-

Small Business Owners: Professionals operating businesses from their homes or owning commercial properties will experience a direct impact on their operational costs. Higher property taxes can significantly reduce profit margins and hinder business growth, especially for small businesses operating on tight budgets. This could necessitate price increases, impacting competitiveness.

-

High-Income Earners: While the impact varies based on location and property size, high-income earners often own more valuable properties, making them disproportionately affected by increased property tax rates. This can lead to a decrease in disposable income and potentially influence lifestyle choices.

-

Rental Property Owners: Landlords and property investors face increased operational costs. Higher taxes might necessitate rent increases, potentially straining tenant-landlord relationships and impacting the affordability of housing in certain areas. Careful financial planning and understanding of the new tax regulations are crucial for navigating this challenge.

H2: Navigating the New Landscape: Strategies for Professionals

The property tax shake-up demands proactive adaptation. Professionals need to understand their options and make informed decisions to mitigate potential negative consequences:

-

Financial Planning: Consult with a financial advisor to reassess your financial strategy. Understanding the potential impact on your tax burden is crucial for budgeting and long-term financial planning.

-

Tax Deductions and Credits: Explore all available tax deductions and credits applicable to property ownership to minimize your tax liability. Familiarize yourself with the updated tax codes and seek professional tax advice if needed.

-

Property Valuation Appeals: If you believe your property's assessed value is inaccurate, consider filing an appeal with the relevant authorities. This could lead to a reduction in your property tax assessment. [Link to relevant government website for property tax appeals]

-

Networking and Information Sharing: Connect with other professionals in your field to share information, insights, and strategies for dealing with the changes.

H2: Looking Ahead: The Long-Term Implications

The long-term effects of this property tax shake-up remain to be seen. However, it's crucial for professionals to stay informed about any further legislative changes or policy adjustments. Continuous monitoring and proactive adaptation will be key to navigating this evolving landscape.

H2: Call to Action

This significant shift in property taxation requires proactive engagement. Stay informed, seek professional advice when needed, and adapt your strategies to mitigate the potential negative impacts. Understanding the complexities of these changes is the first step towards navigating this new financial terrain successfully.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Implications Of The Property Tax Shake-Up And Its Impact On Professionals. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Multiple Shooters Sought After Deadly Brooklyn Lounge Shooting Three Dead Nine Injured

Aug 20, 2025

Multiple Shooters Sought After Deadly Brooklyn Lounge Shooting Three Dead Nine Injured

Aug 20, 2025 -

Newly Released Files Reveal Kohbergers Domineering Personality Before Idaho Murders

Aug 20, 2025

Newly Released Files Reveal Kohbergers Domineering Personality Before Idaho Murders

Aug 20, 2025 -

Krugmans Critique Dissecting The Inhumanity Of Trumps Immigration Stance

Aug 20, 2025

Krugmans Critique Dissecting The Inhumanity Of Trumps Immigration Stance

Aug 20, 2025 -

Cleveland Guardians Messick Mc Kenzie And Top Prospect Performance Analysis

Aug 20, 2025

Cleveland Guardians Messick Mc Kenzie And Top Prospect Performance Analysis

Aug 20, 2025 -

Addressing Rumors Stevie Wonder Speaks Out On His Sight

Aug 20, 2025

Addressing Rumors Stevie Wonder Speaks Out On His Sight

Aug 20, 2025

Latest Posts

-

Kayfus And Rocchio Lead Guardians To Victory Over Diamondbacks

Aug 20, 2025

Kayfus And Rocchio Lead Guardians To Victory Over Diamondbacks

Aug 20, 2025 -

Results Day Stress Coping Mechanisms For Neurodivergent Individuals

Aug 20, 2025

Results Day Stress Coping Mechanisms For Neurodivergent Individuals

Aug 20, 2025 -

The Real Trump Jon Stewarts Wake Up Call For Maga Nation

Aug 20, 2025

The Real Trump Jon Stewarts Wake Up Call For Maga Nation

Aug 20, 2025 -

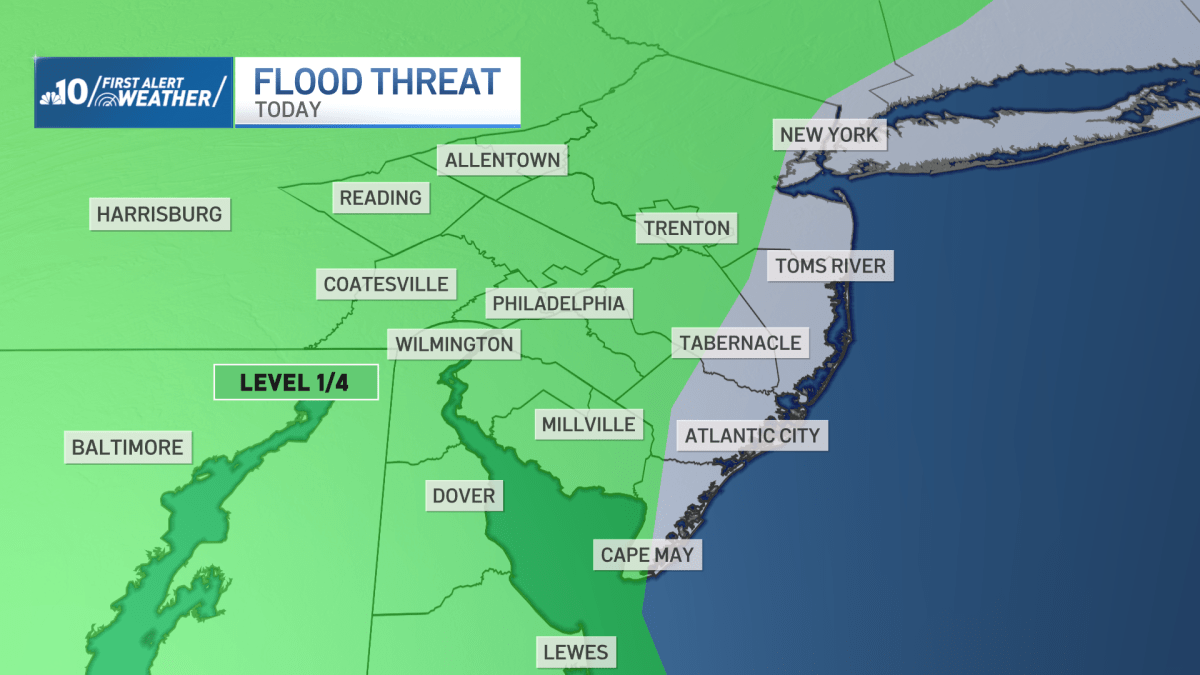

Philadelphia Suburbs Swamped By Flooding Following Torrential Rains

Aug 20, 2025

Philadelphia Suburbs Swamped By Flooding Following Torrential Rains

Aug 20, 2025 -

Norwegian Royal Family Scandal Son Of Crown Princess Indicted On Multiple Counts

Aug 20, 2025

Norwegian Royal Family Scandal Son Of Crown Princess Indicted On Multiple Counts

Aug 20, 2025