U.S. June Inflation Report: Consumer Prices Increase As Anticipated

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. June Inflation Report: Consumer Prices Rise as Expected, Fueling Economic Debate

The latest inflation report from the U.S. Bureau of Labor Statistics (BLS) revealed a 3% year-over-year increase in the Consumer Price Index (CPI) for June, confirming economists' predictions and maintaining a persistent, albeit moderating, upward trend. While the figure aligns with market expectations, it continues to fuel ongoing debates surrounding the Federal Reserve's monetary policy and the overall health of the U.S. economy.

Key Findings from the June CPI Report:

-

Headline Inflation: The headline CPI rose 3% year-over-year in June, matching the consensus forecast among analysts. This represents a slowdown from the 4% increase seen in May, reflecting a continued cooling of inflationary pressures.

-

Core Inflation: Core inflation, which excludes volatile food and energy prices, increased by 4.8% year-over-year. This figure, while still elevated, also signals a deceleration compared to previous months. Understanding the difference between headline and core inflation is crucial for interpreting the report's implications. [Link to a resource explaining headline vs. core inflation]

-

Energy Prices: Energy prices played a significant role in moderating headline inflation, experiencing a year-over-year decrease. This decline, however, is partially offset by persistent increases in other sectors.

-

Food Prices: Food prices remain a concern, continuing their upward trajectory, contributing to the overall inflationary pressure felt by consumers.

Market Reactions and Economic Implications:

The report's release triggered a mixed reaction in the financial markets. While the figures largely matched expectations, preventing significant market volatility, the persistence of elevated core inflation keeps the Federal Reserve's future actions uncertain. Many economists believe the Fed will continue to carefully monitor the data before making further decisions on interest rate hikes. The ongoing debate centers on whether the current rate of inflation is transitory or indicative of a more entrenched problem.

What this means for Consumers:

The sustained, though moderating, inflation continues to impact consumer spending and purchasing power. Rising prices for essential goods, such as food and housing, are particularly concerning for low- and middle-income households. This could lead to a further squeeze on disposable income, potentially impacting overall consumer confidence and economic growth.

Looking Ahead: The Path to Price Stability:

The June inflation report provides further evidence that inflation is cooling, but the journey to price stability is far from over. The Federal Reserve's commitment to bringing inflation down to its 2% target remains steadfast, and future policy decisions will heavily rely on upcoming economic data. The coming months will be crucial in determining whether the current trend towards moderation continues or if new inflationary pressures emerge.

Further Reading:

- [Link to BLS website for the full report]

- [Link to a reputable economic news source for further analysis]

Call to Action: Stay informed about the evolving economic landscape by regularly checking for updates from reputable sources. Understanding inflation is key to making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. June Inflation Report: Consumer Prices Increase As Anticipated. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

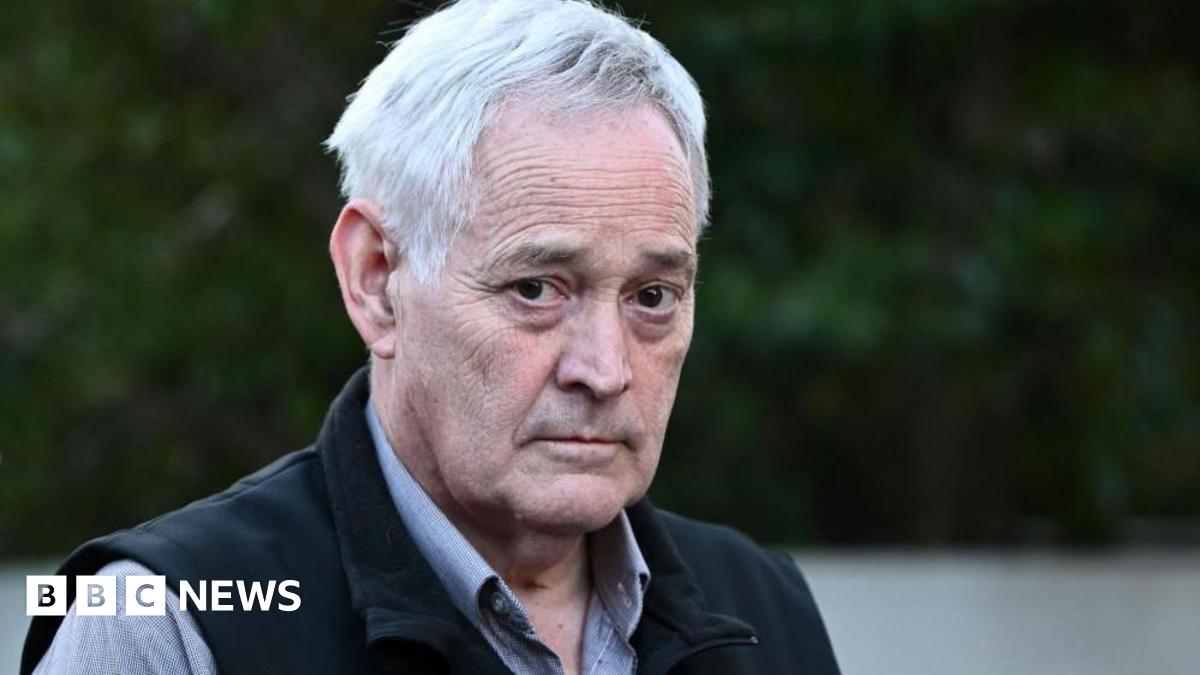

Mushroom Lunch Survivor Recounts Murders In Court Half Alive

Aug 27, 2025

Mushroom Lunch Survivor Recounts Murders In Court Half Alive

Aug 27, 2025 -

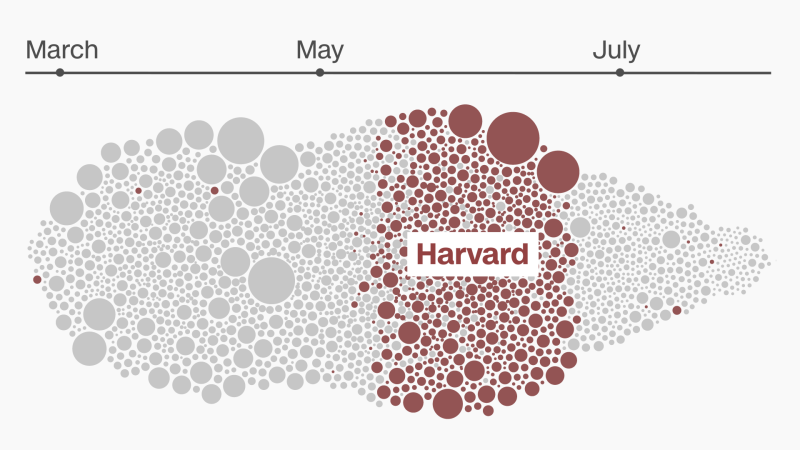

Understanding Harvards 2 4 B Research Grant Cuts An Interactive Data Visualization

Aug 27, 2025

Understanding Harvards 2 4 B Research Grant Cuts An Interactive Data Visualization

Aug 27, 2025 -

Putins War The Plight Of Donetsk Residents Facing Ongoing Attacks

Aug 27, 2025

Putins War The Plight Of Donetsk Residents Facing Ongoing Attacks

Aug 27, 2025 -

Six Children Pulled From Sea During Aberavon Beach Incident

Aug 27, 2025

Six Children Pulled From Sea During Aberavon Beach Incident

Aug 27, 2025 -

Trump Tariffs And Sneakflation The Hidden Cost Of Everyday Goods For American Consumers

Aug 27, 2025

Trump Tariffs And Sneakflation The Hidden Cost Of Everyday Goods For American Consumers

Aug 27, 2025

Latest Posts

-

Congressman Jeffries Rebuts Trumps Assault On Smithsonian

Aug 27, 2025

Congressman Jeffries Rebuts Trumps Assault On Smithsonian

Aug 27, 2025 -

The Slow Burn Sneakflation And The Long Term Effects Of Trumps Tariffs

Aug 27, 2025

The Slow Burn Sneakflation And The Long Term Effects Of Trumps Tariffs

Aug 27, 2025 -

Free Agency Update Ex Buffalo Bills Cb Signs One Year Contract In Afc East

Aug 27, 2025

Free Agency Update Ex Buffalo Bills Cb Signs One Year Contract In Afc East

Aug 27, 2025 -

U S Consumer Price Index June Inflation Data And Analysis

Aug 27, 2025

U S Consumer Price Index June Inflation Data And Analysis

Aug 27, 2025 -

New York Giants Cut Qb Tommy De Vito A Surprising Roster Move

Aug 27, 2025

New York Giants Cut Qb Tommy De Vito A Surprising Roster Move

Aug 27, 2025