U.S. Inflation Remains Stable: June Consumer Price Index Shows Expected Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Inflation Remains Stable: June CPI Shows Expected Modest Increase

Inflation in the United States held steady in June, offering a sigh of relief to consumers and economists alike. The Consumer Price Index (CPI) data released today by the Bureau of Labor Statistics (BLS) showed a modest increase, largely in line with expectations, signaling that the aggressive interest rate hikes implemented by the Federal Reserve may be starting to bear fruit in curbing inflation.

The headline CPI rose 0.2% in June, matching the increase seen in May and slightly below the 0.3% predicted by many analysts. This translates to a year-over-year increase of 3%, down from 4% in May and a significant drop from the peak of 9.1% in June 2022. This sustained deceleration offers further evidence that the inflationary pressures gripping the economy are beginning to ease.

Core Inflation Remains a Key Focus

While the headline CPI offers a broad picture of inflation, economists pay close attention to the core CPI, which excludes volatile food and energy prices. The core CPI increased by 0.2% in June, also matching May's figure and slightly below forecasts. This year-over-year increase sits at 4.8%, down from 5.3% in May, indicating persistent but moderating price increases in the underlying economy.

This relatively stable core inflation reading suggests that price pressures are broadening less rapidly than before. While certain sectors continue to experience upward pressure, the overall trend indicates a gradual cooling.

What Does This Mean for Consumers and the Federal Reserve?

The relatively stable June CPI data provides a glimmer of hope for consumers battling persistently high prices. Although inflation remains above the Federal Reserve's 2% target, the continued downward trend strengthens the case that the central bank might pause its interest rate hikes in the near future.

However, the Fed is likely to remain cautious. Chair Jerome Powell has repeatedly emphasized the need to achieve sustained price stability before declaring victory over inflation. Future CPI reports will be closely scrutinized to gauge the strength and sustainability of this recent moderation.

- Key takeaways from the June CPI report:

- Headline CPI rose 0.2% in June, matching May's figure.

- Year-over-year headline inflation dropped to 3%, down from 4% in May.

- Core CPI also rose 0.2% in June, with year-over-year core inflation at 4.8%.

- The data suggests that inflationary pressures are easing, but the Fed is likely to remain cautious.

Looking Ahead: The Path to Price Stability

The path to achieving sustainable price stability remains complex. Geopolitical factors, supply chain disruptions, and evolving consumer demand continue to influence price levels. The Federal Reserve's next moves will depend heavily on upcoming economic data, including employment figures and further CPI reports.

The coming months will be crucial in determining whether the current trend of easing inflation continues. Economists and market analysts will carefully monitor the data for any signs of resurgence in price pressures. This sustained moderation, however, offers a positive outlook for the U.S. economy and provides a degree of certainty amidst ongoing economic uncertainty. For more in-depth analysis and insights into the US economy, consider consulting resources like the .

Call to Action: Stay informed about economic developments by regularly checking reliable news sources for updates on inflation and economic indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Inflation Remains Stable: June Consumer Price Index Shows Expected Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Last Minute Deal Saves Poundland From Administration

Aug 28, 2025

Last Minute Deal Saves Poundland From Administration

Aug 28, 2025 -

Trial Testimony John Alford Allegedly Abused Girls At Party

Aug 28, 2025

Trial Testimony John Alford Allegedly Abused Girls At Party

Aug 28, 2025 -

Actor John Alford Faces Child Abuse Charges Party Incident Detailed In Court

Aug 28, 2025

Actor John Alford Faces Child Abuse Charges Party Incident Detailed In Court

Aug 28, 2025 -

Taylor Swift Engaged To Travis Kelce Reactions From The Sports And Music Worlds

Aug 28, 2025

Taylor Swift Engaged To Travis Kelce Reactions From The Sports And Music Worlds

Aug 28, 2025 -

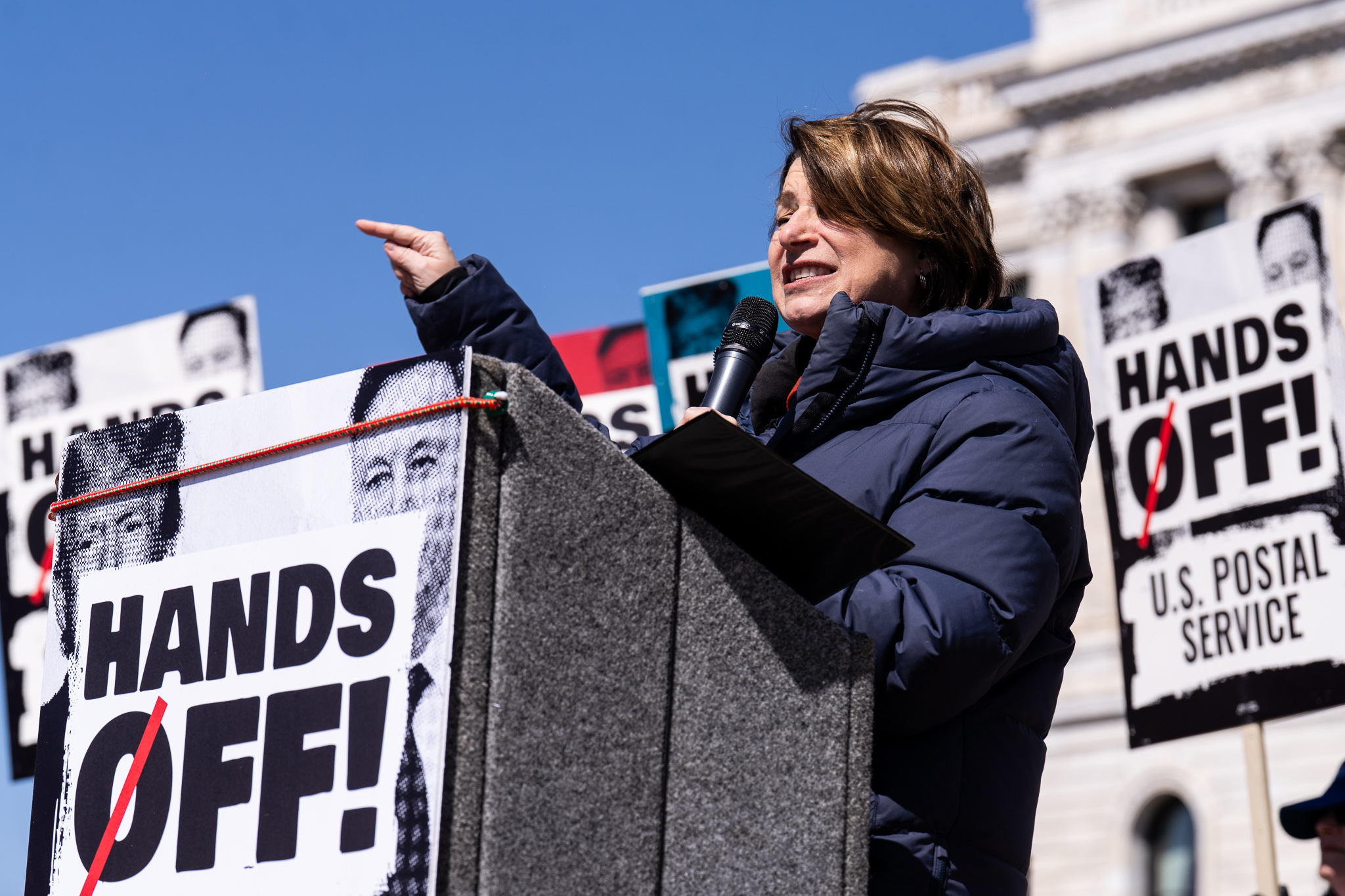

Fake Ad Featuring Amy Klobuchars Voice Sparks Deepfake Debate

Aug 28, 2025

Fake Ad Featuring Amy Klobuchars Voice Sparks Deepfake Debate

Aug 28, 2025

Latest Posts

-

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025

Klobuchars Anti Ai Position A Focus On Personal Branding

Aug 28, 2025 -

Devon Walker Exposes Toxic Work Culture At Saturday Night Live

Aug 28, 2025

Devon Walker Exposes Toxic Work Culture At Saturday Night Live

Aug 28, 2025 -

Carlos Alcarazs Shaved Head Photos Show Regrowth Already

Aug 28, 2025

Carlos Alcarazs Shaved Head Photos Show Regrowth Already

Aug 28, 2025 -

Match Union Berlin Vf B Stuttgart Jaquez Blesse Fracture Du Nez

Aug 28, 2025

Match Union Berlin Vf B Stuttgart Jaquez Blesse Fracture Du Nez

Aug 28, 2025 -

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025