U.S. Inflation Remains Consistent: June Consumer Price Data Released

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Inflation Remains Consistent: June Consumer Price Data Released

Headline: U.S. Inflation Holds Steady in June, Offering Mixed Signals for the Fed

Introduction: The U.S. Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) data for June, revealing a persistent, albeit consistent, inflation rate. While the numbers offer a degree of stability, they present a complex picture for the Federal Reserve as it navigates its monetary policy strategy. The slight easing in inflation may not be enough to signal a pause in interest rate hikes, keeping the economic outlook uncertain for consumers and businesses alike.

Key Findings from the June CPI Report:

The June CPI report showed a 3% year-over-year increase, matching May's figure and slightly below market expectations. This represents a significant slowdown from the peak inflation rates seen in early 2022, but still remains above the Federal Reserve's 2% target. Analyzing the data further reveals:

-

Core Inflation: Stripping out volatile food and energy prices, core inflation also remained steady at 4.8%, a figure closely watched by the Fed. This persistence in core inflation indicates underlying price pressures remain.

-

Shelter Costs: Housing costs, a significant component of the CPI, continued to contribute substantially to inflation. Rent increases and home price pressures are proving sticky, suggesting this sector will continue to influence overall inflation figures in the coming months.

-

Food and Energy Prices: While energy prices saw a slight decline, food prices experienced a modest increase. This volatility underscores the challenges in predicting future inflation trends.

Implications for the Federal Reserve:

The relatively stable inflation figures present a dilemma for the Federal Reserve. While the slowdown from peak inflation is encouraging, the persistence of core inflation and the continued upward pressure from shelter costs suggest the battle against inflation is far from over. The Fed's next move – whether to raise interest rates again or maintain the current rate – will hinge on upcoming economic data and the evolving inflation picture. Many economists believe further rate hikes remain on the table, but the exact timing and magnitude remain uncertain.

What This Means for Consumers:

The consistent inflation rate continues to impact consumers' purchasing power. While the rate of increase has slowed, the persistent inflation continues to put pressure on household budgets, particularly for those with fixed incomes. Increased interest rates also translate to higher borrowing costs for mortgages, auto loans, and credit cards.

Looking Ahead:

The economic outlook remains clouded by uncertainty. Future CPI reports will be crucial in guiding both the Federal Reserve's monetary policy and consumer expectations. Factors such as the ongoing war in Ukraine, supply chain disruptions, and global economic growth will continue to influence inflation. Experts recommend staying informed about economic developments and adjusting personal financial strategies accordingly.

Call to Action: Stay informed about the latest economic news and data releases by regularly checking reputable sources such as the Bureau of Labor Statistics website. Consider consulting a financial advisor to navigate the complexities of the current economic environment.

Keywords: U.S. Inflation, CPI, Consumer Price Index, Inflation Rate, Federal Reserve, Interest Rates, Monetary Policy, Economic Outlook, June CPI Report, Inflation Data, Housing Costs, Core Inflation, Economic News

Internal Links (Examples - replace with actual links to relevant articles on your site):

- [Link to previous month's CPI report analysis]

- [Link to article on Federal Reserve policy]

- [Link to article on personal finance strategies]

External Links (Examples):

- [Link to Bureau of Labor Statistics website]

- [Link to Federal Reserve website]

This article utilizes strong SEO practices by incorporating relevant keywords, headings, internal and external links, bullet points, and a clear call to action. Remember to replace the bracketed links with actual URLs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Inflation Remains Consistent: June Consumer Price Data Released. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Taylor Swifts Sparkling Stage Style Showgirl Chic

Aug 16, 2025

Taylor Swifts Sparkling Stage Style Showgirl Chic

Aug 16, 2025 -

Unresolved Trauma The Nanjing Massacre And Its Legacy In China Japan Relations

Aug 16, 2025

Unresolved Trauma The Nanjing Massacre And Its Legacy In China Japan Relations

Aug 16, 2025 -

Billboard Exec Reacts Taylor Swifts New Album Announcement

Aug 16, 2025

Billboard Exec Reacts Taylor Swifts New Album Announcement

Aug 16, 2025 -

The Photo Thats Breaking The Internet Chelsea Clintons Reaction To Trumps Gate Crash

Aug 16, 2025

The Photo Thats Breaking The Internet Chelsea Clintons Reaction To Trumps Gate Crash

Aug 16, 2025 -

Is Measles A Risk For Travelers Essential Precautions And Advice

Aug 16, 2025

Is Measles A Risk For Travelers Essential Precautions And Advice

Aug 16, 2025

Latest Posts

-

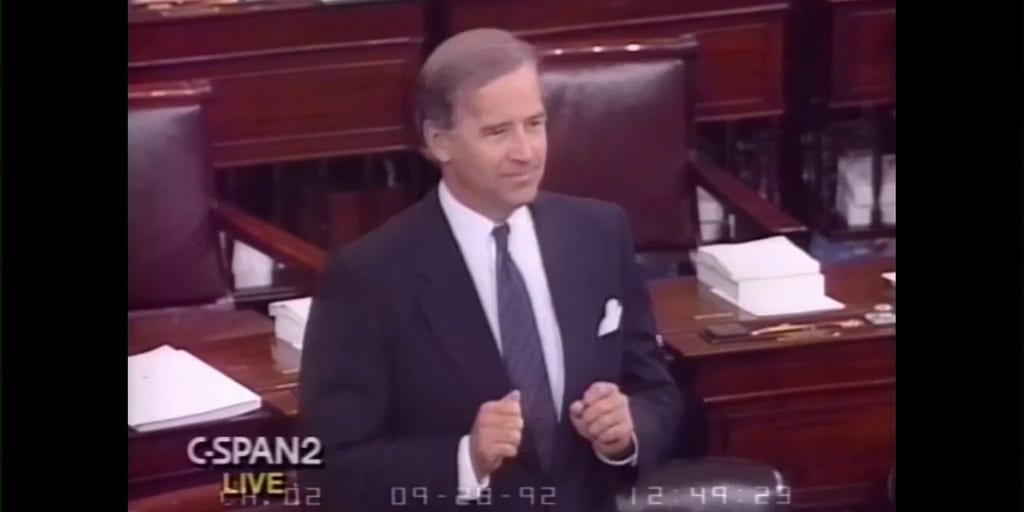

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025