U.S. Inflation: June Consumer Price Index Shows Anticipated Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Inflation: June CPI Shows Anticipated Increase, But Hints of Cooling Remain

The June Consumer Price Index (CPI) report, released this morning by the Bureau of Labor Statistics (BLS), confirmed a slight uptick in inflation, rising 0.2% for the month and 3% year-over-year. While this increase aligns with economists' predictions, it also offers subtle hints that the relentless inflationary pressure gripping the U.S. economy might finally be starting to ease. The data provides a complex picture, requiring careful analysis beyond the headline figures.

Headline Inflation Still Present, but Underlying Trends Suggest Slowdown

The 0.2% monthly increase, slightly exceeding expectations of a 0.1% rise, reflects continued pressure on consumer spending. The year-over-year figure of 3% is a decrease from the 4% reported in May, marking a consistent decline from the peak inflation levels seen in 2022. This slowing trend is a key takeaway, suggesting the Federal Reserve's aggressive interest rate hikes are gradually having the desired effect.

However, it's crucial to look beyond the headline numbers. While overall inflation is moderating, certain sectors continue to show stubborn price increases. For instance, shelter costs remain a significant driver of inflation, indicating that the full impact of higher mortgage rates and reduced housing demand hasn't yet been fully felt.

Sector-Specific Analysis: A Mixed Bag

- Energy Prices: Energy prices saw a modest increase, contributing to the overall CPI rise. However, the impact was less pronounced than in previous months, suggesting some stabilization in this volatile sector. This is partially attributable to the recent decrease in oil prices.

- Food Prices: Food prices continue to climb, albeit at a slower rate than earlier this year. This persistent pressure on grocery budgets highlights the ongoing challenges faced by many American households.

- Used Car Prices: Used car prices, a significant contributor to inflation in 2022, finally showed a decline in June. This sector's cooling trend is a positive sign, further suggesting overall price pressures are lessening.

The Fed's Next Move: A Balancing Act

The June CPI report presents a challenge for the Federal Reserve. While the moderation in inflation is encouraging, the persistent increases in certain sectors necessitate a cautious approach. The Fed is likely to continue monitoring the economic data closely before deciding on its next move regarding interest rates. A premature pause in rate hikes could risk reigniting inflation, while further increases might trigger a deeper economic slowdown. The upcoming months will be critical in determining the future trajectory of monetary policy.

Looking Ahead: What to Expect

Economists anticipate further moderation in inflation in the coming months, but the path is unlikely to be smooth. Geopolitical uncertainties, supply chain disruptions, and fluctuating energy prices could all impact the rate of inflation. Consumers can expect to continue navigating a period of elevated prices, though the pace of increase is expected to slow. Careful budgeting and financial planning remain essential tools for navigating this dynamic economic landscape. Stay informed by regularly consulting reliable sources like the Bureau of Labor Statistics website () for the latest updates.

Call to Action: Stay informed about economic trends and consult with a financial advisor to best manage your personal finances during this period of economic transition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Inflation: June Consumer Price Index Shows Anticipated Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Child And Witness Escape Killer In Southport Home Police Inquiry Underway

Sep 12, 2025

Child And Witness Escape Killer In Southport Home Police Inquiry Underway

Sep 12, 2025 -

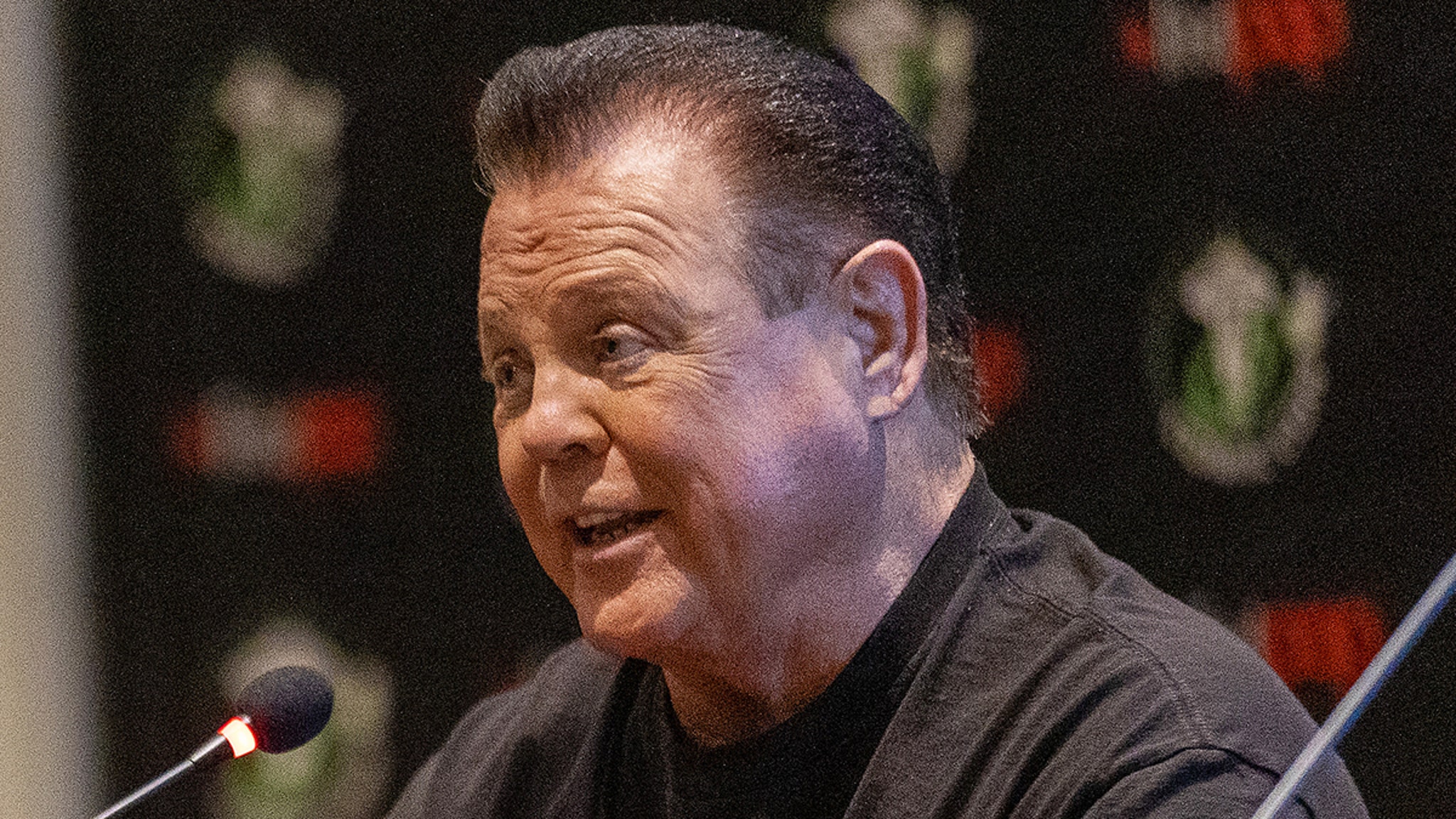

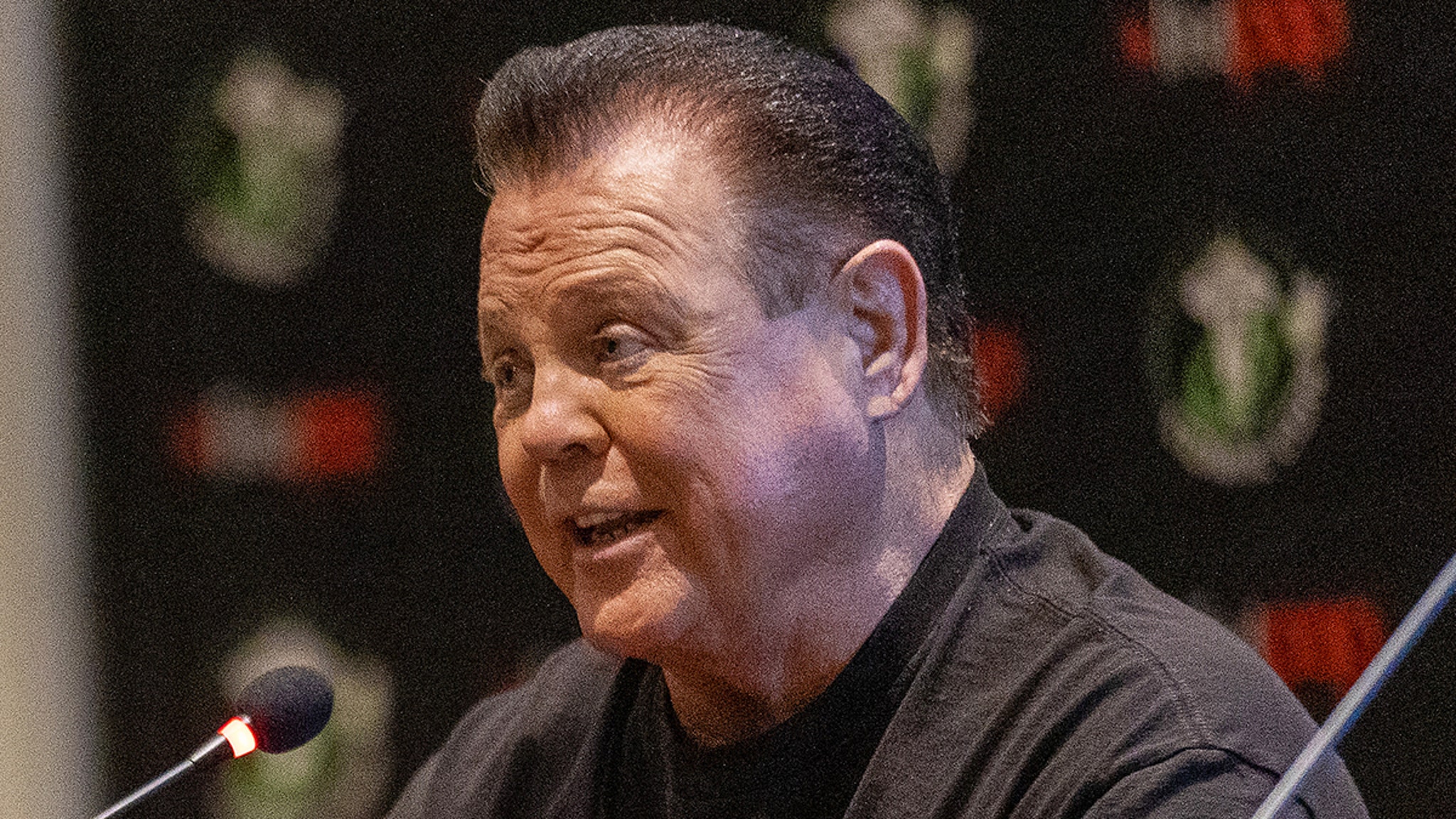

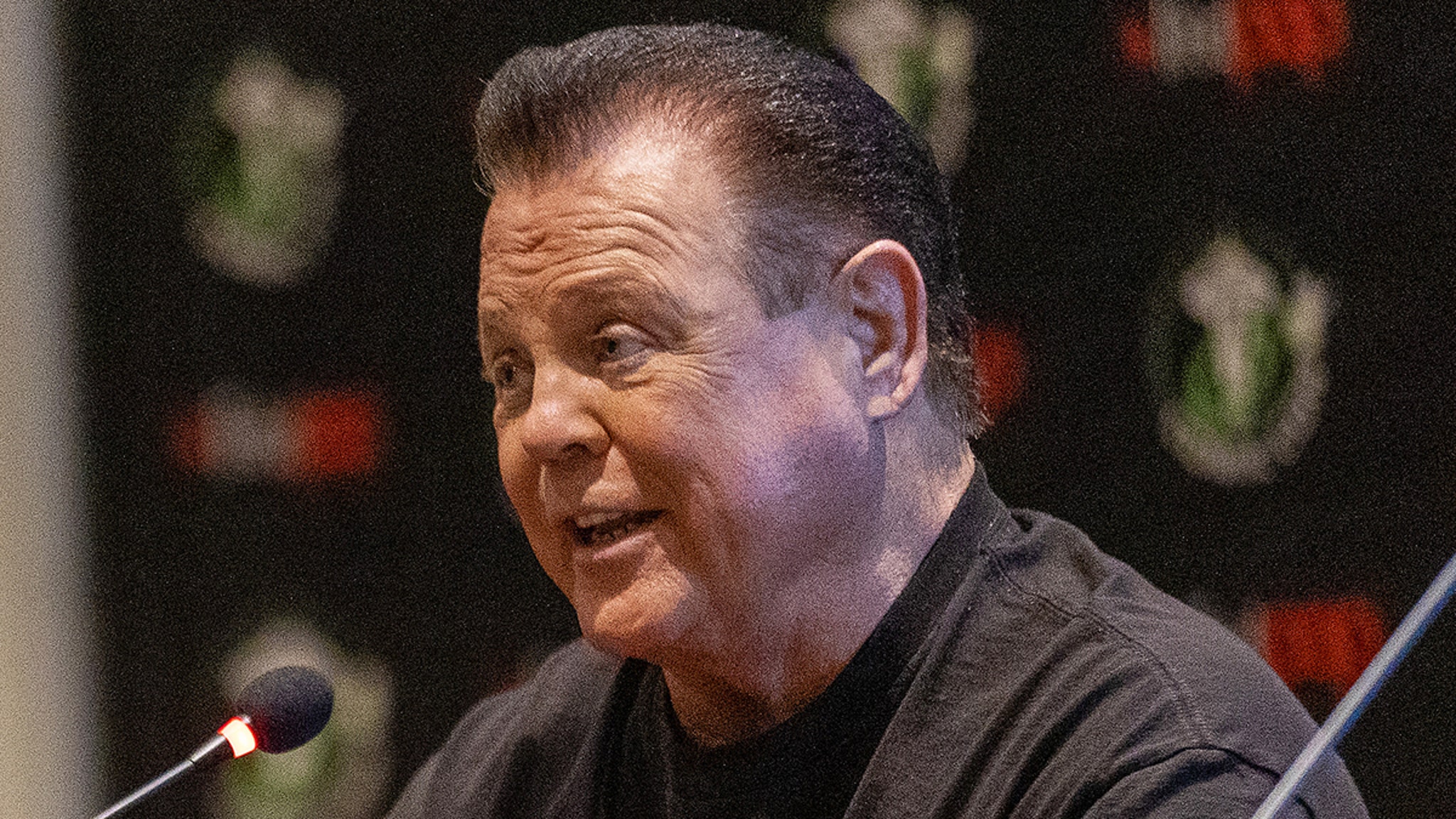

Wwe Legend Jerry Lawler Suffers Stroke Fighting Back

Sep 12, 2025

Wwe Legend Jerry Lawler Suffers Stroke Fighting Back

Sep 12, 2025 -

Update On Jerry Lawlers Condition Following Recent Stroke

Sep 12, 2025

Update On Jerry Lawlers Condition Following Recent Stroke

Sep 12, 2025 -

Wwes Jerry Lawler Recovering After Suffering A Stroke

Sep 12, 2025

Wwes Jerry Lawler Recovering After Suffering A Stroke

Sep 12, 2025 -

Cruzeiro X Atletico Mg Data Horario Onde Assistir E Escalacoes

Sep 12, 2025

Cruzeiro X Atletico Mg Data Horario Onde Assistir E Escalacoes

Sep 12, 2025

Latest Posts

-

Rare Public Display Channing Tatum Celebrates Inka Williams Birthday

Sep 12, 2025

Rare Public Display Channing Tatum Celebrates Inka Williams Birthday

Sep 12, 2025 -

Nc State Wolfpack Vs Wake Forest Demon Deacons Thursdays Acc Matchup Odds And Betting Pick

Sep 12, 2025

Nc State Wolfpack Vs Wake Forest Demon Deacons Thursdays Acc Matchup Odds And Betting Pick

Sep 12, 2025 -

Backlash Against Plan To Install Charlie Kirk Statue In The Capitol

Sep 12, 2025

Backlash Against Plan To Install Charlie Kirk Statue In The Capitol

Sep 12, 2025 -

Urgent Update Shooting At High School In Denver Suburbs Students Wounded

Sep 12, 2025

Urgent Update Shooting At High School In Denver Suburbs Students Wounded

Sep 12, 2025 -

Southport Inquiry Hears Testimony Of Terrifying Home Invasion

Sep 12, 2025

Southport Inquiry Hears Testimony Of Terrifying Home Invasion

Sep 12, 2025