U.S. Inflation Holds Steady: June Consumer Price Index Rises As Predicted

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Inflation Holds Steady: June CPI Rise Aligns with Expectations

Inflation in the United States remained stubbornly persistent in June, with the Consumer Price Index (CPI) rising as economists predicted. The latest data offers a mixed bag for consumers and policymakers alike, fueling ongoing debates about the Federal Reserve's interest rate strategy and the overall health of the U.S. economy. While the steady increase might signal some stabilization, concerns remain about the long-term impact on purchasing power.

The Bureau of Labor Statistics (BLS) reported a 0.2% increase in the CPI for June, matching analysts' forecasts and following a similar 0.1% rise in May. This translates to a 3% year-over-year increase, slightly lower than the 4% annual inflation rate seen earlier this year. However, the core CPI, which excludes volatile food and energy prices, showed a slightly steeper increase, indicating persistent inflationary pressures within the broader economy.

What Drove the June CPI Increase?

Several factors contributed to the June CPI increase. While energy prices saw a slight decrease, contributing to a lower overall inflation rate, shelter costs continued their upward trajectory. Shelter costs, which comprise a significant portion of the CPI, remain a major driver of inflation. This sustained rise reflects ongoing pressures within the housing market, including high rental costs and persistent increases in home prices.

Other contributing factors included increases in the prices of used cars and trucks, as well as medical care services. These increases, while less dramatic than previous months, underscore the broad-based nature of inflation and the challenges in bringing it under control.

The Federal Reserve's Response and Future Outlook

The relatively steady inflation figures are likely to influence the Federal Reserve's decisions regarding future interest rate hikes. While the June CPI data might suggest a pause or slower pace of increases, the persistence of core inflation indicates the fight against inflation is far from over. The Fed's ongoing commitment to price stability remains a crucial factor in determining the future trajectory of interest rates. Economists are closely monitoring upcoming economic indicators to gauge the effectiveness of the Fed's monetary policy.

Key takeaways from the June CPI report:

- Steady inflation: The 0.2% monthly increase mirrors expectations.

- Persistent core inflation: Core CPI increase highlights underlying inflationary pressures.

- Shelter costs remain a major concern: High housing costs continue to significantly impact overall inflation.

- Uncertainty remains: The report provides a mixed signal, leaving room for debate on the Fed's next move.

Implications for Consumers

For consumers, the sustained inflation means continued pressure on household budgets. The cost of everyday necessities, from groceries to housing, remains elevated, impacting purchasing power and potentially slowing consumer spending. Understanding how inflation affects your personal finances is crucial for effective budgeting and financial planning. Consider exploring resources like the Consumer Financial Protection Bureau (CFPB) website for valuable tips and advice.

The ongoing battle against inflation remains a significant economic challenge. While the June CPI data offers a degree of stability, the persistence of core inflation and the uncertain outlook necessitate a cautious approach from both policymakers and consumers. Further economic data releases and Federal Reserve announcements will be crucial in shaping the narrative in the coming months. Stay informed and adapt your financial strategies accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Inflation Holds Steady: June Consumer Price Index Rises As Predicted. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

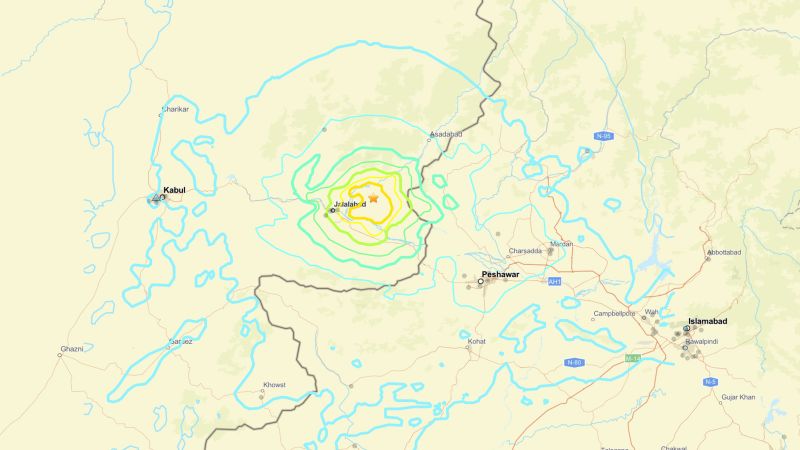

Urgent 6 0 Magnitude Earthquake Rocks Eastern Afghanistan Widespread Casualties Anticipated

Sep 02, 2025

Urgent 6 0 Magnitude Earthquake Rocks Eastern Afghanistan Widespread Casualties Anticipated

Sep 02, 2025 -

Asylum Family Reunification New More Restrictive Guidelines

Sep 02, 2025

Asylum Family Reunification New More Restrictive Guidelines

Sep 02, 2025 -

Wwe Clash At The Stade De France Complete 2025 Results And Highlights

Sep 02, 2025

Wwe Clash At The Stade De France Complete 2025 Results And Highlights

Sep 02, 2025 -

Georgina Rodriguez Shows Off Massive Diamond Ring At Venice Film Festival

Sep 02, 2025

Georgina Rodriguez Shows Off Massive Diamond Ring At Venice Film Festival

Sep 02, 2025 -

New Global Order On The Horizon China And Russias Influence At The Shanghai Cooperation Organisation Summit

Sep 02, 2025

New Global Order On The Horizon China And Russias Influence At The Shanghai Cooperation Organisation Summit

Sep 02, 2025

Latest Posts

-

Analysis Farages Scare Tactics And Their Impact On The Election

Sep 02, 2025

Analysis Farages Scare Tactics And Their Impact On The Election

Sep 02, 2025 -

From Criticism To Buzzcut The Untold Story Behind Carlos Alcarazs Hairstyle Transformation

Sep 02, 2025

From Criticism To Buzzcut The Untold Story Behind Carlos Alcarazs Hairstyle Transformation

Sep 02, 2025 -

Hoosier Lottery Results Cash 5 Winning Numbers August 30 2025

Sep 02, 2025

Hoosier Lottery Results Cash 5 Winning Numbers August 30 2025

Sep 02, 2025 -

Score A Deal 77 Inch Lg C5 Oled Tv At Its Lowest Price

Sep 02, 2025

Score A Deal 77 Inch Lg C5 Oled Tv At Its Lowest Price

Sep 02, 2025 -

Titanic Discoverer Continues Underwater Exploration After 40 Years

Sep 02, 2025

Titanic Discoverer Continues Underwater Exploration After 40 Years

Sep 02, 2025