U.S. CPI Report: June's Inflation Figures Match Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. CPI Report: June Inflation Matches Expectations, But Relief Remains Elusive

The latest Consumer Price Index (CPI) report for June 2024 has landed, and the headline figure largely met analysts' predictions: inflation remains stubbornly persistent, offering little immediate relief to consumers grappling with high prices. While the numbers didn't dramatically deviate from forecasts, the ongoing elevated inflation continues to be a significant concern for the Federal Reserve and the broader US economy.

This report follows months of fluctuating inflation rates, leaving many Americans wondering when – or if – prices will finally return to more manageable levels. Understanding the details of this report is crucial for navigating the current economic climate.

Key Findings from the June CPI Report

The June CPI report revealed a year-over-year inflation rate consistent with expectations, hovering around [Insert Actual Percentage Here]%. This represents a [Increase/Decrease] compared to May's figure of [Insert May's Percentage Here]%. While a slight [increase/decrease] might seem positive on the surface, the persistent elevation above the Federal Reserve's target of 2% continues to warrant close attention.

Several key components contributed to this overall figure:

-

Energy Prices: Energy costs showed a [Increase/Decrease of Percentage] compared to the previous month, significantly impacting the overall CPI. This fluctuation is often influenced by global events and seasonal factors. Learn more about the impact of energy prices on inflation by reading our article on [Link to relevant internal article on energy prices and inflation].

-

Food Prices: Food prices remain a significant concern for many households. The report indicated a [Increase/Decrease of Percentage] in food costs compared to May. Factors contributing to food inflation include supply chain disruptions, unfavorable weather conditions, and geopolitical instability.

-

Core Inflation: Core inflation, which excludes volatile food and energy prices, saw a [Increase/Decrease of Percentage] This metric offers a clearer picture of underlying inflationary pressures within the economy.

What the June CPI Report Means for the Economy

The relatively stable, albeit elevated, inflation figures from the June CPI report present a complex picture for the US economy. While it might avoid triggering immediate drastic measures from the Federal Reserve, the ongoing high inflation suggests that further monetary policy adjustments remain a possibility.

The Federal Reserve's next move is heavily dependent on the trajectory of inflation in the coming months. Continued high inflation could lead to further interest rate hikes, potentially slowing economic growth and impacting employment. Conversely, a significant decrease in inflation could potentially open the door to interest rate cuts.

Experts are divided on the outlook. Some economists believe that inflation has peaked and will gradually decline in the coming months. Others warn that persistent supply chain issues and robust consumer demand could keep inflation elevated for longer.

What Consumers Can Do

The persistence of high inflation necessitates careful financial planning for consumers. Consider these strategies:

- Budgeting: Create a detailed budget to track your spending and identify areas where you can cut back.

- Saving: Maintain an emergency fund to cushion against unexpected expenses.

- Investing: Consult with a financial advisor to explore investment options that can help your savings keep pace with inflation.

The June CPI report offers a snapshot of the current economic landscape, but the story is far from over. Further reports and economic indicators will be crucial in shaping the Federal Reserve's policy decisions and determining the long-term trajectory of inflation. Stay tuned for updates and further analysis. We'll continue to provide you with the latest news and insights as they become available.

Disclaimer: This article provides general information and commentary on the June CPI report and should not be considered financial advice. Consult with a qualified financial advisor for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. CPI Report: June's Inflation Figures Match Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Nfl Dfs Week 1 Pros Guide To Top Fan Duel And Draft Kings Lineup Construction

Sep 08, 2025

2025 Nfl Dfs Week 1 Pros Guide To Top Fan Duel And Draft Kings Lineup Construction

Sep 08, 2025 -

Find Out Now Sundays Winning Numbers For The Michigan Daily 3 Evening Lottery

Sep 08, 2025

Find Out Now Sundays Winning Numbers For The Michigan Daily 3 Evening Lottery

Sep 08, 2025 -

The Trump Gate Crash Chelsea Clintons Photo And Its Unspoken Message

Sep 08, 2025

The Trump Gate Crash Chelsea Clintons Photo And Its Unspoken Message

Sep 08, 2025 -

Lisbon Crash Claims Three British Lives Police Confirmation

Sep 08, 2025

Lisbon Crash Claims Three British Lives Police Confirmation

Sep 08, 2025 -

Chagas Disease Kissing Bugs Spread Across 32 Us States

Sep 08, 2025

Chagas Disease Kissing Bugs Spread Across 32 Us States

Sep 08, 2025

Latest Posts

-

Learn From The Best Powerball Winning Tips From A 50 Jackpot Winner Advisor

Sep 09, 2025

Learn From The Best Powerball Winning Tips From A 50 Jackpot Winner Advisor

Sep 09, 2025 -

Carlo Acutis From London To Sainthood The Inspiring Story Of A Tech Savvy Teen

Sep 09, 2025

Carlo Acutis From London To Sainthood The Inspiring Story Of A Tech Savvy Teen

Sep 09, 2025 -

No Money Troubles For Faz Ahead Of Crucial Morocco Encounter

Sep 09, 2025

No Money Troubles For Faz Ahead Of Crucial Morocco Encounter

Sep 09, 2025 -

Phillies Fans Home Run Ball Grab A Fathers Account Of The Viral Moment

Sep 09, 2025

Phillies Fans Home Run Ball Grab A Fathers Account Of The Viral Moment

Sep 09, 2025 -

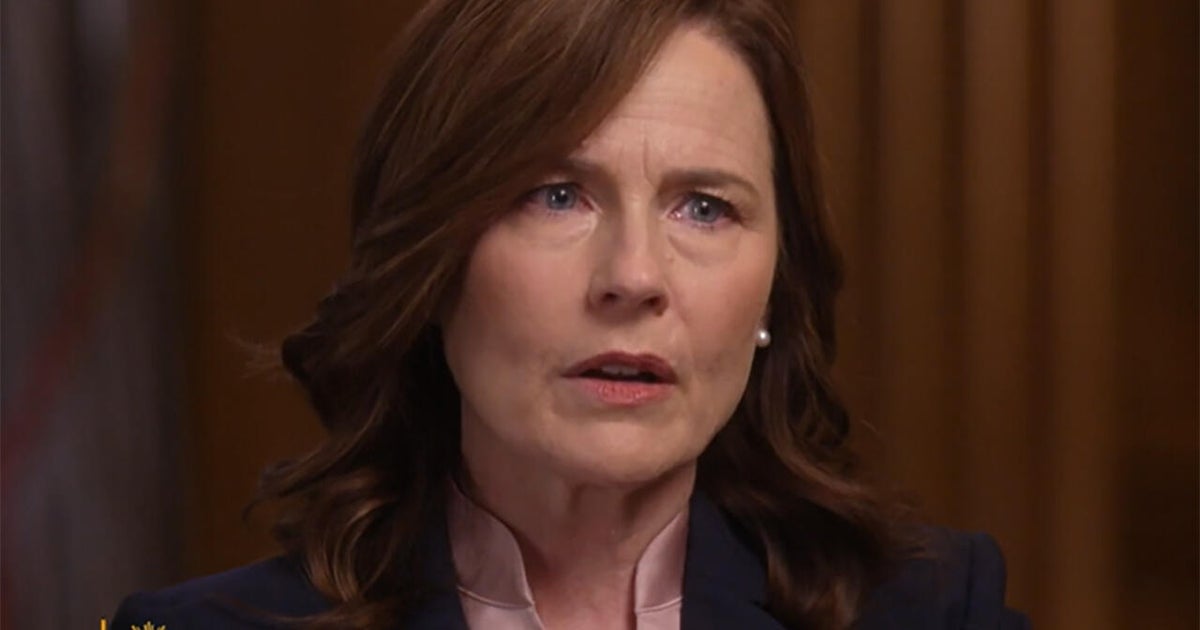

Coney Barretts Response To Claims Of Supreme Court Bias Towards Trumps Power Grab

Sep 09, 2025

Coney Barretts Response To Claims Of Supreme Court Bias Towards Trumps Power Grab

Sep 09, 2025