U.S. CPI Report: June Shows Expected Increase In Consumer Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. CPI Report: June Inflation Rises as Expected, but Concerns Remain

The latest Consumer Price Index (CPI) report for June, released by the Bureau of Labor Statistics (BLS), showed a modest increase in consumer prices, aligning with economists' predictions. While the headline inflation figure offers a temporary sigh of relief, underlying inflationary pressures persist, keeping the Federal Reserve's monetary policy decisions firmly in the spotlight. The report's details provide a complex picture, requiring a closer look to understand its implications for the U.S. economy.

Headline Inflation Inches Up, But Core Inflation Remains Sticky

The headline CPI, which includes volatile components like food and energy, rose by 0.2% in June, following a 0.1% increase in May. This translates to an annual inflation rate of 3%, down from 4% in May and significantly lower than the peak of 9.1% in June 2022. This deceleration is largely attributed to falling energy prices. However, the core CPI, which excludes food and energy, increased by 0.2%, mirroring May's growth and maintaining an annual rate of 4.8%. This persistent core inflation is a key concern for policymakers.

What Drove the June CPI Numbers?

Several factors contributed to the June CPI figures:

-

Falling Energy Prices: Decreased gasoline prices played a significant role in taming headline inflation. This is a welcome trend, especially for consumers facing budgetary constraints. However, the sustainability of this trend remains uncertain.

-

Used Car Prices Stabilize: Used car prices, which had previously contributed significantly to inflation, showed more moderate increases in June. This stabilization provides some relief, indicating a potential easing of supply chain bottlenecks.

-

Persistent Shelter Costs: Housing costs, a major component of the CPI, continue to rise. This persistent increase in rent and owner's equivalent rent contributes significantly to core inflation, highlighting the ongoing challenge of affordability in the housing market. Experts predict this sector will continue to influence inflation figures for some time.

Implications for the Federal Reserve and the Broader Economy

The June CPI report provides mixed signals for the Federal Reserve. While the slowing headline inflation offers some room for optimism, the stubborn core inflation suggests the battle against inflation is far from over. The Fed's next move remains uncertain, but most analysts believe further interest rate hikes are still on the table, albeit potentially at a slower pace. The possibility of a pause in rate hikes depends heavily on upcoming economic data and the continued trajectory of inflation.

Looking Ahead: What to Watch For

The coming months will be crucial in determining the path of inflation. Key indicators to watch include:

- Further declines in energy prices: Will the decrease in energy costs continue, or will we see a reversal?

- The labor market: A tight labor market can fuel wage growth, potentially contributing to inflationary pressures.

- Supply chain dynamics: Any further disruptions to global supply chains could reignite price increases.

The June CPI report paints a nuanced picture of the current inflation landscape. While the headline number offers some comfort, the persistent core inflation underscores the need for continued vigilance. The Federal Reserve's future decisions, and ultimately the health of the U.S. economy, will hinge on the unfolding economic narrative in the months ahead. Stay informed and consult with financial professionals for personalized advice.

Keywords: CPI, Consumer Price Index, Inflation, June CPI Report, BLS, Bureau of Labor Statistics, Federal Reserve, Interest Rates, Core Inflation, Headline Inflation, Economy, Economic Data, US Economy, Inflation Rate, Housing Costs, Energy Prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. CPI Report: June Shows Expected Increase In Consumer Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Showtime Pulls The Plug On Dexter Original Sin A Deeper Look At The Series End

Aug 28, 2025

Showtime Pulls The Plug On Dexter Original Sin A Deeper Look At The Series End

Aug 28, 2025 -

Apples September 9th Event I Phone 15 Release Date And Features

Aug 28, 2025

Apples September 9th Event I Phone 15 Release Date And Features

Aug 28, 2025 -

Will Pegula Advance Us Open Day 4 Predictions Featuring Pegula Vs Blinkova

Aug 28, 2025

Will Pegula Advance Us Open Day 4 Predictions Featuring Pegula Vs Blinkova

Aug 28, 2025 -

Chelsea Clintons Photo A Case Study In Controlled Public Image After Trump Incident

Aug 28, 2025

Chelsea Clintons Photo A Case Study In Controlled Public Image After Trump Incident

Aug 28, 2025 -

Poundland Administration Averted A Lifeline For The Discount Chain

Aug 28, 2025

Poundland Administration Averted A Lifeline For The Discount Chain

Aug 28, 2025

Latest Posts

-

Ai Deepfake Audio Fake Klobuchar Ad Criticizes Sydney Sweeney

Aug 28, 2025

Ai Deepfake Audio Fake Klobuchar Ad Criticizes Sydney Sweeney

Aug 28, 2025 -

Court Hears Man Approached Girls In Epping Expressed Desire For Child

Aug 28, 2025

Court Hears Man Approached Girls In Epping Expressed Desire For Child

Aug 28, 2025 -

Deepfake Scandal Amy Klobuchar Impersonated In Anti Sydney Sweeney Advertisement

Aug 28, 2025

Deepfake Scandal Amy Klobuchar Impersonated In Anti Sydney Sweeney Advertisement

Aug 28, 2025 -

Public Opinion Shifts Collins Searsport Appearance Met With Demonstrations

Aug 28, 2025

Public Opinion Shifts Collins Searsport Appearance Met With Demonstrations

Aug 28, 2025 -

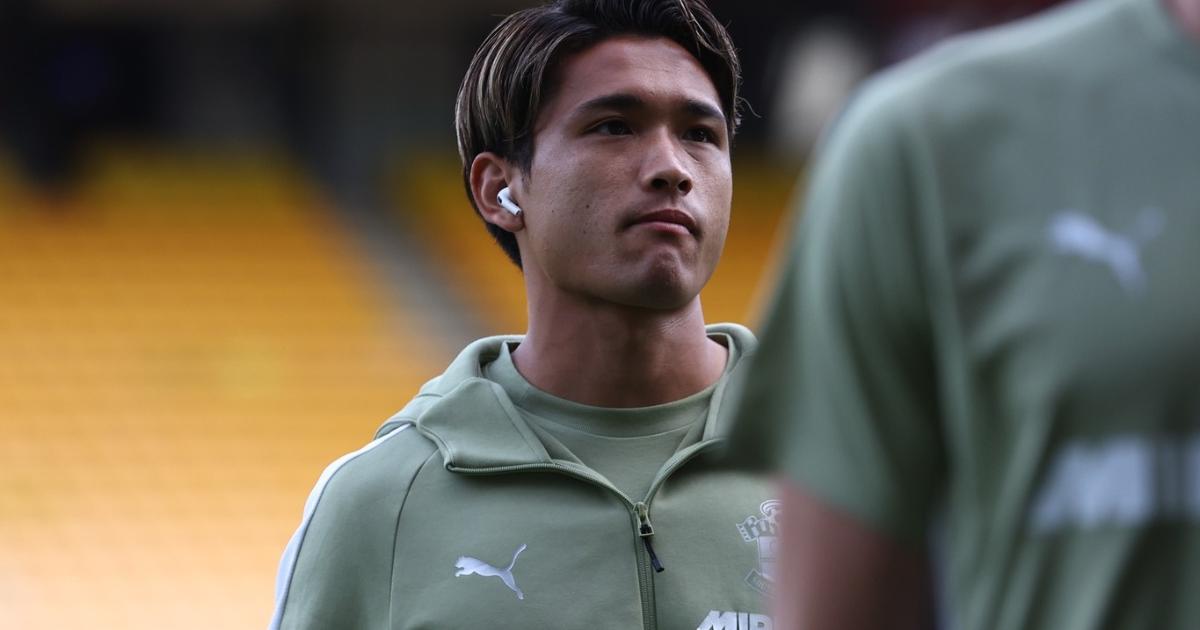

A Worldie Potential Assessing Matsukis Development At Southampton

Aug 28, 2025

A Worldie Potential Assessing Matsukis Development At Southampton

Aug 28, 2025