U.S. CPI Report: June Inflation Figures Meet Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. CPI Report: June Inflation Figures Meet Expectations, but Concerns Remain

The latest Consumer Price Index (CPI) report for June 2024 has been released, and the headline figure largely met analysts' expectations. While this provides a degree of short-term relief, the report reveals a complex picture of the ongoing battle against inflation, leaving room for both optimism and continued caution. The data suggests the Federal Reserve's aggressive interest rate hikes may be starting to bear fruit, but the fight is far from over.

June CPI: A Detailed Look

The Bureau of Labor Statistics (BLS) announced a 3.0% year-over-year increase in the CPI for June, aligning with the consensus forecast of economists. This represents a slight moderation from the previous month's 3.2% increase. However, core inflation, which excludes volatile food and energy prices, saw a slightly higher-than-expected increase, reaching 4.1%. This discrepancy highlights the persistent challenges in taming underlying inflationary pressures.

- Year-over-year inflation: 3.0% (matching expectations)

- Core inflation (excluding food and energy): 4.1% (slightly above expectations)

- Energy prices: Showed a modest decrease, contributing to the overall moderation in headline inflation.

- Food prices: Remained elevated, continuing to impact household budgets across the nation.

What the CPI Report Means for the Economy

The relatively tame headline inflation figure is undoubtedly positive news. It suggests the Federal Reserve's monetary policy tightening is starting to have its intended effect, cooling down the overheating economy. This could potentially reduce the likelihood of further aggressive interest rate hikes in the coming months.

However, the persistent upward pressure on core inflation raises concerns. This suggests that underlying inflationary pressures remain deeply embedded in the economy, potentially fueled by factors such as robust consumer demand and lingering supply chain issues. The persistence of core inflation could lead the Federal Reserve to maintain a hawkish stance for longer than previously anticipated.

Looking Ahead: Challenges and Opportunities

The June CPI report provides a mixed bag of information. While the headline figure offers a glimmer of hope, the core inflation data serves as a reminder that the fight against inflation is far from over. The Federal Reserve will carefully analyze this report and other economic indicators before making decisions about future interest rate adjustments.

The impact on consumers: While lower headline inflation is welcome news for consumers, the continued rise in core inflation and high food prices continue to squeeze household budgets. Many families are still struggling with the increased cost of living.

The impact on businesses: Businesses will be monitoring the inflation data closely as it impacts their pricing strategies, investment decisions, and overall economic outlook. Uncertainty regarding future inflation rates can lead to hesitation in investment and hiring.

Further Reading and Resources:

- Bureau of Labor Statistics (BLS): – Access the full report and detailed data from the official source.

- Federal Reserve: – Stay updated on the latest monetary policy decisions.

Conclusion:

The June CPI report offers a complex picture of the current inflation landscape. While the headline figure meets expectations and offers some optimism, the persistent strength of core inflation requires continued vigilance. The coming months will be crucial in determining whether the current moderation in inflation is sustained or if further measures are needed to bring inflation down to the Federal Reserve's target level. The ongoing economic situation remains fluid, and it's vital for both consumers and businesses to stay informed and adapt to evolving circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. CPI Report: June Inflation Figures Meet Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Humanitarian Crisis Deepens Mass Exodus From Gaza City As Attacks Escalate

Sep 04, 2025

Humanitarian Crisis Deepens Mass Exodus From Gaza City As Attacks Escalate

Sep 04, 2025 -

Uk Considers Ban On Energy Drinks For Under 16s

Sep 04, 2025

Uk Considers Ban On Energy Drinks For Under 16s

Sep 04, 2025 -

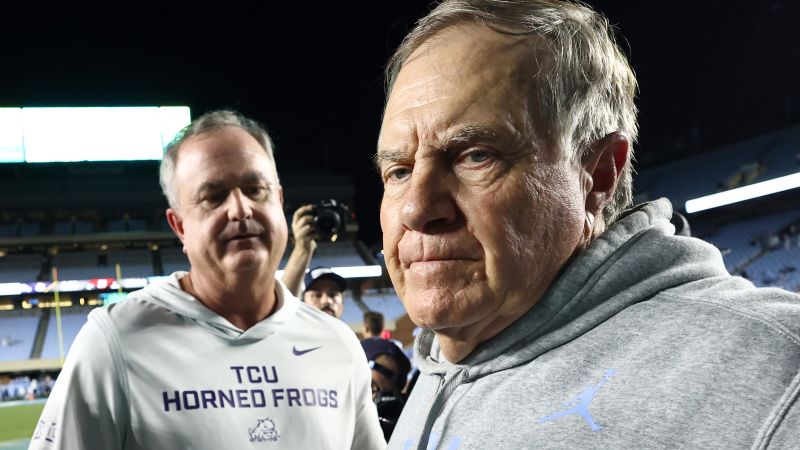

Belichicks College Coaching Premiere Heavy Unc Loss Against Tcu

Sep 04, 2025

Belichicks College Coaching Premiere Heavy Unc Loss Against Tcu

Sep 04, 2025 -

Powerball Lottery 1 3 Billion Jackpot Up For Grabs Following Labor Day Drawing

Sep 04, 2025

Powerball Lottery 1 3 Billion Jackpot Up For Grabs Following Labor Day Drawing

Sep 04, 2025 -

30 Years Of Xena Warrior Princess Legacy And Impact

Sep 04, 2025

30 Years Of Xena Warrior Princess Legacy And Impact

Sep 04, 2025

Remembering Brother Wease His Impact On Rochester Radio

Remembering Brother Wease His Impact On Rochester Radio