U.S. CPI Report: June Inflation Figures Match Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. CPI Report: June Inflation Figures Meet Expectations, but Concerns Remain

The much-anticipated June Consumer Price Index (CPI) report landed this morning, revealing inflation figures largely in line with economists' predictions. While the headline numbers offer a momentary sigh of relief, experts caution against premature celebrations, highlighting persistent underlying inflationary pressures and the ongoing impact on consumers. The report provides a mixed bag of news, offering some hope for cooling inflation but simultaneously underscoring the challenges still facing the Federal Reserve.

Headline Inflation Holds Steady:

The Bureau of Labor Statistics (BLS) reported a 3% year-over-year increase in the CPI for June, matching the consensus forecast. This marks a slight deceleration from May's 4% increase, suggesting a continued, albeit gradual, cooling of inflation. This slowing trend aligns with the Federal Reserve's efforts to tame inflation through interest rate hikes. However, the month-over-month increase was a modest 0.2%, slightly higher than anticipated by some analysts.

Core Inflation Remains Stubborn:

While the headline CPI number is encouraging, a closer look at the core CPI – which excludes volatile food and energy prices – reveals a less optimistic picture. Core inflation, a key indicator for the Fed, rose 0.2% month-over-month, remaining stubbornly persistent. This suggests that underlying inflationary pressures remain significant and could continue to impact consumer spending and overall economic growth. The year-over-year increase in core inflation also held steady at 4.8%, reinforcing concerns about sustained inflationary pressures.

What This Means for Consumers:

The relatively stable CPI figures provide a degree of stability for consumers, but the ongoing inflationary pressures remain a significant concern. The cost of living continues to be a major challenge for many households, particularly with persistent increases in the prices of essential goods and services. This underscores the importance of careful budgeting and financial planning during this period of economic uncertainty.

Implications for the Federal Reserve:

The June CPI report adds another layer of complexity to the Federal Reserve's policy decisions. While the slowing headline inflation provides some support for the Fed's strategy, the persistent core inflation suggests that further interest rate hikes may be necessary to bring inflation down to the central bank's 2% target. The Fed will carefully weigh the risks of further tightening monetary policy against the potential impact on economic growth. Future CPI reports will play a crucial role in shaping the Fed's decisions in the coming months. [Link to Federal Reserve website]

Looking Ahead:

The upcoming months will be critical in determining the trajectory of inflation. Factors such as energy prices, global supply chain dynamics, and wage growth will all play a significant role in shaping the inflation outlook. Continued monitoring of the CPI and other economic indicators is essential for both policymakers and consumers to navigate this period of economic uncertainty.

Keywords: CPI, inflation, Consumer Price Index, BLS, Federal Reserve, interest rates, economic growth, consumer spending, inflation rate, economic outlook, June CPI report, US economy.

Call to Action (subtle): Stay informed about important economic news by bookmarking this page and checking back regularly for updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. CPI Report: June Inflation Figures Match Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

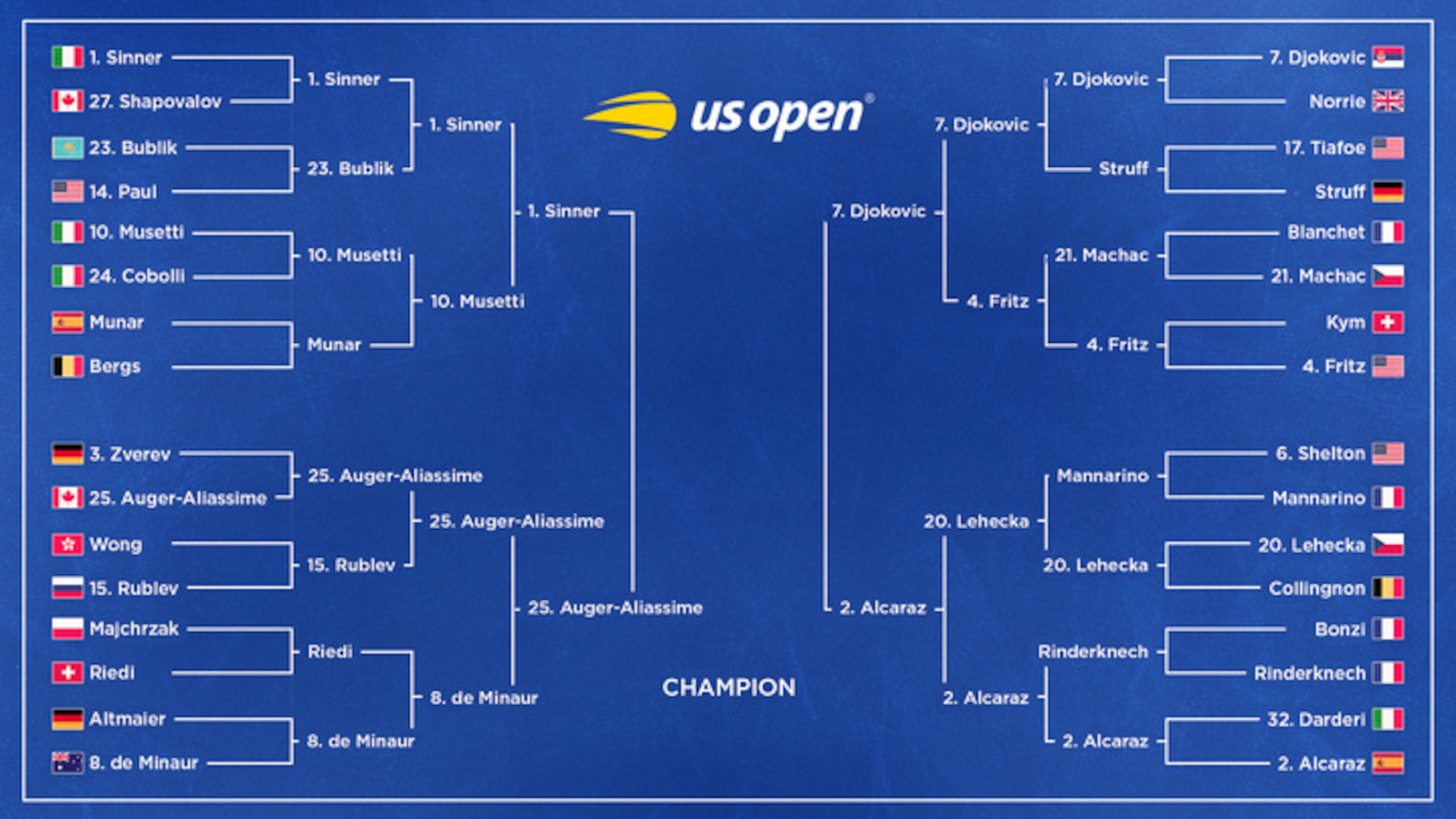

Us Open 2025 Analyzing The Mens Semifinal Bracket And Top Contenders

Sep 04, 2025

Us Open 2025 Analyzing The Mens Semifinal Bracket And Top Contenders

Sep 04, 2025 -

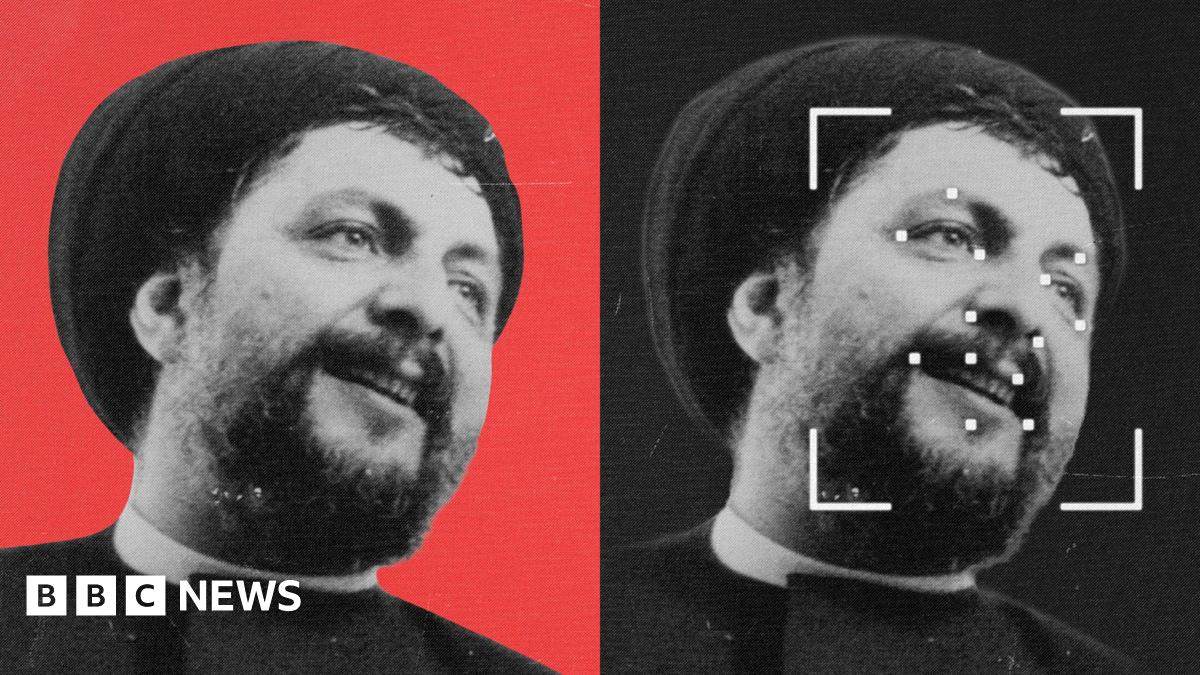

New Development In Musa Al Sadr Case Unidentified Remains Found In Libya

Sep 04, 2025

New Development In Musa Al Sadr Case Unidentified Remains Found In Libya

Sep 04, 2025 -

Starmer Under Pressure Can He Differentiate Himself From Reform Uk

Sep 04, 2025

Starmer Under Pressure Can He Differentiate Himself From Reform Uk

Sep 04, 2025 -

Western New York Claims Another Powerball Winner

Sep 04, 2025

Western New York Claims Another Powerball Winner

Sep 04, 2025 -

Jeannette Pa Resident William Bill S Foriska Obituary From Mason Gelder Funeral Home

Sep 04, 2025

Jeannette Pa Resident William Bill S Foriska Obituary From Mason Gelder Funeral Home

Sep 04, 2025

Latest Posts

-

West Virginia Cash Pop Winning Numbers Tuesdays Draw Results

Sep 04, 2025

West Virginia Cash Pop Winning Numbers Tuesdays Draw Results

Sep 04, 2025 -

Venezuela Claims Drug Smuggling Video Is Ai Generated

Sep 04, 2025

Venezuela Claims Drug Smuggling Video Is Ai Generated

Sep 04, 2025 -

86 On Rotten Tomatoes This 6 Season Fantasy Epic Turns 30

Sep 04, 2025

86 On Rotten Tomatoes This 6 Season Fantasy Epic Turns 30

Sep 04, 2025 -

30 Years Of Xena Warrior Princess Legacy And Impact

Sep 04, 2025

30 Years Of Xena Warrior Princess Legacy And Impact

Sep 04, 2025 -

Michael K Pete Mehalic Key Accomplishments And Impact

Sep 04, 2025

Michael K Pete Mehalic Key Accomplishments And Impact

Sep 04, 2025