U.S. CPI Remains Stable: June Data Shows Anticipated Rise In Consumer Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. CPI Remains Stable: June Data Shows Anticipated Rise in Consumer Prices

Inflation Concerns Persist Despite Expected June CPI Increase

The U.S. Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) data for June, revealing a modest increase largely in line with economists' predictions. While the rise offers a degree of reassurance, concerns about persistent inflation remain prominent, particularly with the Federal Reserve's ongoing interest rate hikes. The report provides a mixed bag for consumers and investors alike, prompting continued scrutiny of the economic outlook.

Headline CPI Up 0.2%, Year-Over-Year Inflation Slows Slightly

The headline CPI rose 0.2% in June, mirroring the increase seen in May. This marks a slight deceleration from the year-over-year inflation rate, which dipped to 3%, down from 4% in May. While the monthly increase is within expectations, the persistent inflation rate remains above the Federal Reserve's 2% target. This suggests that the Fed's aggressive monetary policy tightening might still have a way to go before effectively curbing inflation.

Core CPI Shows Similar Trend, Excluding Volatile Food and Energy Prices

The core CPI, which excludes volatile food and energy prices, also increased by 0.2% in June, aligning with the headline figure. This suggests that underlying inflationary pressures remain relatively steady. The year-over-year core inflation rate sits at 4.8%, highlighting a stubborn persistence of price increases across a broader range of goods and services.

What Drove the June CPI Increase?

Several factors contributed to the June CPI increase. These include:

- Increased shelter costs: Housing remains a significant driver of inflation, reflecting ongoing high rents and home prices. This component continues to be a major contributor to the overall CPI figures.

- Steady growth in used car prices: Although used car prices have generally cooled, they still contributed to the overall increase.

- Persistent price increases in certain service sectors: Several service sectors, including healthcare and recreation, saw continued price increases, adding to the overall inflationary pressure.

Implications for the Federal Reserve and the Economy

The June CPI data is unlikely to significantly alter the Federal Reserve's approach to monetary policy. While the slight deceleration in year-over-year inflation is encouraging, the persistent core inflation rate suggests further rate hikes might be necessary. The Fed will likely continue to carefully monitor upcoming economic data to determine the appropriate course of action. The market anticipates further analysis of the labor market and future inflation readings before making any substantial shifts in policy.

Looking Ahead: What to Expect

Economists are divided on the future trajectory of inflation. Some believe that inflation is finally cooling, pointing to easing supply chain pressures and moderating demand. Others remain cautious, citing the persistent strength of the labor market and ongoing geopolitical uncertainties as potential inflationary risks. The coming months will be crucial in determining the overall economic outlook and the effectiveness of the Federal Reserve's monetary policy. Close monitoring of upcoming CPI reports, along with other economic indicators like the employment situation summary, is essential for accurate forecasting. Understanding the implications of these reports is critical for both investors and consumers navigating the current economic climate.

Further Reading:

- (Replace with actual link)

- (Replace with actual link)

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. CPI Remains Stable: June Data Shows Anticipated Rise In Consumer Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Georgina Rodriguezs Stunning 6 Million Engagement Ring A Closer Look

Sep 02, 2025

Georgina Rodriguezs Stunning 6 Million Engagement Ring A Closer Look

Sep 02, 2025 -

Song Of The Summer Showdown Cnns New York City Street Poll Results

Sep 02, 2025

Song Of The Summer Showdown Cnns New York City Street Poll Results

Sep 02, 2025 -

Edersons Man City Exit Confirmed Joins Fenerbahce

Sep 02, 2025

Edersons Man City Exit Confirmed Joins Fenerbahce

Sep 02, 2025 -

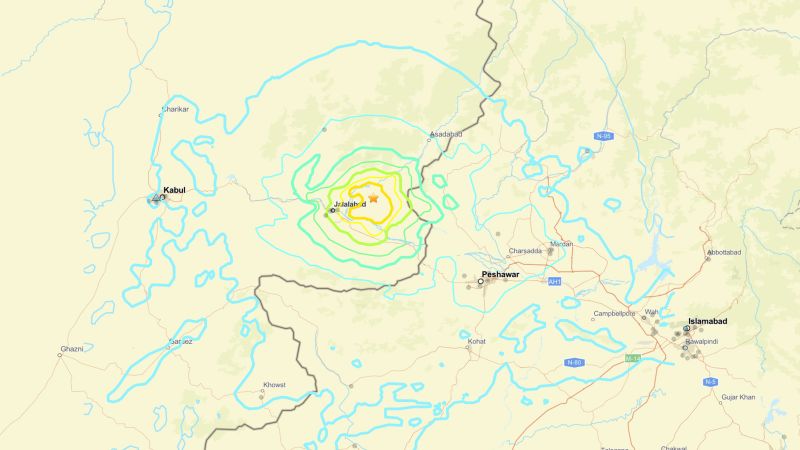

Urgent Major Earthquake In Eastern Afghanistan Significant Casualties Anticipated

Sep 02, 2025

Urgent Major Earthquake In Eastern Afghanistan Significant Casualties Anticipated

Sep 02, 2025 -

Giuliani Receives Presidential Medal Of Freedom From Trump

Sep 02, 2025

Giuliani Receives Presidential Medal Of Freedom From Trump

Sep 02, 2025

Latest Posts

-

Shanghai Cooperation Summit China Russia Chart A Course For A Reshaped World Order

Sep 02, 2025

Shanghai Cooperation Summit China Russia Chart A Course For A Reshaped World Order

Sep 02, 2025 -

Family Tragedy Forces Howard Stern To Halt Comeback Plans

Sep 02, 2025

Family Tragedy Forces Howard Stern To Halt Comeback Plans

Sep 02, 2025 -

September 1 2025 South Carolina Lottery Powerball And Pick 3 Winning Numbers

Sep 02, 2025

September 1 2025 South Carolina Lottery Powerball And Pick 3 Winning Numbers

Sep 02, 2025 -

Trumps Immigration Policy Krugman Highlights A Critical Inhumane Defect

Sep 02, 2025

Trumps Immigration Policy Krugman Highlights A Critical Inhumane Defect

Sep 02, 2025 -

Trumps Presidential Medal Of Freedom Award For Rudy Giuliani

Sep 02, 2025

Trumps Presidential Medal Of Freedom Award For Rudy Giuliani

Sep 02, 2025