U.S. Consumer Prices Up In June: What The CPI Report Means

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Prices Up in June: What the CPI Report Means for Your Wallet

Inflation remains a persistent concern for American consumers, and the latest Consumer Price Index (CPI) report for June offers a mixed bag of news. While the headline inflation number showed a slight deceleration, the underlying data reveals a stubborn persistence of price pressures, leaving many wondering what this means for their personal finances and the broader economy.

The Bureau of Labor Statistics (BLS) announced that the CPI rose 3% in June compared to the same period last year, down from 4% in May. This represents a continued slowdown from the peak inflation rates seen in early 2022, offering a glimmer of hope for those struggling with rising costs. However, the report also revealed a 0.2% increase in the CPI compared to May, suggesting that inflation may not be cooling as rapidly as some had hoped.

What Drove the June CPI Increase?

Several factors contributed to the June CPI increase. Shelter costs, a significant component of the index, continued their upward trajectory, reflecting persistent increases in rent and home prices. This sector alone accounted for a substantial portion of the overall inflation increase. While energy prices saw a slight decline, food prices remained elevated, continuing to pinch household budgets. Used car prices also experienced a modest increase, offsetting some of the positive news from other sectors.

Core Inflation Remains Sticky

A closer look at core inflation, which excludes volatile food and energy prices, paints a less optimistic picture. Core inflation, a key indicator for the Federal Reserve's monetary policy decisions, rose 0.2% for the month and 4.8% year-over-year. This indicates that underlying price pressures remain significant, suggesting that the fight against inflation is far from over.

What Does This Mean for You?

The June CPI report underscores the ongoing challenges faced by American consumers. While the overall inflation rate is moderating, the persistent rise in core inflation and specific cost components like shelter mean that many households continue to experience significant price increases. This necessitates careful budgeting and potentially adjusting spending habits to cope with the higher cost of living.

What's Next?

The Federal Reserve will closely monitor the CPI data and other economic indicators to guide future monetary policy decisions. Further interest rate hikes remain a possibility depending on the trajectory of inflation in the coming months. Economists are divided on the outlook, with some predicting a "soft landing" and others warning of potential recessionary risks.

Key Takeaways:

- Headline inflation slowed slightly: The overall CPI rose 3% year-over-year, down from 4% in May.

- Core inflation remains elevated: Core inflation, excluding food and energy, increased by 4.8% year-over-year.

- Shelter costs remain a major driver of inflation: Rising rent and home prices continue to exert upward pressure on prices.

- Uncertainty remains: The future trajectory of inflation and the Federal Reserve's response remain uncertain.

The June CPI report provides a complex picture of the current inflationary landscape. While the slowdown in headline inflation offers some relief, the persistence of underlying price pressures underscores the need for continued vigilance and adaptive financial planning. Stay informed by regularly checking the BLS website for updated CPI data and economic analysis. Understanding these trends can help you make informed decisions about your personal finances in these challenging economic times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Prices Up In June: What The CPI Report Means. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tennessee Reopens Debate On The 19th Amendments Legacy

Aug 27, 2025

Tennessee Reopens Debate On The 19th Amendments Legacy

Aug 27, 2025 -

Tommy De Vitos Time With Giants Ends Team Announces Roster Cut

Aug 27, 2025

Tommy De Vitos Time With Giants Ends Team Announces Roster Cut

Aug 27, 2025 -

Austin Butler Reportedly Slept On Caught Stealing Set In Underwear

Aug 27, 2025

Austin Butler Reportedly Slept On Caught Stealing Set In Underwear

Aug 27, 2025 -

Reform Uk Demands Fracking Readiness From Energy Sector

Aug 27, 2025

Reform Uk Demands Fracking Readiness From Energy Sector

Aug 27, 2025 -

Jackson Family Discord Intensifies Following Pariss Engagement Cancellation

Aug 27, 2025

Jackson Family Discord Intensifies Following Pariss Engagement Cancellation

Aug 27, 2025

Latest Posts

-

Epping Man Faces Court Accused Of Making Inappropriate Comments To Girls

Aug 27, 2025

Epping Man Faces Court Accused Of Making Inappropriate Comments To Girls

Aug 27, 2025 -

Taylor Swift And Travis Kelce Is A Wedding On The Horizon

Aug 27, 2025

Taylor Swift And Travis Kelce Is A Wedding On The Horizon

Aug 27, 2025 -

Tennis Star Carlos Alcaraz Laughs Off Us Open Haircut Disaster

Aug 27, 2025

Tennis Star Carlos Alcaraz Laughs Off Us Open Haircut Disaster

Aug 27, 2025 -

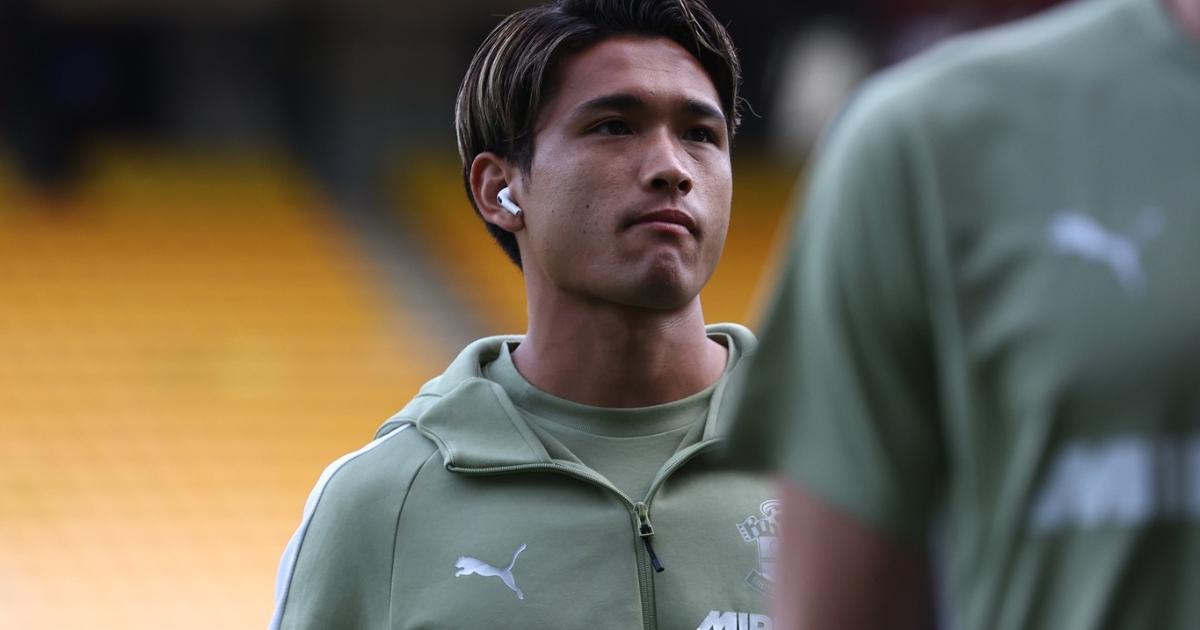

Southamptons Matsuki Is He Developing Into A Top Player

Aug 27, 2025

Southamptons Matsuki Is He Developing Into A Top Player

Aug 27, 2025 -

Emma Heming Willis On Bruce Willis Condition His Brain Is Failing

Aug 27, 2025

Emma Heming Willis On Bruce Willis Condition His Brain Is Failing

Aug 27, 2025