U.S. Consumer Prices: June Inflation Data And Market Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Prices: June Inflation Data and Market Impact

Headline: June Inflation Data Sends Shockwaves Through US Markets: What it Means for Consumers and Investors

The release of the June Consumer Price Index (CPI) data sent shockwaves through US financial markets, leaving investors and consumers alike grappling with the implications of persistent inflation. While economists anticipated a slowdown, the numbers revealed a stubborn persistence of price increases, raising concerns about the Federal Reserve's ongoing battle against inflation and its potential impact on the broader economy. This article delves into the key takeaways from the June CPI report and analyzes its potential consequences.

H2: June CPI Report: Key Findings

The June CPI data, released by the Bureau of Labor Statistics (BLS), revealed a 3% year-over-year increase in consumer prices. While this represents a slight deceleration from May's 4% increase, it still remains significantly above the Federal Reserve's 2% target inflation rate. Several key factors contributed to this persistent inflation:

- Shelter Costs: Shelter costs, a major component of the CPI, continue to rise sharply, driven by strong rental demand and limited housing supply. This sector alone accounts for a significant portion of the overall inflation increase.

- Sticky Core Inflation: Core inflation, which excludes volatile food and energy prices, also remained elevated, suggesting that inflationary pressures are broader than just temporary spikes in commodity prices. This points to more deeply entrenched inflationary pressures.

- Used Car Prices: While used car prices have cooled somewhat, they still contribute to overall inflation, indicating ongoing supply chain challenges in some sectors.

H2: Market Reactions and Investor Sentiment

The release of the June CPI data triggered immediate and significant reactions in the financial markets:

- Stock Market Volatility: Stock market indices experienced volatility following the report, with investors reacting to the persistent inflationary pressures and the potential for further interest rate hikes by the Federal Reserve.

- Bond Yields: Treasury yields, particularly those on longer-term bonds, rose, reflecting investor expectations of higher interest rates for an extended period.

- Dollar Strength: The US dollar strengthened against other major currencies, as investors sought a safe haven asset amidst the uncertainty surrounding inflation and economic growth.

H2: Implications for Consumers and Businesses

The persistence of inflation continues to pose significant challenges for both consumers and businesses:

- Increased Living Costs: Consumers continue to face higher prices for essential goods and services, impacting their purchasing power and overall standard of living. This necessitates careful budgeting and financial planning.

- Business Investment: Businesses are grappling with increased input costs, impacting profitability and potentially leading to reduced investment and hiring. Supply chain disruptions and labor shortages also remain significant concerns.

H2: The Federal Reserve's Response

The Federal Reserve is likely to closely monitor the upcoming inflation data releases and consider further interest rate hikes to combat persistent inflation. The central bank's commitment to bringing inflation back down to its 2% target is unwavering. However, aggressive rate hikes carry the risk of triggering a recession, prompting a delicate balancing act for policymakers.

H2: What to Expect Moving Forward

The future trajectory of inflation remains uncertain. Several factors, including global supply chain dynamics, geopolitical events, and consumer demand, will play a crucial role in shaping the economic outlook. Continuous monitoring of economic indicators, including upcoming CPI and Producer Price Index (PPI) releases, is essential for both investors and consumers. Staying informed about economic news and trends is key to navigating this period of uncertainty.

H3: Further Reading:

Call to Action: Stay tuned for further updates on inflation and its impact on the US economy. Consider consulting with a financial advisor for personalized guidance on managing your finances during this period of economic uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Prices: June Inflation Data And Market Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

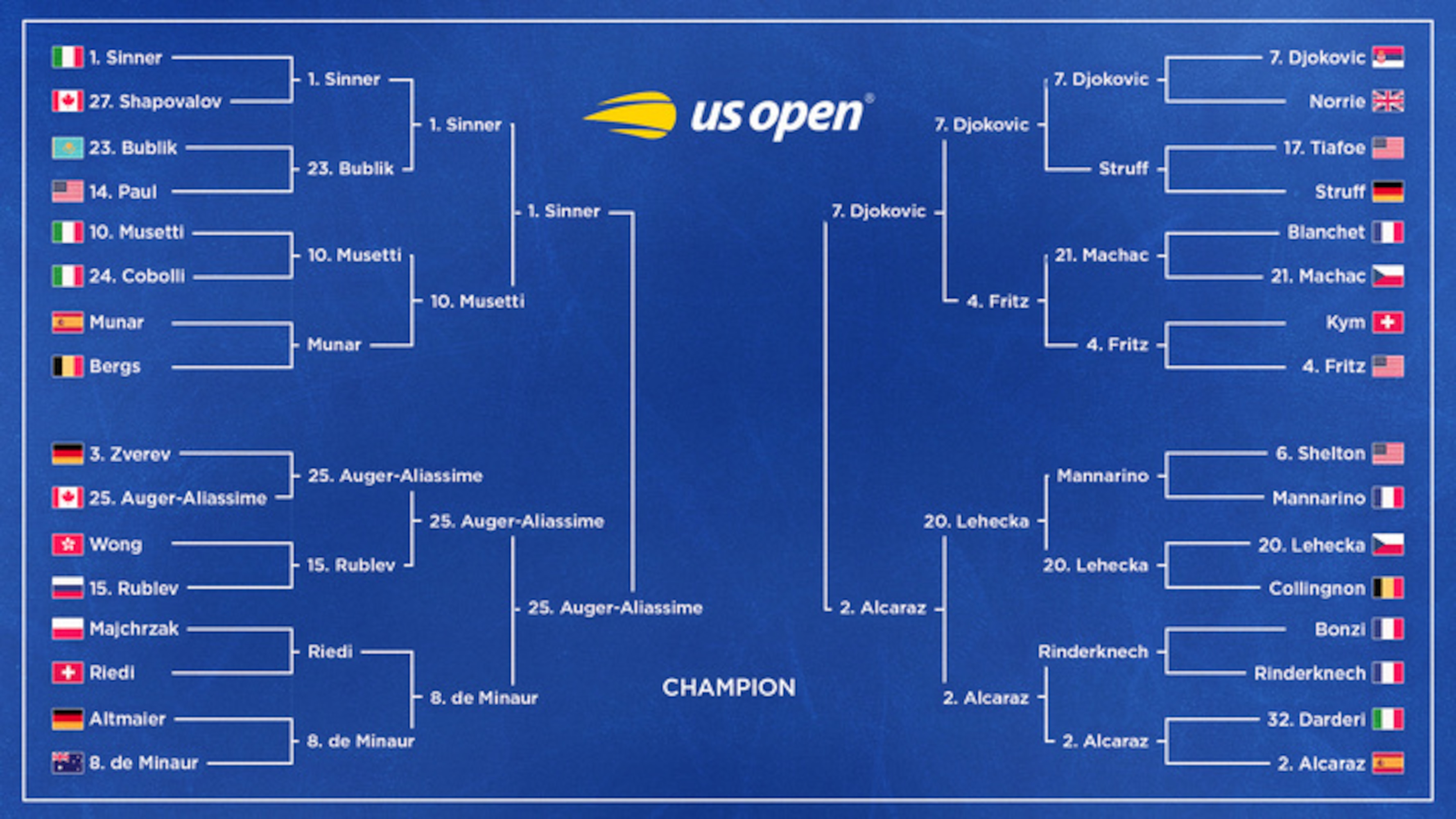

Us Open 2025 Mens Semifinals Potential Upsets And Championship Contenders

Sep 04, 2025

Us Open 2025 Mens Semifinals Potential Upsets And Championship Contenders

Sep 04, 2025 -

Financial Ruin After Graduation The Plight Of Overburdened Students

Sep 04, 2025

Financial Ruin After Graduation The Plight Of Overburdened Students

Sep 04, 2025 -

Watch The Grappling Power Of Turkish Oil Wrestling

Sep 04, 2025

Watch The Grappling Power Of Turkish Oil Wrestling

Sep 04, 2025 -

Death Toll Mounts Talibans Urgent Appeal For Help Following Afghanistan Earthquake

Sep 04, 2025

Death Toll Mounts Talibans Urgent Appeal For Help Following Afghanistan Earthquake

Sep 04, 2025 -

Nba 2 K26 Early Impressions And Review In Progress

Sep 04, 2025

Nba 2 K26 Early Impressions And Review In Progress

Sep 04, 2025

Remembering Brother Wease His Impact On Rochester Radio

Remembering Brother Wease His Impact On Rochester Radio