U.S. Consumer Prices Increase In June, Meeting Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Prices Increase in June, Meeting Expectations: Inflation Remains a Concern

Inflation in the United States continues to be a persistent concern, as the latest Consumer Price Index (CPI) data reveals a modest increase in June, aligning with economists' projections. While the rise wasn't dramatic, it underscores the ongoing challenges the Federal Reserve faces in its efforts to tame inflation without triggering a recession. The report, released by the Bureau of Labor Statistics (BLS), provides crucial insights into the state of the U.S. economy and its trajectory moving forward.

June CPI Data: A Closer Look

The BLS reported a 0.2% increase in the CPI for June, marking a slight uptick from the previous month. This mirrors the consensus forecast among economists, who had predicted a similar level of price growth. Year-over-year, the CPI rose by 3%, a moderation from the significantly higher rates seen earlier in 2023. However, this figure still sits above the Federal Reserve's 2% inflation target.

This seemingly small increase masks nuances within the report. While energy prices saw a slight decline, contributing to a lower overall inflation figure, core inflation (excluding volatile food and energy prices) remained stubbornly persistent. This persistence highlights the challenges in tackling underlying inflationary pressures.

Core Inflation: A Lingering Issue

The core CPI, a key indicator closely watched by the Federal Reserve, rose by 0.2% in June, maintaining a similar trend to the overall CPI. This steady increase in core inflation signals that price pressures are not simply isolated to specific sectors but are rather more deeply entrenched within the economy. Factors contributing to core inflation include robust consumer demand, tight labor markets, and ongoing supply chain disruptions, although these are gradually easing.

Impact on Federal Reserve Policy

The June CPI data is unlikely to dramatically alter the Federal Reserve's near-term monetary policy decisions. While the relatively modest increase might offer some relief, the persistence of core inflation suggests the Fed is likely to maintain its hawkish stance, potentially including further interest rate hikes in the coming months. The goal remains to balance the need to control inflation with the avoidance of triggering a recession. The Fed will carefully analyze upcoming economic data to assess the impact of prior rate hikes and guide future monetary policy decisions.

What This Means for Consumers

For consumers, the continued rise in prices, even at a moderated pace, means maintaining careful budget management. While the overall inflation rate is slowing, the cost of essential goods and services remains elevated compared to pre-pandemic levels. This underscores the importance of mindful spending habits and careful financial planning in the face of persistent inflationary pressure.

Looking Ahead: Uncertainty Remains

While the June CPI data provides a snapshot of the current economic climate, uncertainty remains about the future trajectory of inflation. Geopolitical events, supply chain dynamics, and evolving consumer behavior will all play significant roles in shaping inflation in the months ahead. Close monitoring of upcoming economic indicators and Federal Reserve statements is crucial for understanding the ongoing impact of inflation on the U.S. economy.

Keywords: Inflation, CPI, Consumer Price Index, US Economy, Federal Reserve, Interest Rates, Monetary Policy, Economic Data, BLS, Bureau of Labor Statistics, Core Inflation, Price Increase, Recession, Economic Outlook

Call to Action (subtle): Stay informed about the latest economic news and updates by subscribing to our newsletter for regular insights and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Prices Increase In June, Meeting Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ashvir Singh Johal Breaking Barriers As Morecambes New Youngest Manager

Aug 20, 2025

Ashvir Singh Johal Breaking Barriers As Morecambes New Youngest Manager

Aug 20, 2025 -

Wild Card Implications High As Rays Prepare For Yankees Showdown

Aug 20, 2025

Wild Card Implications High As Rays Prepare For Yankees Showdown

Aug 20, 2025 -

Late Night Tvs Uncertain Future Conan O Briens Perspective And Colberts Example

Aug 20, 2025

Late Night Tvs Uncertain Future Conan O Briens Perspective And Colberts Example

Aug 20, 2025 -

Herefordshire Farmer Faces Losses Broccoli Harvest Hit By Extreme Heat

Aug 20, 2025

Herefordshire Farmer Faces Losses Broccoli Harvest Hit By Extreme Heat

Aug 20, 2025 -

Doubleheader Disaster Brewers Fall To Cubs 4 1

Aug 20, 2025

Doubleheader Disaster Brewers Fall To Cubs 4 1

Aug 20, 2025

Latest Posts

-

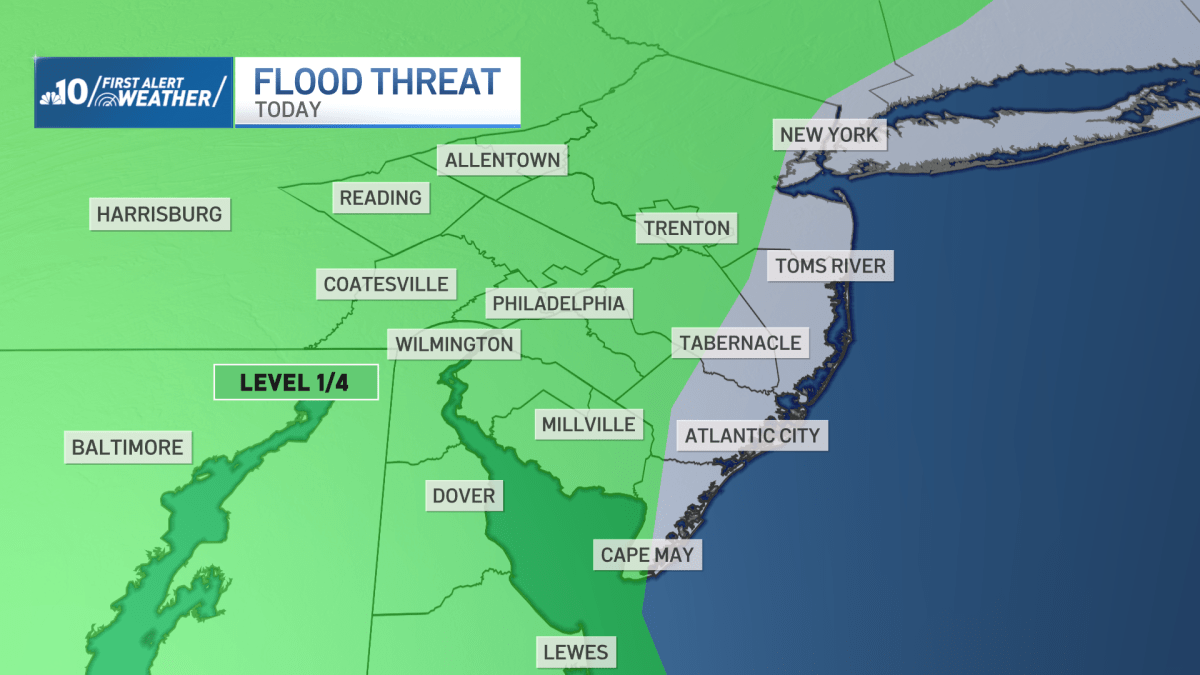

Powerful Storms Unleash Downpours And Widespread Flooding In Philadelphia

Aug 20, 2025

Powerful Storms Unleash Downpours And Widespread Flooding In Philadelphia

Aug 20, 2025 -

Rodons Stellar Outing Five Ks Power Yankees To 13th Win

Aug 20, 2025

Rodons Stellar Outing Five Ks Power Yankees To 13th Win

Aug 20, 2025 -

Resolution Reached Uk And Us Settle Apple Privacy Dispute

Aug 20, 2025

Resolution Reached Uk And Us Settle Apple Privacy Dispute

Aug 20, 2025 -

Cleveland Guardians Arizona Project Fallout

Aug 20, 2025

Cleveland Guardians Arizona Project Fallout

Aug 20, 2025 -

Cleveland Guardians Prospect Parker Messick Set For Big League Start

Aug 20, 2025

Cleveland Guardians Prospect Parker Messick Set For Big League Start

Aug 20, 2025