U.S. Consumer Prices Climb In June, Meeting Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Prices Climb in June, Meeting Forecasts: Inflation Remains a Concern

Headline: U.S. Inflation Holds Steady in June, Fueling Ongoing Economic Debate

Introduction: The U.S. Consumer Price Index (CPI) for June, released this morning, showed a 3% year-over-year increase, aligning with economists' predictions. While the figure represents a slight moderation from previous months, it reinforces concerns about persistent inflation and its impact on the American economy. This persistent inflation keeps the Federal Reserve's monetary policy decisions firmly in the spotlight, with further interest rate hikes still a possibility.

Key Takeaways:

- Inflation Remains Elevated: The 3% year-over-year increase in the CPI underscores that inflation, although slowing, remains significantly above the Federal Reserve's 2% target. This sustained increase continues to impact household budgets and purchasing power.

- Core Inflation Steady: Core inflation, which excludes volatile food and energy prices, also saw a modest increase, indicating broader price pressures across the economy. This suggests that inflation isn't solely driven by temporary factors.

- Energy Prices Fluctuate: While energy prices saw some fluctuation during June, their impact on the overall CPI remains a significant contributing factor to the overall inflation rate. This volatility highlights the ongoing uncertainty in the global energy market.

- Food Prices Remain High: Food prices continue to be a major driver of inflation, impacting household budgets and potentially contributing to food insecurity for some segments of the population. This factor necessitates further investigation into supply chain disruptions and agricultural policies.

- Federal Reserve's Next Move: The June CPI data will likely influence the Federal Reserve's decisions regarding future interest rate adjustments. While a pause might be considered, the persistence of inflation could prompt further rate hikes aimed at cooling the economy.

What This Means for Consumers:

The persistent inflation, even at a slightly moderated rate, continues to impact consumers. Rising prices for essential goods and services like groceries and housing are squeezing household budgets, potentially leading to reduced spending and economic slowdown. Careful budgeting and financial planning are crucial during this period of economic uncertainty. Consider exploring resources like the [link to a reputable financial planning website or government resource].

Analyzing the Data:

Economists are closely analyzing the details within the CPI report, examining the contributions from various sectors and attempting to predict future trends. The debate continues about whether the current inflation rate is transitory or indicative of a longer-term problem. Further analysis will be crucial in informing both consumer behavior and government policy.

Looking Ahead:

The coming months will be critical in assessing the trajectory of inflation. The Federal Reserve will continue to monitor economic indicators closely, weighing the risks of further interest rate hikes against the potential for a recession. The impact of global events and geopolitical instability will also continue to play a significant role in shaping the economic landscape. Stay informed by following reputable news sources and economic analysis for the latest updates.

Call to Action: Understanding the nuances of inflation and its impact is crucial for informed financial decision-making. Stay informed and adapt your spending habits accordingly. What strategies are you employing to manage the current economic climate? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Prices Climb In June, Meeting Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Impact Of Marthas Rule Full Implementation In English Acute Hospitals

Sep 06, 2025

Impact Of Marthas Rule Full Implementation In English Acute Hospitals

Sep 06, 2025 -

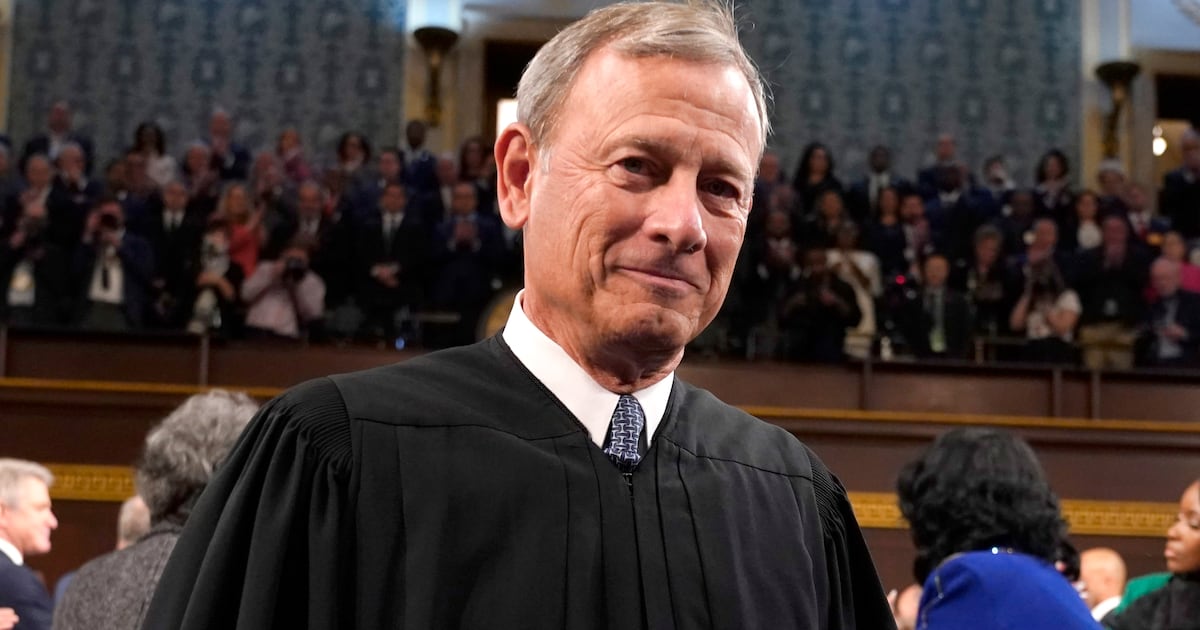

Supreme Court Insider Chief Justice Roberts Calculated Moves

Sep 06, 2025

Supreme Court Insider Chief Justice Roberts Calculated Moves

Sep 06, 2025 -

Insulation Scheme Fiasco 30 000 Homes Affected Ministers Confirm

Sep 06, 2025

Insulation Scheme Fiasco 30 000 Homes Affected Ministers Confirm

Sep 06, 2025 -

Sycamore Gap Tree Age Revealed Through Dendrochronology

Sep 06, 2025

Sycamore Gap Tree Age Revealed Through Dendrochronology

Sep 06, 2025 -

Nyt Connections Game Clues And Solutions For September 4 2025

Sep 06, 2025

Nyt Connections Game Clues And Solutions For September 4 2025

Sep 06, 2025

Latest Posts

-

U S Inflation Remains Stable In June Latest Cpi Report

Sep 06, 2025

U S Inflation Remains Stable In June Latest Cpi Report

Sep 06, 2025 -

Will Rain End New Hampshires Drought Watch The Video Forecast

Sep 06, 2025

Will Rain End New Hampshires Drought Watch The Video Forecast

Sep 06, 2025 -

Brexit And The 2024 Election Sir John Curtice On Reforms Winning Strategy

Sep 06, 2025

Brexit And The 2024 Election Sir John Curtice On Reforms Winning Strategy

Sep 06, 2025 -

Minnesota Church Shooting Gun Shop Video Surfaces Showing Shooter Days Before Tragedy

Sep 06, 2025

Minnesota Church Shooting Gun Shop Video Surfaces Showing Shooter Days Before Tragedy

Sep 06, 2025 -

Tesla Board Proposes Compensation Plan Potentially Making Elon Musk The Worlds First Trillionaire

Sep 06, 2025

Tesla Board Proposes Compensation Plan Potentially Making Elon Musk The Worlds First Trillionaire

Sep 06, 2025