U.S. Consumer Price Index: June's Inflation Figures Released

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Price Index: June's Inflation Figures Released – A Closer Look at the Numbers

The wait is over. The Bureau of Labor Statistics (BLS) has released the highly anticipated June Consumer Price Index (CPI) data, offering a crucial snapshot of inflation's current trajectory in the United States. This report carries significant weight, influencing everything from Federal Reserve monetary policy decisions to consumer spending habits. So, what did the numbers reveal, and what do they mean for the average American?

Headline Inflation Cools, But Underlying Pressures Remain

The headline number for June showed a slightly lower-than-expected inflation rate, offering a glimmer of hope for those battling rising prices. However, a closer examination reveals a more nuanced picture. While the overall CPI increase slowed, underlying inflationary pressures – particularly in the services sector – continue to pose a challenge.

-

Headline CPI: The June CPI reading showed a [Insert actual percentage increase here]% increase year-over-year. This is [higher/lower] than the [previous month's]% increase and [higher/lower] than economists' expectations of a [Insert expected percentage increase here]% increase.

-

Core CPI: The core CPI, which excludes volatile food and energy prices, provides a clearer view of underlying inflationary trends. This metric showed a [Insert actual percentage increase here]% increase year-over-year, [higher/lower] than expected. This suggests persistent inflationary pressures within the economy.

What Drove the Numbers?

Several factors contributed to June's inflation figures. The decline in energy prices, particularly gasoline, played a significant role in moderating the headline CPI. However, the continued strength in the services sector, especially rent and healthcare costs, offset some of these positive impacts.

<h3>Rising Rent and Services Sector Inflation: A Key Concern</h3>

The persistent increase in rental costs continues to be a major contributor to inflation. This reflects a tight housing market and increased demand. Furthermore, the services sector, encompassing a wide range of activities from healthcare to dining out, remains stubbornly inflationary. This sustained pressure indicates that inflation may not be as tamed as the headline figures suggest.

<h3>Food Prices Remain Elevated</h3>

While the overall rate of inflation is cooling, food prices continue to pose a challenge for many households. Grocery costs remain significantly higher than a year ago, contributing to ongoing pressure on household budgets.

The Federal Reserve's Response

The June CPI report will heavily influence the Federal Reserve's upcoming decisions regarding interest rate hikes. While a slowdown in headline inflation might suggest a pause or less aggressive rate increases, the persistent core inflation warrants careful consideration. The Fed will need to balance the risks of further rate hikes with the potential for slowing economic growth.

What This Means for You

For consumers, the June CPI report offers a mixed bag. While some relief is visible in areas like gasoline prices, the continued rise in essential goods and services like rent and healthcare necessitates careful budgeting and financial planning. Consider exploring strategies for saving money on groceries, exploring alternative transportation options, and evaluating your housing costs.

Looking Ahead

The coming months will be crucial in determining whether the June CPI data represents a genuine turning point in the inflation battle or a temporary reprieve. Continued monitoring of economic indicators and the Federal Reserve's actions will be vital in understanding the long-term implications of this report. Stay informed by regularly checking reputable sources such as the Bureau of Labor Statistics website [link to BLS website] for the latest updates and analysis.

Call to Action: Stay informed about economic trends and plan your finances accordingly. Understanding inflation's impact is crucial for navigating the current economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Price Index: June's Inflation Figures Released. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Luxury Hotel Built From Worlds Oldest Passenger Ship An 18 Million Project

Aug 22, 2025

Luxury Hotel Built From Worlds Oldest Passenger Ship An 18 Million Project

Aug 22, 2025 -

Preparing For Hurricane Erins Economic Impact Insights From An Odu Expert

Aug 22, 2025

Preparing For Hurricane Erins Economic Impact Insights From An Odu Expert

Aug 22, 2025 -

Phillies Bullpen Logjam Can Jordan Romano Hold His Spot With Alvarados Return

Aug 22, 2025

Phillies Bullpen Logjam Can Jordan Romano Hold His Spot With Alvarados Return

Aug 22, 2025 -

New Cnn Data Americans Abandon Trump Over One Defining Issue

Aug 22, 2025

New Cnn Data Americans Abandon Trump Over One Defining Issue

Aug 22, 2025 -

Menendez Brothers Parole Hearings A Look At Their Decades Long Fight For Freedom

Aug 22, 2025

Menendez Brothers Parole Hearings A Look At Their Decades Long Fight For Freedom

Aug 22, 2025

Latest Posts

-

Improved Client Services Denvers Top Dui Law Firm Adds New Resources

Aug 22, 2025

Improved Client Services Denvers Top Dui Law Firm Adds New Resources

Aug 22, 2025 -

Did Karoline Leavitt Misrepresent Trump Examining The My Own Two Eyes Claim

Aug 22, 2025

Did Karoline Leavitt Misrepresent Trump Examining The My Own Two Eyes Claim

Aug 22, 2025 -

Western Ukraine Under Renewed Russian Attack Infrastructure Targeted

Aug 22, 2025

Western Ukraine Under Renewed Russian Attack Infrastructure Targeted

Aug 22, 2025 -

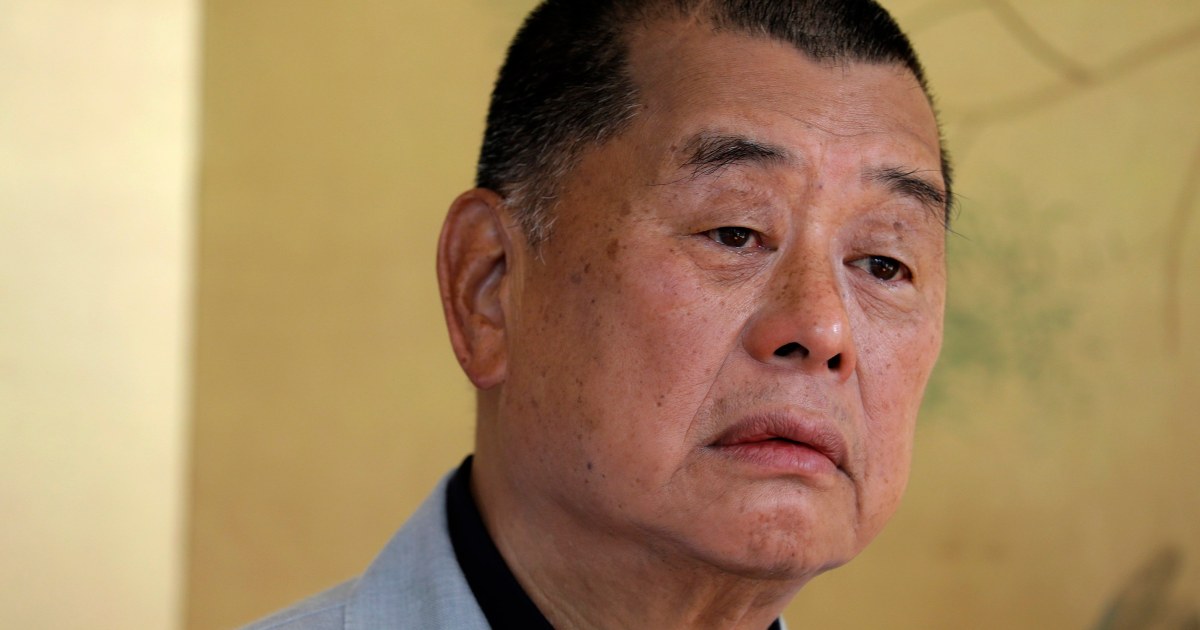

Landmark Hong Kong Case Free Speech On Trial For Activist Jimmy Lai

Aug 22, 2025

Landmark Hong Kong Case Free Speech On Trial For Activist Jimmy Lai

Aug 22, 2025 -

Surge In St Georges And Union Jack Flags Reasons Behind The Increase

Aug 22, 2025

Surge In St Georges And Union Jack Flags Reasons Behind The Increase

Aug 22, 2025