U.S. Consumer Price Index: June Inflation Matches Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Price Index: June Inflation Matches Forecasts, Offering Glimmers of Hope for Cooling Prices

The U.S. Bureau of Labor Statistics (BLS) released its highly anticipated Consumer Price Index (CPI) report for June 2024, revealing that inflation remained steady at 3%, aligning perfectly with economists' predictions. While this figure doesn't signal a dramatic drop in prices, it does offer a cautious note of optimism, suggesting that the aggressive interest rate hikes implemented by the Federal Reserve may be starting to bear fruit in the fight against inflation.

This relatively stable inflation reading follows several months of fluctuating CPI numbers, leaving many consumers and investors anxiously awaiting signs of a sustained cooling trend. The 3% figure represents a significant decrease from the peak inflation rates seen in 2022, offering a glimmer of hope for a return to more predictable economic conditions.

What Drove the June CPI Numbers?

Several factors contributed to the stable June CPI figure. While energy prices remained relatively consistent, a slight decrease in food prices played a positive role. The housing market, a significant contributor to inflation, also showed signs of moderation, though rental costs remain a persistent concern.

- Energy Prices: Remained largely unchanged compared to May, avoiding a surge that could have pushed the CPI higher.

- Food Prices: Experienced a modest decline, providing some relief to consumers grappling with grocery bill increases.

- Housing Costs: Showed signs of slowing, although rental costs continue to contribute significantly to overall inflation. This area warrants continued monitoring.

- Used Car Prices: Continued their downward trend, reflecting a cooling off in the previously overheated used car market.

What Does This Mean for Consumers and the Economy?

The stable CPI reading offers a degree of reassurance, suggesting that the Federal Reserve's monetary policy is having the intended effect. However, it's crucial to avoid premature celebrations. A single month of stable inflation doesn't guarantee a sustained downward trend. The Fed will likely continue to closely monitor economic indicators before deciding on future interest rate adjustments.

For consumers, the stable inflation rate offers a degree of predictability in terms of budgeting and planning. While prices remain elevated compared to pre-pandemic levels, the absence of further significant price increases is a positive development.

Looking Ahead: The Road to Price Stability

The battle against inflation is far from over. The Federal Reserve is likely to remain vigilant, balancing the need to control inflation with the desire to avoid triggering a recession. Future CPI reports will be crucial in guiding the Fed's policy decisions. Economists will be closely watching key indicators like wage growth, employment numbers, and consumer spending to assess the overall health of the economy.

Key Takeaways:

- June's CPI of 3% matches forecasts, offering a cautiously optimistic outlook.

- While energy and food prices played a role, housing costs remain a key factor to watch.

- The Fed will continue to monitor economic data to inform future interest rate decisions.

- Consumers can find some relief in the stable inflation reading, offering more predictable budgeting.

This stability provides a welcome respite, but sustained vigilance and monitoring of economic indicators are necessary to ensure a lasting return to price stability. For further updates and in-depth analysis of the U.S. economy, be sure to check back regularly for more news and insights. [Link to a relevant economic news site or government resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Price Index: June Inflation Matches Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Federal Reserves Interest Rate Hike Implications For Mortgages

Sep 10, 2025

Federal Reserves Interest Rate Hike Implications For Mortgages

Sep 10, 2025 -

Immigration Implications Uks Potential Visa Freeze For Countries Without Return Deals

Sep 10, 2025

Immigration Implications Uks Potential Visa Freeze For Countries Without Return Deals

Sep 10, 2025 -

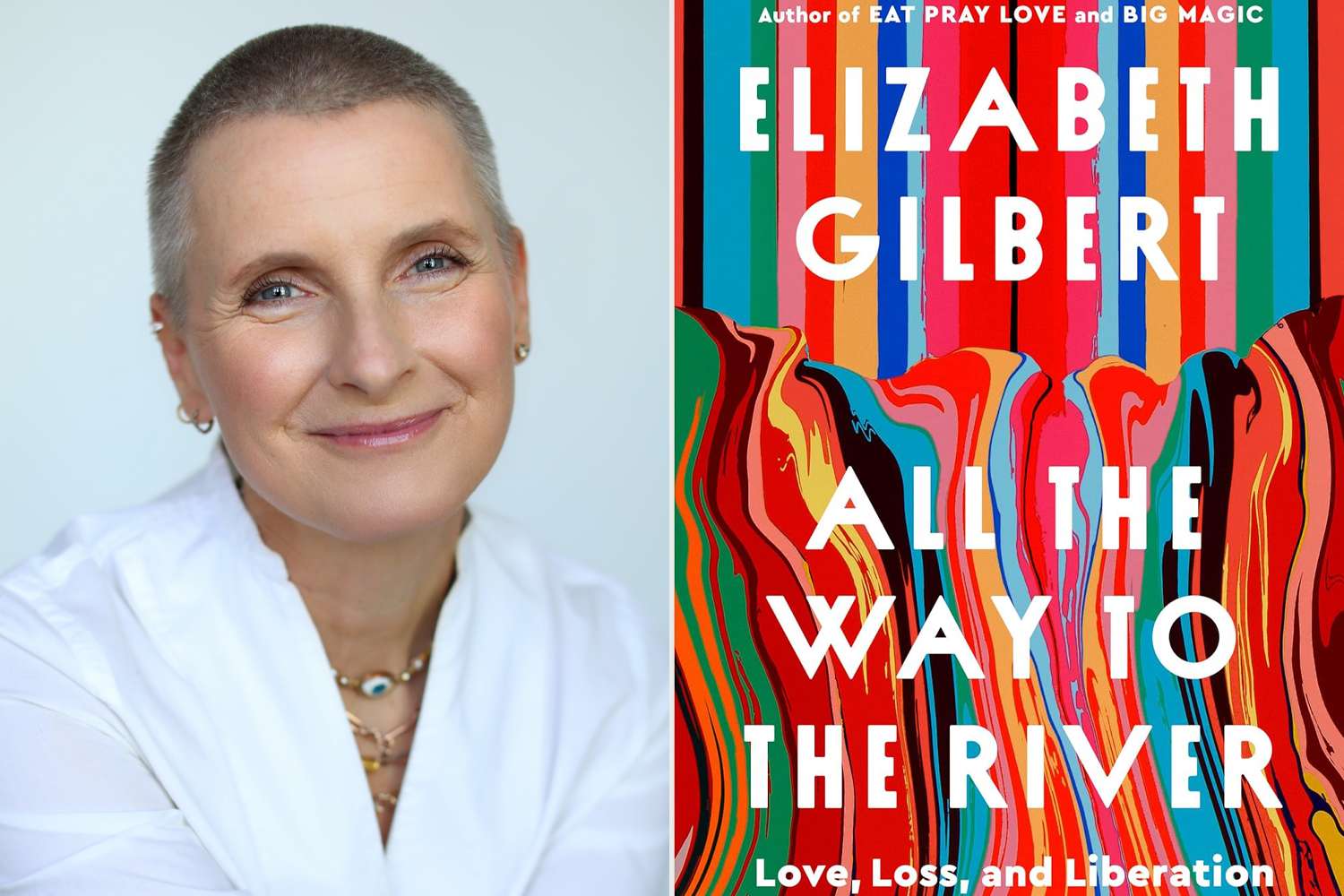

Elizabeth Gilberts Raw And Honest Memoir Details Sex Drugs And A Murder Plot

Sep 10, 2025

Elizabeth Gilberts Raw And Honest Memoir Details Sex Drugs And A Murder Plot

Sep 10, 2025 -

Thriving In A Transnational Marriage Overcoming The Challenges Of Distance

Sep 10, 2025

Thriving In A Transnational Marriage Overcoming The Challenges Of Distance

Sep 10, 2025 -

American Public Opinion Turns Against Trump Key Issue Identified By Cnn Data

Sep 10, 2025

American Public Opinion Turns Against Trump Key Issue Identified By Cnn Data

Sep 10, 2025

Latest Posts

-

Thriving In A Transnational Marriage Overcoming The Challenges Of Distance

Sep 10, 2025

Thriving In A Transnational Marriage Overcoming The Challenges Of Distance

Sep 10, 2025 -

Cocaine Superhighway Dismantled Massive Drug Bust Details Revealed

Sep 10, 2025

Cocaine Superhighway Dismantled Massive Drug Bust Details Revealed

Sep 10, 2025 -

St Elmos Fires October Return What To Expect

Sep 10, 2025

St Elmos Fires October Return What To Expect

Sep 10, 2025 -

World Leaders International Travel Since 1991 Data And Insights

Sep 10, 2025

World Leaders International Travel Since 1991 Data And Insights

Sep 10, 2025 -

Investigation Underway Video Evidence In Fatal Light Rail Stabbing Of Ukrainian Refugee In Charlotte

Sep 10, 2025

Investigation Underway Video Evidence In Fatal Light Rail Stabbing Of Ukrainian Refugee In Charlotte

Sep 10, 2025