U.S. Consumer Price Index Increases In June: Inflation Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Price Index Increases in June: Inflation Report Sparks Debate

The U.S. Bureau of Labor Statistics (BLS) released its highly anticipated Consumer Price Index (CPI) report for June, revealing a continued, albeit slower, rise in inflation. The data sparked immediate reactions from economists and policymakers, reigniting the debate surrounding the Federal Reserve's monetary policy and its impact on the American economy. This report offers a crucial snapshot of the current economic climate and its implications for consumers.

Headline Inflation Cools, But Core CPI Remains Sticky

The headline CPI, which measures the overall change in prices for a basket of consumer goods and services, rose 3.0% year-over-year in June, down from 4.0% in May. This decrease marks a significant slowdown from the peak inflation rates seen in early 2022. However, the core CPI, which excludes volatile food and energy prices, increased by 4.8% year-over-year, slightly higher than the 4.6% increase in May. This persistence of core inflation is a concern for policymakers, suggesting underlying price pressures remain strong.

What Drove the June CPI Increase?

Several factors contributed to the June CPI increase:

- Shelter Costs: Shelter costs, which comprise a significant portion of the CPI, continue to contribute substantially to inflation. Rising rental costs and home prices are key drivers here. [Link to BLS data on shelter costs]

- Used Car Prices: Although used car prices have cooled significantly from their peak, they still contributed to the overall increase.

- Food Prices: While food price increases have moderated somewhat, they still remain a significant concern for many American households. [Link to USDA food price data]

The Federal Reserve's Response and Economic Outlook

The June CPI report will undoubtedly influence the Federal Reserve's upcoming decisions regarding interest rates. While the slowdown in headline inflation is encouraging, the persistent rise in core inflation suggests that further rate hikes may be necessary to bring inflation down to the Fed's 2% target. Economists are divided on the future trajectory of interest rates, with some predicting further increases while others anticipate a pause or even potential rate cuts later in the year. The uncertainty surrounding the economic outlook adds to the complexity of the situation.

Impact on Consumers and Businesses

The persistent inflation, even at a slower pace, continues to impact American consumers and businesses. Higher prices for essential goods and services reduce purchasing power, putting a strain on household budgets. Businesses also face challenges in managing rising input costs, potentially leading to price increases or reduced profit margins. This creates a complex interplay of economic factors that require careful monitoring.

Looking Ahead: What to Expect

The coming months will be crucial in determining the trajectory of inflation. Close monitoring of core CPI, along with other economic indicators such as employment data and consumer spending, will be essential for understanding the overall economic health. The Federal Reserve’s actions and any potential shifts in global economic conditions will also significantly impact future inflation rates.

Call to Action: Stay informed about economic updates by following the Bureau of Labor Statistics and other reputable economic sources. Understanding the economic climate is vital for making informed financial decisions.

Keywords: Consumer Price Index, CPI, Inflation, Inflation Report, U.S. Economy, Federal Reserve, Interest Rates, Economic Outlook, BLS, June CPI, Core CPI, Price Increases, Economic Data, Monetary Policy, Inflation Rate, Cost of Living

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Price Index Increases In June: Inflation Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

San Francisco Housing Market Analyzing The Implications Of Reduced Voucher Funding

Aug 31, 2025

San Francisco Housing Market Analyzing The Implications Of Reduced Voucher Funding

Aug 31, 2025 -

Missed Opportunity Examining Coffee Chains Matcha Marketing Failures

Aug 31, 2025

Missed Opportunity Examining Coffee Chains Matcha Marketing Failures

Aug 31, 2025 -

2025 Venice Film Festival A Look At The Most Memorable Outfits

Aug 31, 2025

2025 Venice Film Festival A Look At The Most Memorable Outfits

Aug 31, 2025 -

Governor Kellys Emergency Declaration Responding To Harvey County Gas Leak

Aug 31, 2025

Governor Kellys Emergency Declaration Responding To Harvey County Gas Leak

Aug 31, 2025 -

Strength Concerns Abel Sanchez On Crawfords Canelo Matchup

Aug 31, 2025

Strength Concerns Abel Sanchez On Crawfords Canelo Matchup

Aug 31, 2025

Latest Posts

-

Longtime Congressman Jerry Nadlers Decision No Reelection Bid In New York

Sep 03, 2025

Longtime Congressman Jerry Nadlers Decision No Reelection Bid In New York

Sep 03, 2025 -

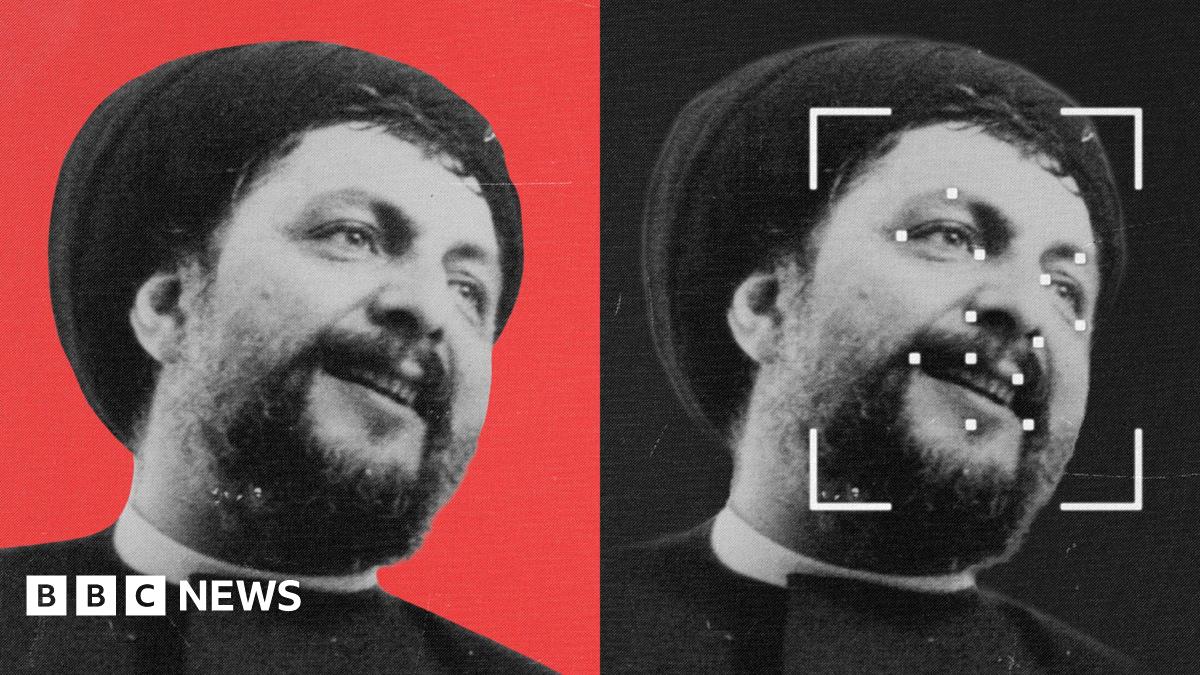

Musa Al Sadr Body Identified In Libya Decades Long Enigma Nears Resolution

Sep 03, 2025

Musa Al Sadr Body Identified In Libya Decades Long Enigma Nears Resolution

Sep 03, 2025 -

Labours Tightrope Walk Starmer Navigates Pressure From Reform Uk

Sep 03, 2025

Labours Tightrope Walk Starmer Navigates Pressure From Reform Uk

Sep 03, 2025 -

I Phone 17 Launch Nears Apple Wraps Up I Os 17 Beta Testing Phase

Sep 03, 2025

I Phone 17 Launch Nears Apple Wraps Up I Os 17 Beta Testing Phase

Sep 03, 2025 -

Scotlands Drug Problem A Continuing European Tragedy

Sep 03, 2025

Scotlands Drug Problem A Continuing European Tragedy

Sep 03, 2025