U.S. Consumer Price Index Increases In June: Inflation Remains Stable

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Price Index Increases in June: Inflation Remains Stable, But Concerns Linger

The U.S. Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) data for June, revealing a modest increase in inflation that, while stable compared to previous months, continues to fuel debate among economists and policymakers. The report indicates a persistent, albeit slower, rise in prices, leaving consumers and businesses navigating a complex economic landscape. Understanding these numbers is crucial for navigating personal finances and predicting future economic trends.

June CPI: A Closer Look at the Numbers

The June CPI showed a 0.2% increase compared to May, and a 3% increase compared to June of the previous year. While this year-over-year increase is lower than the peak inflation rates seen in 2022, it still surpasses the Federal Reserve's 2% target. This indicates that inflation, while easing, remains a persistent challenge for the American economy. Specific categories contributing to the increase include:

- Shelter: Rent and owner-equivalent rent continue to be major drivers of inflation, reflecting the ongoing tightness in the housing market. This component alone significantly impacts the overall CPI.

- Used cars and trucks: Prices in this sector experienced a slight uptick, after a period of decline.

- Food: Food prices, while showing some moderation, remain elevated, contributing to household budget constraints for many Americans.

What Does This Mean for Consumers?

The relatively stable inflation figures offer a degree of reassurance, suggesting that the aggressive interest rate hikes implemented by the Federal Reserve may be starting to have the desired effect. However, the persistent upward pressure on prices, particularly in housing and food, means that consumers will likely continue to face challenges in managing their household budgets. Many families are still feeling the pinch of higher costs, particularly those with lower incomes.

For consumers, this means careful financial planning is more crucial than ever. Budgeting effectively, exploring ways to reduce expenses, and potentially seeking financial advice can help mitigate the impact of persistent inflation. [Link to a reputable personal finance website].

Implications for the Federal Reserve

The June CPI data will heavily influence the Federal Reserve's decisions regarding future interest rate adjustments. While the slower pace of inflation may suggest a pause or a smaller rate hike at the next meeting, the persistent rise in prices, especially in core inflation (excluding volatile food and energy prices), might prompt the Fed to remain cautious. The Fed is walking a tightrope, aiming to curb inflation without triggering a recession.

Looking Ahead: Uncertainty Remains

The future trajectory of inflation remains uncertain. Geopolitical events, supply chain disruptions, and consumer demand all play a significant role. Economists are divided on whether the current level of inflation represents a sustained plateau or a temporary lull before another potential surge. Close monitoring of future CPI reports and other economic indicators is crucial for understanding the evolving economic landscape. The coming months will be critical in determining whether the current stabilization marks a turning point in the fight against inflation or just a temporary reprieve. Staying informed through reliable sources like the BLS website is essential for making informed decisions. [Link to BLS website]

Keywords: Consumer Price Index, CPI, Inflation, U.S. Economy, Federal Reserve, Interest Rates, Economic Indicators, Inflation Rate, Price Increases, Economic Outlook, Housing Market, Food Prices, Consumer Spending

Call to Action (subtle): Stay informed about the latest economic news and data to make sound financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Price Index Increases In June: Inflation Remains Stable. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Relive The Y2 K Era With Taco Bells Decades Menu

Sep 03, 2025

Relive The Y2 K Era With Taco Bells Decades Menu

Sep 03, 2025 -

I Os 26 Public Beta Concludes Anticipation Builds For I Phone 17 Unveiling

Sep 03, 2025

I Os 26 Public Beta Concludes Anticipation Builds For I Phone 17 Unveiling

Sep 03, 2025 -

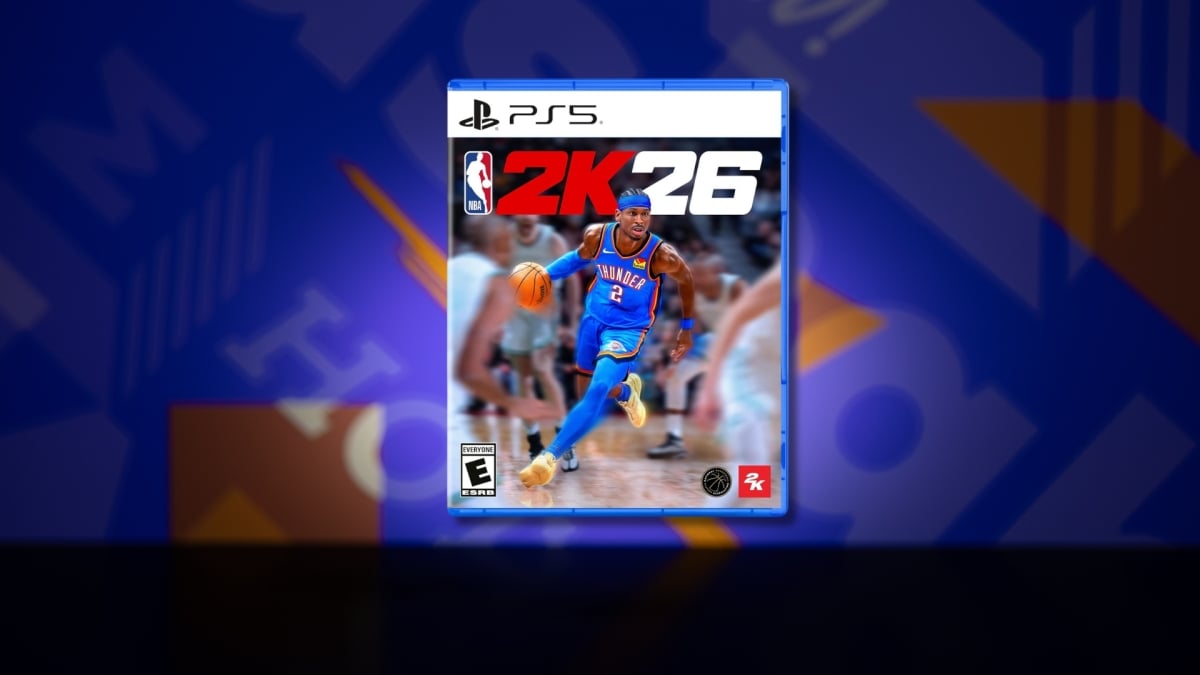

Get Ahead Nba 2 K26 Early Access Release Date Editions And Vc Breakdown

Sep 03, 2025

Get Ahead Nba 2 K26 Early Access Release Date Editions And Vc Breakdown

Sep 03, 2025 -

Gaza City Under Siege Families And Children Flee Intensifying Attacks

Sep 03, 2025

Gaza City Under Siege Families And Children Flee Intensifying Attacks

Sep 03, 2025 -

Chinas Rising Global Influence Xi And Putins United Front

Sep 03, 2025

Chinas Rising Global Influence Xi And Putins United Front

Sep 03, 2025

Latest Posts

-

Tragedy Strikes Ding Dong Ditch Prank Leads To Boys Death Arrest Made

Sep 04, 2025

Tragedy Strikes Ding Dong Ditch Prank Leads To Boys Death Arrest Made

Sep 04, 2025 -

Revisit A Classic The Fantasy Masterpiece Celebrating Its 30th Year

Sep 04, 2025

Revisit A Classic The Fantasy Masterpiece Celebrating Its 30th Year

Sep 04, 2025 -

Is Conor Mc Gregors Return To Ufc Impossible A Champion Weighs In

Sep 04, 2025

Is Conor Mc Gregors Return To Ufc Impossible A Champion Weighs In

Sep 04, 2025 -

Us Open Semifinals 2025 Complete Schedule Live Streaming And Results

Sep 04, 2025

Us Open Semifinals 2025 Complete Schedule Live Streaming And Results

Sep 04, 2025 -

The Ivory Tower Trap How Student Loans Distort The American Dream

Sep 04, 2025

The Ivory Tower Trap How Student Loans Distort The American Dream

Sep 04, 2025