U.S. Consumer Price Index Increases In June: Inflation Holds Steady

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Price Index Increases in June: Inflation Holds Steady, But Concerns Remain

The U.S. Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) data for June 2024, revealing a modest increase in inflation that continues a recent trend of steady, though persistent, price growth. While the numbers offer a glimmer of hope for those hoping for a cooling inflation rate, economists remain cautious, warning against premature declarations of victory in the fight against rising prices. This report delves into the key findings and analyzes what they mean for consumers and the broader economy.

Headline Inflation Remains Elevated:

The headline CPI, which measures the overall change in consumer prices, rose 0.2% in June, following a similar increase in May. This marks a slower pace of growth compared to the surge seen earlier in 2023, but it's still significantly above the Federal Reserve's 2% target inflation rate. The year-over-year increase sits at 3.2%, a slight uptick from the previous month. This persistent upward pressure on prices continues to impact household budgets across the nation.

Core Inflation: A Closer Look:

To get a clearer picture of underlying inflationary pressures, economists often focus on the core CPI, which excludes volatile food and energy prices. The core CPI increased by 0.2% in June, mirroring the headline figure. This sustained core inflation suggests that inflationary pressures are not solely driven by fluctuations in energy or food costs, but are more deeply embedded in the economy. This persistence is a key concern for policymakers.

What's Driving Inflation?

Several factors contribute to the ongoing inflationary pressures:

- Strong Labor Market: A tight labor market, with low unemployment and high demand for workers, is leading to increased wage growth. While this is positive for workers, it also puts upward pressure on prices as businesses pass on increased labor costs to consumers.

- Supply Chain Issues: Though improving, lingering supply chain disruptions continue to impact the availability and cost of certain goods.

- Increased Demand: Consumer demand remains robust, further contributing to price increases.

Impact on Consumers and the Economy:

The persistent inflation continues to erode purchasing power for many American families. Rising costs for essentials like groceries, housing, and transportation are impacting household budgets and financial wellbeing. The sustained inflation also creates uncertainty for businesses, making long-term planning and investment more challenging.

The Federal Reserve's Response:

The Federal Reserve (Fed) is closely monitoring these inflation figures and will likely continue to evaluate its monetary policy stance. Further interest rate hikes remain a possibility if inflation fails to cool down towards the target rate. The Fed's actions will significantly influence the direction of the economy in the coming months.

Looking Ahead:

While the June CPI data indicates a relatively stable inflation rate, the overall picture remains complex. Economists are divided on the outlook for inflation in the coming months. Some believe inflation will continue to moderate gradually, while others express concerns about the potential for a resurgence. Further data releases and the Fed's policy decisions will be crucial in determining the trajectory of inflation in the months ahead. It's crucial for consumers to stay informed and adapt their financial strategies accordingly.

Keywords: Consumer Price Index (CPI), Inflation, US Inflation, June CPI, Economic Data, Federal Reserve, Monetary Policy, Interest Rates, Economic Outlook, Inflation Rate, Price Growth, Supply Chain, Labor Market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Price Index Increases In June: Inflation Holds Steady. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Murder Charges Filed Parents Of Missing Infant Appear In Court For First Time

Aug 28, 2025

Murder Charges Filed Parents Of Missing Infant Appear In Court For First Time

Aug 28, 2025 -

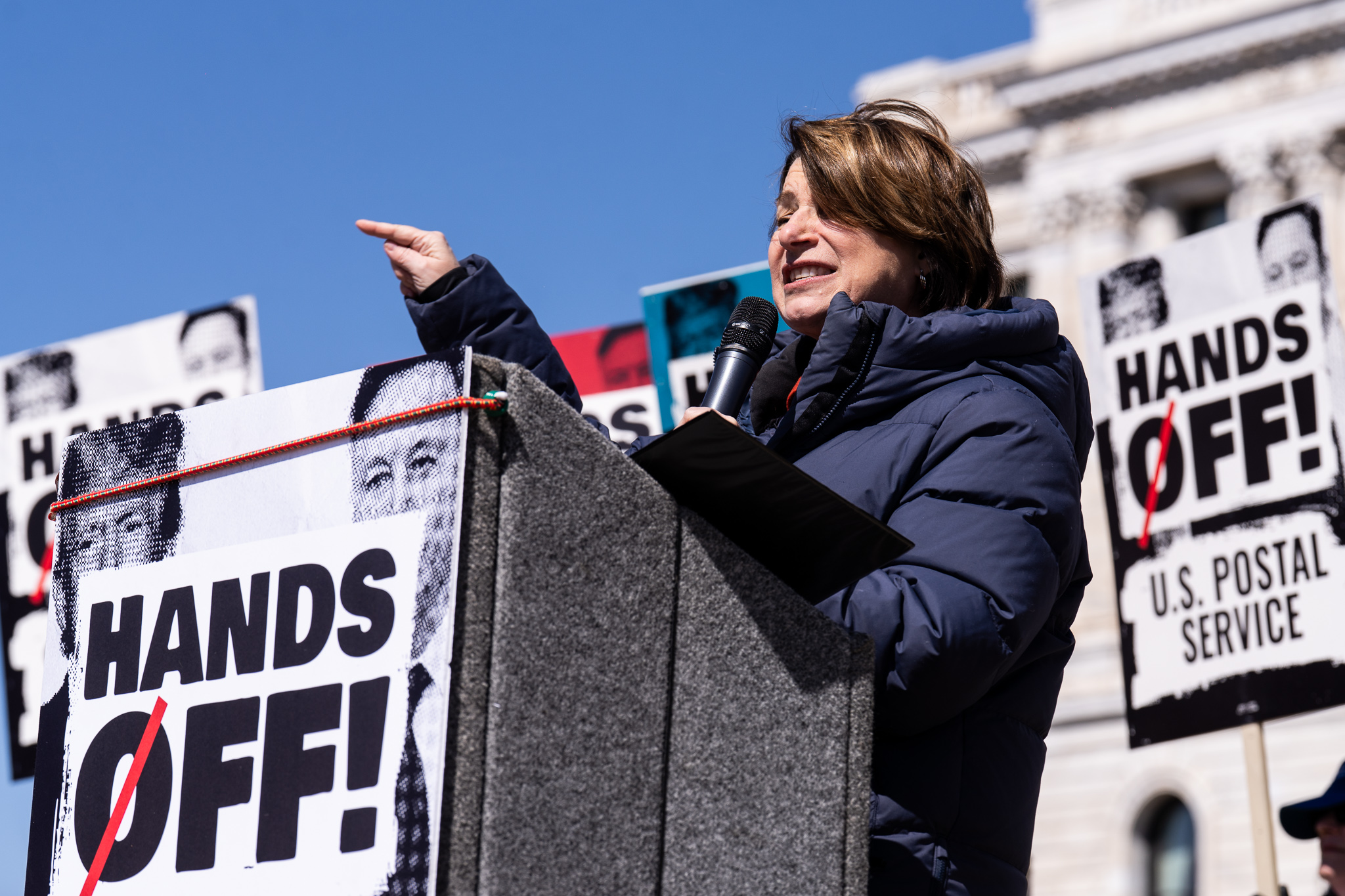

Deepfake Audio Scandal Amy Klobuchar Impersonated In Anti Sydney Sweeney Ad

Aug 28, 2025

Deepfake Audio Scandal Amy Klobuchar Impersonated In Anti Sydney Sweeney Ad

Aug 28, 2025 -

Transfer Soeylentileri Mourinho Kerem Aktuerkoglu Ve Geny Catamo Hakkinda Konustu

Aug 28, 2025

Transfer Soeylentileri Mourinho Kerem Aktuerkoglu Ve Geny Catamo Hakkinda Konustu

Aug 28, 2025 -

What Arsenals Potential Signing Of Eberechi Eze Means

Aug 28, 2025

What Arsenals Potential Signing Of Eberechi Eze Means

Aug 28, 2025 -

Klobuchars Ai Position More About Her Than The Technology

Aug 28, 2025

Klobuchars Ai Position More About Her Than The Technology

Aug 28, 2025

Latest Posts

-

Toxic As Hell Devon Walkers Explosive Snl Exit And Accusations

Aug 28, 2025

Toxic As Hell Devon Walkers Explosive Snl Exit And Accusations

Aug 28, 2025 -

Powerful Haboob Pummels Phoenix Dust Storm Brings Damage Airport Delays And Power Outages

Aug 28, 2025

Powerful Haboob Pummels Phoenix Dust Storm Brings Damage Airport Delays And Power Outages

Aug 28, 2025 -

Saison Compromise Jaquez Vf B Stuttgart Souffre D Une Fracture Du Nez

Aug 28, 2025

Saison Compromise Jaquez Vf B Stuttgart Souffre D Une Fracture Du Nez

Aug 28, 2025 -

Analysis Karoline Leavitts Trump Claim And Its Implications

Aug 28, 2025

Analysis Karoline Leavitts Trump Claim And Its Implications

Aug 28, 2025 -

Artwork Stolen By Nazis Reappears In Modern Estate Agent Ad

Aug 28, 2025

Artwork Stolen By Nazis Reappears In Modern Estate Agent Ad

Aug 28, 2025