U.S. Consumer Price Index (CPI) Jumps In June: Inflation Persists

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Consumer Price Index (CPI) Jumps in June: Inflation Persists, Raising Concerns for the Fed

The U.S. Consumer Price Index (CPI) surged in June, exceeding economists' expectations and reigniting concerns about persistent inflation. This unexpected jump throws a wrench into hopes for a swift return to price stability and puts further pressure on the Federal Reserve to continue its aggressive interest rate hikes. The data released this morning paints a concerning picture for consumers and the broader economy.

Headline Inflation Remains Stubbornly High

The Bureau of Labor Statistics reported a 0.2% increase in the CPI for June, following a 0.1% rise in May. This translates to an annual inflation rate of 3%, significantly higher than the Federal Reserve's 2% target. While this represents a slight deceleration from the 4% annual rate seen in May, the persistence of inflation above target levels remains a major challenge. Core CPI, which excludes volatile food and energy prices, also rose by 0.2%, indicating broader inflationary pressures.

This unexpected jump in the CPI is particularly troubling because it follows several months of relatively moderate inflation figures. Many economists had predicted a further slowdown in price increases, leading to speculation that the Fed might pause its rate hiking cycle. This new data suggests that those predictions were overly optimistic.

What's Driving the Persistent Inflation?

Several factors contribute to the ongoing inflationary pressures. These include:

- Strong Consumer Demand: Despite rising interest rates, consumer spending remains relatively robust, putting upward pressure on prices.

- Tight Labor Market: The historically low unemployment rate continues to drive wage growth, adding to inflationary pressures. [Link to BLS Employment Situation Summary]

- Supply Chain Disruptions: Although easing, lingering supply chain bottlenecks still contribute to higher costs for some goods and services.

- Rising Energy Prices: Fluctuations in global energy markets continue to impact inflation, especially gasoline prices.

Implications for the Federal Reserve and the Economy

The June CPI report significantly impacts the Federal Reserve's upcoming monetary policy decisions. The persistence of inflation strengthens the case for further interest rate increases, potentially at the next Federal Open Market Committee (FOMC) meeting. However, aggressive rate hikes also carry the risk of triggering a recession.

The Fed faces a delicate balancing act – the need to curb inflation without causing excessive economic hardship. The market reaction to this news will be closely watched, as investors assess the likelihood of further rate hikes and their potential impact on economic growth. [Link to Federal Reserve website]

Looking Ahead: Uncertainty Remains

The June CPI report underscores the complexity and unpredictability of the current inflationary environment. While some economists believe inflation will continue to moderate in the coming months, others are more cautious, citing the persistence of underlying inflationary pressures. The coming months will be crucial in determining the trajectory of inflation and the Federal Reserve's subsequent policy response. Uncertainty remains, but one thing is clear: the fight against inflation is far from over.

Keywords: Consumer Price Index, CPI, Inflation, Federal Reserve, Fed, Interest Rates, Monetary Policy, Economy, Economic Growth, Recession, Unemployment, Supply Chain, Energy Prices, BLS, Bureau of Labor Statistics, FOMC, June CPI, Inflation Report

Call to Action (subtle): Stay informed about the latest economic news by subscribing to our newsletter for regular updates and analysis. (Link to Newsletter Sign-Up)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Consumer Price Index (CPI) Jumps In June: Inflation Persists. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

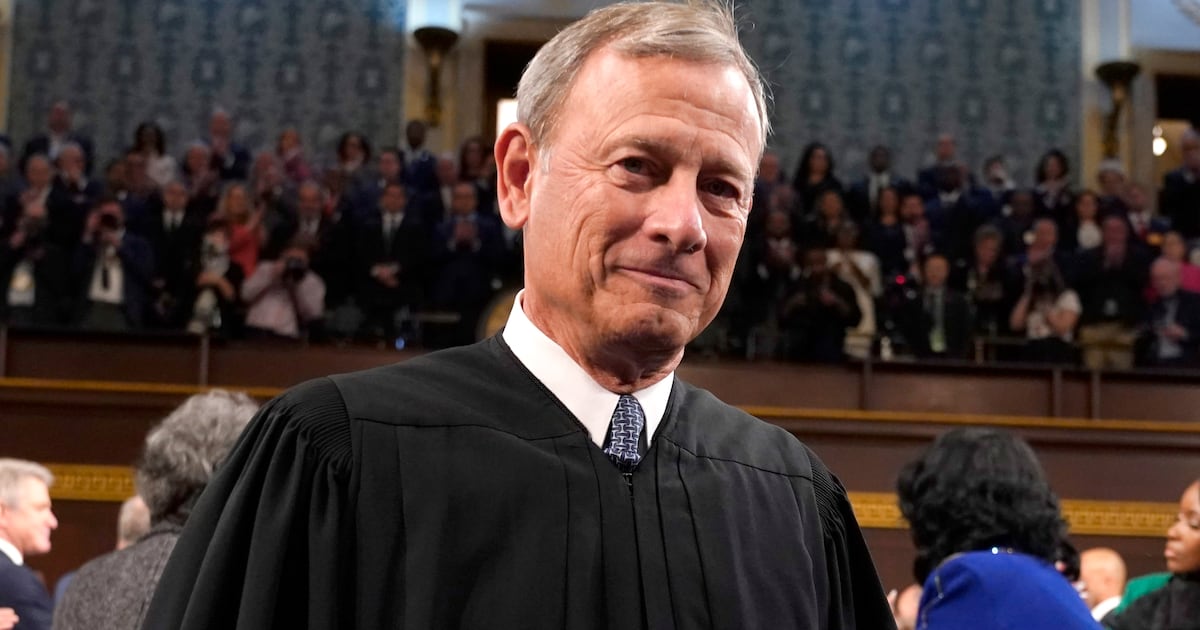

Supreme Court Insider Exposes Roberts Long Term Strategy

Sep 05, 2025

Supreme Court Insider Exposes Roberts Long Term Strategy

Sep 05, 2025 -

Zapreschennye Veschestva U Zvezdy Kholopa Podrobnosti Zaderzhaniya V Moskve

Sep 05, 2025

Zapreschennye Veschestva U Zvezdy Kholopa Podrobnosti Zaderzhaniya V Moskve

Sep 05, 2025 -

Dont Miss It A 30 Year Old Fantasy Epic With An 86 Rotten Tomatoes Rating

Sep 05, 2025

Dont Miss It A 30 Year Old Fantasy Epic With An 86 Rotten Tomatoes Rating

Sep 05, 2025 -

Ufc Champion Conor Mc Gregor Ahead Of His Time Retirement Confirmed

Sep 05, 2025

Ufc Champion Conor Mc Gregor Ahead Of His Time Retirement Confirmed

Sep 05, 2025 -

Live Longer Effective One Minute Exercise Routines

Sep 05, 2025

Live Longer Effective One Minute Exercise Routines

Sep 05, 2025

Latest Posts

-

Big Bens Refurbishment A Contender For The Riba Stirling Prize

Sep 05, 2025

Big Bens Refurbishment A Contender For The Riba Stirling Prize

Sep 05, 2025 -

How Many Rings Scientists Determine Sycamore Gap Trees Age

Sep 05, 2025

How Many Rings Scientists Determine Sycamore Gap Trees Age

Sep 05, 2025 -

Moskovskiy Aeroport Zvezda Kholopa Zaderzhan Obnaruzheny Narkotiki

Sep 05, 2025

Moskovskiy Aeroport Zvezda Kholopa Zaderzhan Obnaruzheny Narkotiki

Sep 05, 2025 -

Riba Stirling Prize Shortlist Includes Historic Big Ben Restoration

Sep 05, 2025

Riba Stirling Prize Shortlist Includes Historic Big Ben Restoration

Sep 05, 2025 -

Illegal Sports Streaming Site Streameast Officially Shut Down By Authorities

Sep 05, 2025

Illegal Sports Streaming Site Streameast Officially Shut Down By Authorities

Sep 05, 2025