Trump Administration Focuses On Tax Cuts To Secure Public Support For Major Legislation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Administration Bets on Tax Cuts to Secure Public Support for Major Legislation

The Trump administration is reportedly doubling down on tax cuts as a key strategy to garner public support for its ambitious legislative agenda. Facing significant opposition and dwindling approval ratings, the White House appears to be prioritizing economic incentives to sway public opinion and push through crucial bills. This approach, however, is sparking debate among economists and political analysts regarding its long-term effectiveness and potential consequences.

A Gamble on Economic Populism?

The administration's focus on tax cuts reflects a broader strategy of economic populism, aiming to directly benefit average Americans and stimulate the economy. By framing tax cuts as a means of putting more money back into the pockets of everyday citizens, the administration hopes to build a grassroots movement in favor of its legislation. This strategy is reminiscent of past administrations that have utilized similar economic measures to bolster public approval. However, the success of this approach hinges on several factors, including the actual impact of the tax cuts on disposable income and the public's perception of the overall economic climate.

Potential Benefits and Drawbacks of Tax Cut Strategy

-

Stimulating Economic Growth: Proponents argue that tax cuts can boost economic activity by encouraging investment and consumer spending. This, in turn, could lead to job creation and increased wages, making the legislation more palatable to the public. [Link to a reputable source discussing the economic effects of tax cuts]

-

Increased National Debt: Critics warn that significant tax cuts, particularly without corresponding spending cuts, could lead to a ballooning national debt. This could have long-term negative consequences for the economy and the nation's fiscal stability. [Link to a reputable source discussing the national debt]

-

Inequality Concerns: Another point of contention revolves around the potential for tax cuts to exacerbate income inequality. If the benefits disproportionately favor higher-income earners, it could lead to further social and economic divisions. [Link to a reputable source discussing income inequality]

Public Opinion and Political Fallout

The effectiveness of the administration's strategy will ultimately depend on public perception. Polls will be crucial in gauging the impact of tax cuts on public opinion and the overall success of the legislative agenda. A lack of public support could lead to political gridlock and hinder the administration's ability to pass crucial legislation. [Link to a recent poll on public opinion regarding tax cuts]

Looking Ahead: A Critical Juncture

The Trump administration's reliance on tax cuts to secure public support represents a high-stakes gamble. The coming months will be critical in determining whether this strategy succeeds in achieving its objectives or backfires, leading to further political challenges and economic uncertainty. The long-term consequences of this approach will be closely scrutinized by economists, policymakers, and the public alike. Further analysis is needed to fully understand the complex interplay between tax policy, public opinion, and the overall political landscape. This situation deserves continued monitoring and careful consideration.

Keywords: Trump Administration, Tax Cuts, Public Support, Legislation, Economic Populism, National Debt, Income Inequality, Political Strategy, Economic Policy, Public Opinion, Fiscal Policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Administration Focuses On Tax Cuts To Secure Public Support For Major Legislation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Toddler Milk Marketing Under Fire Parents Take Legal Action

Aug 22, 2025

Toddler Milk Marketing Under Fire Parents Take Legal Action

Aug 22, 2025 -

Adorable Behind The Scenes Footage Jim Curtis Supports Jennifer Aniston

Aug 22, 2025

Adorable Behind The Scenes Footage Jim Curtis Supports Jennifer Aniston

Aug 22, 2025 -

Alvarados Phillies Return Impact Extends Beyond The Mound

Aug 22, 2025

Alvarados Phillies Return Impact Extends Beyond The Mound

Aug 22, 2025 -

Michigan Lottery Results Daily 3 And Daily 4 Numbers August 11 2025

Aug 22, 2025

Michigan Lottery Results Daily 3 And Daily 4 Numbers August 11 2025

Aug 22, 2025 -

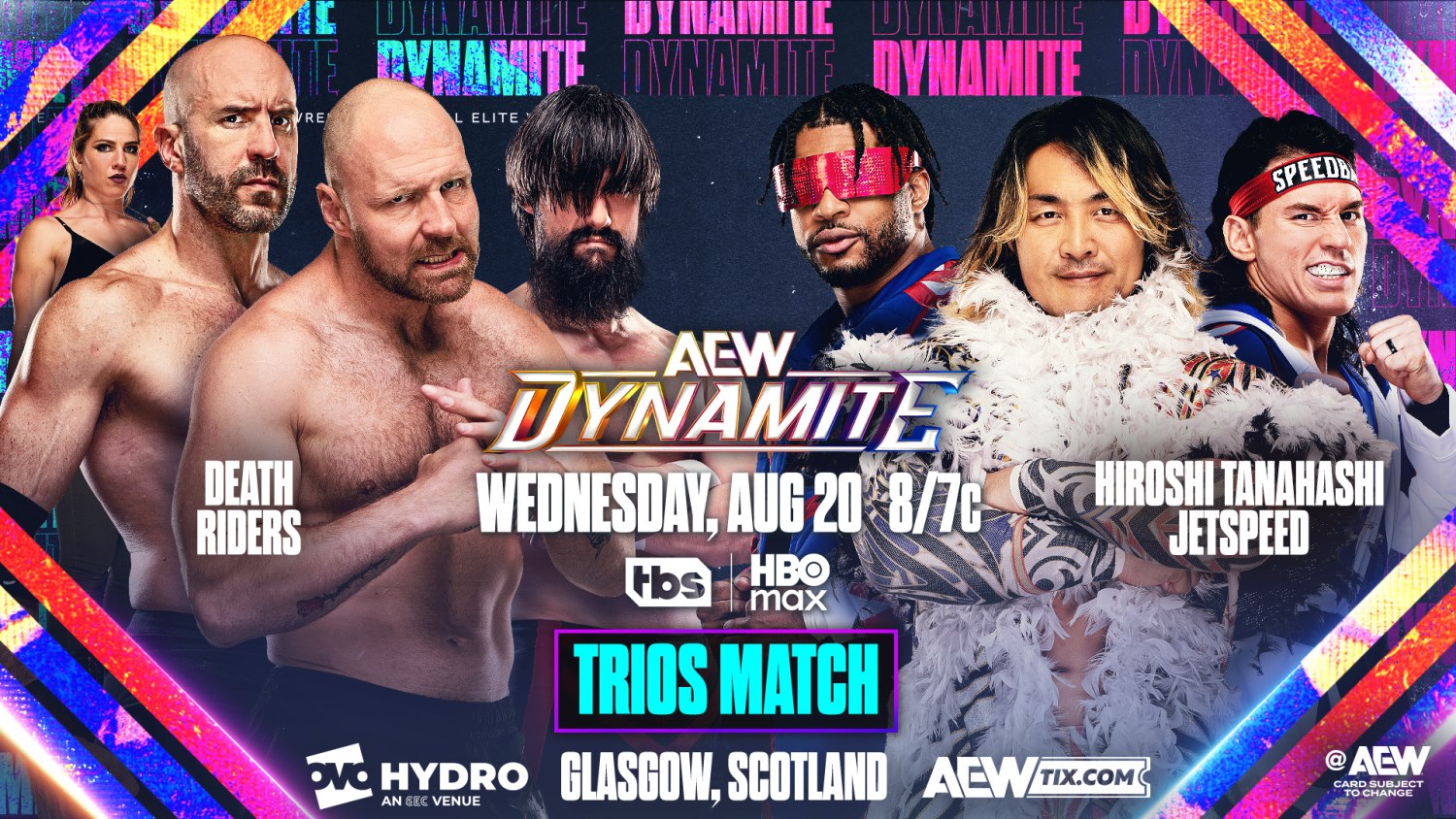

Ftr Vs Brodiee And Dynamites Biggest Matches Full Aew Results August 20 2025

Aug 22, 2025

Ftr Vs Brodiee And Dynamites Biggest Matches Full Aew Results August 20 2025

Aug 22, 2025

Latest Posts

-

Public Opinion Turns Cnn Data Highlights Key Issue Driving Anti Trump Sentiment

Aug 22, 2025

Public Opinion Turns Cnn Data Highlights Key Issue Driving Anti Trump Sentiment

Aug 22, 2025 -

Trump Gate Crash Fallout Chelsea Clintons Photo And The Art Of Implied Criticism

Aug 22, 2025

Trump Gate Crash Fallout Chelsea Clintons Photo And The Art Of Implied Criticism

Aug 22, 2025 -

Clima En Miami Hoy Y Proximos Dias Prevision Meteorologica Completa

Aug 22, 2025

Clima En Miami Hoy Y Proximos Dias Prevision Meteorologica Completa

Aug 22, 2025 -

Legal Action Against Toddler Milk Companies Parents Fight Back

Aug 22, 2025

Legal Action Against Toddler Milk Companies Parents Fight Back

Aug 22, 2025 -

Exposed The Cowboy Builder Who Stole Thousands And Avoided Prosecution

Aug 22, 2025

Exposed The Cowboy Builder Who Stole Thousands And Avoided Prosecution

Aug 22, 2025