Trump Administration Doubles Down On Tax Cuts To Sell Sweeping Legislative Agenda

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Administration Doubles Down on Tax Cuts to Sell Sweeping Legislative Agenda

The Trump administration is aggressively pushing its sweeping legislative agenda, leveraging the 2017 tax cuts as a central selling point to garner public and congressional support. This strategy, however, faces significant headwinds, with critics arguing the cuts disproportionately benefited the wealthy and exacerbated existing economic inequalities. The administration's renewed focus on this controversial policy highlights a pivotal moment in its broader political strategy.

Tax Cuts as the Cornerstone of the Agenda

The administration's renewed emphasis on the tax cuts comes at a time when other aspects of its legislative agenda, such as infrastructure spending and healthcare reform, have faced considerable hurdles. By highlighting the perceived economic benefits of the 2017 tax cuts – including increased job growth and business investment – the administration aims to frame its broader policy goals as economically sound and beneficial to the average American. This narrative, however, has been consistently challenged by independent economic analyses.

Economic Data and the Tax Cut Debate

While the administration points to positive economic indicators following the tax cuts, such as a period of moderate job growth, critics argue that these gains are not directly attributable to the tax cuts alone. Furthermore, independent studies have suggested that the benefits of the cuts were largely concentrated among high-income earners, widening the already significant wealth gap in the United States. [Link to independent economic analysis]. This disparity fuels ongoing debate about the fairness and effectiveness of the tax cuts.

Political Fallout and Public Opinion

The political ramifications of the administration's strategy are significant. The continued emphasis on the 2017 tax cuts risks alienating moderate voters and further polarizing the political landscape. Public opinion polls reveal a divided electorate on the issue, with strong partisan divides shaping perceptions of the tax cuts' effectiveness and fairness. [Link to relevant poll data]. This division presents a significant challenge for the administration as it attempts to secure broad-based support for its legislative agenda.

The Road Ahead: Challenges and Uncertainties

The administration's strategy of using the 2017 tax cuts as a central selling point for its broader legislative agenda faces significant hurdles. The lack of consensus on the economic impact of the cuts, coupled with persistent concerns about income inequality, creates a challenging environment for pushing through further legislative priorities. The coming months will be crucial in determining whether this strategy proves successful or contributes to further political gridlock. The future of the administration's agenda, therefore, remains uncertain, heavily dependent on public perception and the willingness of Congress to cooperate.

Key Takeaways:

- The Trump administration is doubling down on the 2017 tax cuts as a key element of its broader legislative agenda.

- Critics argue that the tax cuts disproportionately benefited the wealthy and exacerbated economic inequality.

- The administration's strategy faces significant political and economic headwinds.

- Public opinion on the tax cuts remains deeply divided.

- The future success of the administration's legislative agenda hinges on the outcome of this strategy.

Call to Action: What are your thoughts on the administration's use of the 2017 tax cuts as a political tool? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Administration Doubles Down On Tax Cuts To Sell Sweeping Legislative Agenda. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

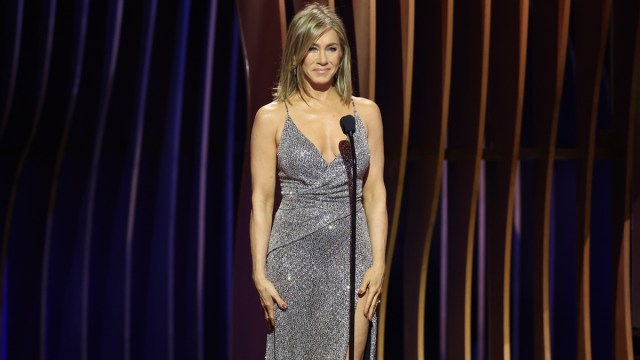

New Couple Alert Jennifer Aniston And Jim Curtiss Relationship Revealed

Aug 23, 2025

New Couple Alert Jennifer Aniston And Jim Curtiss Relationship Revealed

Aug 23, 2025 -

Menendez Brothers Parole A Look At Their Case And Potential Release

Aug 23, 2025

Menendez Brothers Parole A Look At Their Case And Potential Release

Aug 23, 2025 -

Cnns Data Reveals Public Shift Against Trump Over Key Policy

Aug 23, 2025

Cnns Data Reveals Public Shift Against Trump Over Key Policy

Aug 23, 2025 -

Exclusive Jennifer Anistons Best Friend Speaks Out On Her Romantic Life

Aug 23, 2025

Exclusive Jennifer Anistons Best Friend Speaks Out On Her Romantic Life

Aug 23, 2025 -

400 Profit Growth How Labubus Became A Viral Business Success

Aug 23, 2025

400 Profit Growth How Labubus Became A Viral Business Success

Aug 23, 2025

Latest Posts

-

Supreme Court Decision Trumps Challenge To Nih Grants Partially Successful

Aug 23, 2025

Supreme Court Decision Trumps Challenge To Nih Grants Partially Successful

Aug 23, 2025 -

Giants Rookie Db Suffers Devastating Leg Injury Against Patriots

Aug 23, 2025

Giants Rookie Db Suffers Devastating Leg Injury Against Patriots

Aug 23, 2025 -

I Dream Of Jeannie 60th Anniversary A Celebration With Barbara Eden

Aug 23, 2025

I Dream Of Jeannie 60th Anniversary A Celebration With Barbara Eden

Aug 23, 2025 -

Penn State 2025 Depth Chart Preview Season Opener Matchup Against Nevada

Aug 23, 2025

Penn State 2025 Depth Chart Preview Season Opener Matchup Against Nevada

Aug 23, 2025 -

Intuit Financial Report Q4 Fiscal 2025 Highlights And Future Revenue Projections

Aug 23, 2025

Intuit Financial Report Q4 Fiscal 2025 Highlights And Future Revenue Projections

Aug 23, 2025