Trump Administration Doubles Down On Tax Cuts To Garner Support For Major Legislation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Administration Doubles Down on Tax Cuts to Garner Support for Major Legislation

The Trump administration is reportedly redoubling its efforts to push through significant tax cuts as a strategy to secure crucial support for its ambitious legislative agenda. This move, analysts suggest, is a calculated gamble aimed at swaying undecided lawmakers and boosting the chances of passage for key bills facing stiff opposition. But will this high-stakes gamble pay off?

A Controversial Strategy

The proposed tax cuts, details of which remain somewhat shrouded in secrecy, are expected to primarily benefit corporations and high-income earners. This has drawn sharp criticism from Democrats and some Republicans, who argue that such measures exacerbate income inequality and disproportionately benefit the wealthy at the expense of crucial social programs. The timing, coinciding with negotiations on [mention specific legislation, e.g., infrastructure spending or healthcare reform], further fuels the controversy.

Critics point to the potential long-term consequences, arguing that the tax cuts could inflate the national debt and hinder efforts to address pressing social and economic challenges. The Committee for a Responsible Federal Budget, for example, has consistently warned about the unsustainable trajectory of the national debt under such policies. [Link to CFRB report].

However, the administration maintains that the tax cuts are a necessary incentive to stimulate economic growth. Proponents argue that the resulting economic boom will ultimately generate sufficient revenue to offset the initial cost of the cuts, a theory often debated among economists. This "trickle-down" economics approach remains a contentious point of discussion.

Strategic Political Maneuvering

The administration's strategy appears to be one of calculated political maneuvering. By offering tax incentives, they aim to sway wavering Republican senators and potentially even attract some Democratic support, crucial for passing legislation in a closely divided Congress. This tactic, however, is not without risk.

Potential Backlash: The administration faces potential backlash from various groups. Progressive organizations are already mobilizing against the proposed cuts, arguing they worsen existing inequalities. Moderate Republicans, concerned about the fiscal implications, could also balk at the proposal.

Public Opinion: Public opinion on tax cuts is divided, with polls showing varying levels of support depending on the specifics of the proposed changes and the target demographics. Understanding public sentiment will be crucial in determining the long-term success of this strategy. [Link to relevant polling data].

Key Questions Remain

- Transparency: The lack of complete transparency surrounding the details of the proposed tax cuts has fueled speculation and criticism. Increased transparency would help address concerns and foster more productive debate.

- Economic Impact: Independent economic analyses are crucial to accurately assess the potential economic impact of the tax cuts, both positive and negative. The long-term consequences need thorough examination.

- Political Fallout: The political implications of this strategy remain uncertain. Could the administration's gamble backfire, leading to further political division and hindering its legislative agenda?

The coming weeks will be crucial in determining the fate of these proposed tax cuts and their impact on the administration's broader legislative goals. The situation remains fluid and requires close monitoring. This high-stakes political gamble could redefine the economic and political landscape for years to come.

Call to Action: Stay informed about the latest developments by subscribing to our newsletter [link to newsletter signup] and following us on social media. Share your thoughts on this crucial issue in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Administration Doubles Down On Tax Cuts To Garner Support For Major Legislation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lucy Connolly Released Fallout From Controversial X Post

Aug 22, 2025

Lucy Connolly Released Fallout From Controversial X Post

Aug 22, 2025 -

Decoding The Gcse 9 1 Grade Boundaries 2025 Explained

Aug 22, 2025

Decoding The Gcse 9 1 Grade Boundaries 2025 Explained

Aug 22, 2025 -

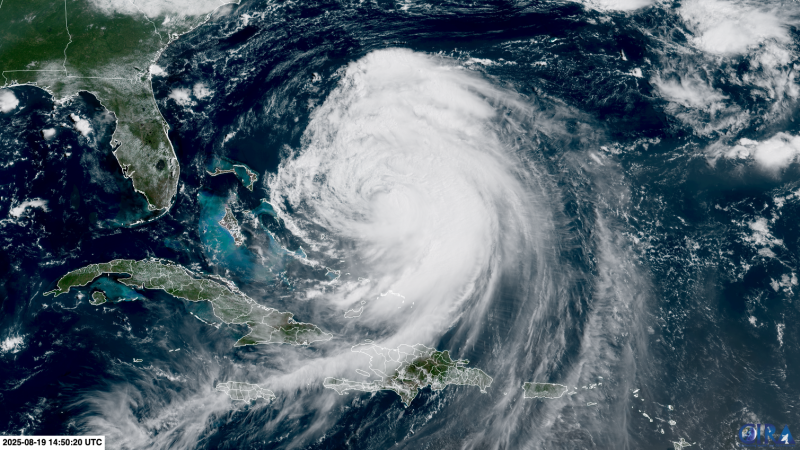

Double Trouble Hurricane Erin And New Storm Bring Dangerous Surf To Eastern Seaboard

Aug 22, 2025

Double Trouble Hurricane Erin And New Storm Bring Dangerous Surf To Eastern Seaboard

Aug 22, 2025 -

Cowboy Builders Tricks Avoiding Costly Mistakes When Hiring A Contractor

Aug 22, 2025

Cowboy Builders Tricks Avoiding Costly Mistakes When Hiring A Contractor

Aug 22, 2025 -

Road To Ufc 4 Episodes 5 And 6 Who Will Win

Aug 22, 2025

Road To Ufc 4 Episodes 5 And 6 Who Will Win

Aug 22, 2025