The Microsoft (MSFT) Investment Case: A Time-Sensitive Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Microsoft (MSFT) Investment Case: A Time-Sensitive Analysis

Microsoft (MSFT) stock has been a stalwart performer for years, but is it still a worthwhile investment in today's rapidly changing tech landscape? This time-sensitive analysis delves into the current state of Microsoft, examining its strengths, weaknesses, opportunities, and threats (SWOT analysis) to help investors determine if now is the right time to buy, hold, or sell.

The tech giant's recent performance has been a mixed bag, with growth in certain sectors offset by challenges in others. Understanding these dynamics is crucial for making informed investment decisions. This article aims to provide a clear and concise overview, focusing on key factors influencing Microsoft's future trajectory.

H2: Microsoft's Strengths: A Foundation of Stability

Microsoft boasts a diverse portfolio, a key strength mitigating risks associated with reliance on single products or markets. Its leading positions in several critical areas provide a solid base for continued growth:

-

Cloud Computing Dominance: Azure, Microsoft's cloud computing platform, is a major growth engine, consistently challenging Amazon Web Services (AWS) for market share. This ongoing competition fuels innovation and drives substantial revenue. The future of cloud computing remains bright, positioning Microsoft favorably for long-term success.

-

Windows Operating System Monopoly: While facing increasing competition, Windows remains the dominant operating system for PCs globally. This entrenched position ensures a steady stream of revenue and provides a strong platform for other Microsoft products and services.

-

Office 365/Microsoft 365 Subscription Model: The shift to a subscription model has proven highly successful, generating predictable recurring revenue and fostering customer loyalty. This model provides a more stable revenue stream compared to traditional one-time software purchases.

-

Strong Brand Recognition and Loyalty: Microsoft enjoys unparalleled brand recognition and loyalty, a significant advantage in a competitive marketplace. This brand recognition translates to higher consumer trust and confidence in its products and services.

H2: Weaknesses and Threats: Navigating the Challenges

While Microsoft's strengths are substantial, several factors present potential challenges:

-

Competition in the Cloud: The competition from AWS and Google Cloud remains fierce, requiring ongoing innovation and investment to maintain and expand market share. This competitive landscape necessitates significant R&D spending to stay ahead of the curve.

-

Regulatory Scrutiny: Increasing regulatory scrutiny across various sectors, including antitrust concerns, could impact Microsoft's growth trajectory. Navigating this complex regulatory environment is a key challenge for the company.

-

Economic Downturn Sensitivity: As a large technology company, Microsoft is not immune to the impact of economic downturns. Reduced spending from businesses and consumers could affect demand for its products and services.

-

Cybersecurity Threats: The growing prevalence of cybersecurity threats poses a significant risk to Microsoft and its customers. Maintaining robust security measures is critical to preserving its reputation and customer trust.

H2: Opportunities for Growth and Innovation

Microsoft possesses significant opportunities for future growth, fueled by technological advancements and evolving market trends:

-

Expansion in AI: Microsoft is heavily investing in artificial intelligence (AI), integrating AI capabilities across its product portfolio. This focus positions it to capitalize on the rapidly expanding AI market. [Link to an external article on Microsoft's AI initiatives]

-

Growth in Gaming: Xbox and its gaming ecosystem represent a substantial growth opportunity, especially with the rise of cloud gaming and esports. Microsoft's strategic acquisitions in the gaming space demonstrate its commitment to this sector.

-

Metaverse and Extended Reality (XR): Microsoft is actively exploring opportunities in the metaverse and extended reality, positioning itself for potential future growth in this emerging technological landscape.

-

Enterprise Software Solutions: Continued innovation and expansion in enterprise software solutions will be crucial for sustaining growth in the business-to-business (B2B) market.

H2: Conclusion: Is MSFT a Buy, Hold, or Sell?

The Microsoft investment case is complex and depends on individual risk tolerance and investment timelines. While the company faces challenges, its strong fundamentals and strategic positioning in key growth areas suggest a positive long-term outlook. However, the competitive landscape and potential economic headwinds require careful consideration. Conduct thorough due diligence, consult with a financial advisor, and carefully assess your own risk tolerance before making any investment decisions. The information provided here is for informational purposes only and should not be construed as financial advice.

Call to Action: Stay informed about Microsoft's progress by following reputable financial news sources and conducting your own research.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Microsoft (MSFT) Investment Case: A Time-Sensitive Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mars Rover Discovery Rocks Suggest Past Life

Sep 12, 2025

Mars Rover Discovery Rocks Suggest Past Life

Sep 12, 2025 -

Revenge Game Looms Nc State Faces Wake Forest In Key Acc Clash

Sep 12, 2025

Revenge Game Looms Nc State Faces Wake Forest In Key Acc Clash

Sep 12, 2025 -

Health Update Jerry Lawler Pulls Out Of Scheduled Events

Sep 12, 2025

Health Update Jerry Lawler Pulls Out Of Scheduled Events

Sep 12, 2025 -

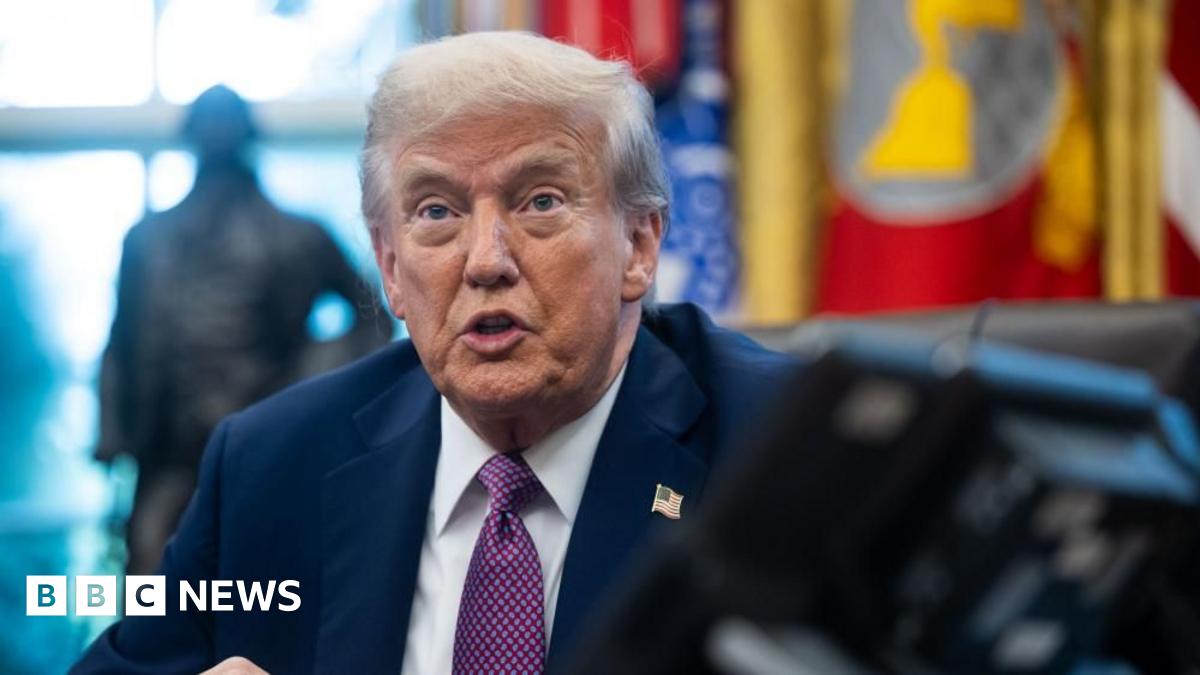

Trump Confronts Crises In Qatar And Poland A Growing Headache

Sep 12, 2025

Trump Confronts Crises In Qatar And Poland A Growing Headache

Sep 12, 2025 -

Fantasy Football Evaluating Rookie Performances After Week 2

Sep 12, 2025

Fantasy Football Evaluating Rookie Performances After Week 2

Sep 12, 2025

Latest Posts

-

Bbc Exposes Israels Gaza Evacuation Aid Sites Amidst Resident Defiance

Sep 12, 2025

Bbc Exposes Israels Gaza Evacuation Aid Sites Amidst Resident Defiance

Sep 12, 2025 -

Jerry Lawlers Stroke Recovery Progress And Well Wishes

Sep 12, 2025

Jerry Lawlers Stroke Recovery Progress And Well Wishes

Sep 12, 2025 -

Controversy Erupts Over Proposed Charlie Kirk Statue In Capitol Building

Sep 12, 2025

Controversy Erupts Over Proposed Charlie Kirk Statue In Capitol Building

Sep 12, 2025 -

Virada No Horizonte Tres Feitos Recentes Inspiram O Atletico Mg

Sep 12, 2025

Virada No Horizonte Tres Feitos Recentes Inspiram O Atletico Mg

Sep 12, 2025 -

Jerry Lawler Wwe Hall Of Famers Stroke And Road To Recovery

Sep 12, 2025

Jerry Lawler Wwe Hall Of Famers Stroke And Road To Recovery

Sep 12, 2025