The Impact Of Trump's Tariffs On The National Debt: Analysis And Caveats

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Impact of Trump's Tariffs on the National Debt: Analysis and Caveats

Introduction: Donald Trump's administration implemented a series of tariffs on imported goods, aiming to reshape global trade and bolster domestic industries. While the economic impact of these tariffs remains a subject of ongoing debate, their influence on the US national debt is a crucial aspect requiring careful analysis. This article delves into the complex relationship between Trump's tariffs and the national debt, exploring both direct and indirect effects, while acknowledging the significant caveats inherent in such an assessment.

Direct Fiscal Impacts: A Mixed Bag

The most direct impact of tariffs is through increased government revenue. Tariffs generate revenue as importers pay duties on goods entering the country. Initially, this boosted government coffers, seemingly offering a counterbalance to other spending pressures. However, this revenue increase was often offset by other factors.

-

Reduced Trade Volume: Tariffs led to retaliatory tariffs from other countries, significantly reducing the overall volume of trade. This decrease in import and export activity consequently diminished the overall tax revenue generated from those activities, partially negating the positive effect of tariff revenue.

-

Increased Costs for Businesses and Consumers: Higher prices for imported goods fueled inflation, impacting consumer spending and business investment. This slowdown in economic activity further reduced tax revenue collected from corporate income tax and individual income tax, indirectly increasing the debt.

Indirect Economic Impacts: A More Murky Picture

The indirect effects of Trump's tariffs on the national debt are far more intricate and difficult to isolate.

-

Impact on Economic Growth: The tariffs disrupted established supply chains, leading to higher production costs for businesses and uncertainty in the market. This economic instability negatively affected GDP growth. Lower GDP growth typically translates to lower tax revenues and potentially higher government spending on social programs like unemployment benefits, ultimately increasing the national debt.

-

Investment and Job Creation: The administration argued that tariffs would protect American jobs and stimulate domestic investment. However, studies have produced mixed results, with some suggesting job losses in certain sectors outweighing any gains in others. The lack of significant job growth or investment, despite the tariffs, contributed to a less robust economy, impacting tax revenue and increasing pressure on the national debt.

Caveats and Uncertanties:

Analyzing the specific impact of tariffs on the national debt presents numerous challenges:

-

Correlation vs. Causation: Attributing changes in the national debt solely to tariffs is difficult. Numerous other economic factors, including government spending policies and global economic conditions, significantly influence the debt. Separating the effect of tariffs from these other factors requires sophisticated econometric modeling and remains a subject of ongoing academic debate.

-

Long-term Effects: The full consequences of Trump's tariffs may not be fully apparent for years to come. Long-term economic effects, such as shifts in global trade patterns and changes in investment behaviors, will continue to shape the national debt over time.

-

Data Limitations: Precise quantification of the impact is limited by data availability and the complexity of disentangling the myriad of interconnected economic variables at play.

Conclusion:

While Trump's tariffs initially generated some revenue, their overall impact on the national debt is likely negative, both directly through reduced trade and indirectly through slower economic growth. The complex interplay of economic factors makes precise quantification difficult, highlighting the need for further research and careful consideration of various economic models. Understanding these complex interactions is crucial for policymakers to formulate effective economic strategies and manage the national debt responsibly. Further research and analysis, incorporating various econometric methodologies, are needed to refine our understanding of the long-term consequences of these trade policies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of Trump's Tariffs On The National Debt: Analysis And Caveats. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Deepfake Senator Amy Klobuchar Appears To Criticize Sydney Sweeney In Fabricated Ad

Aug 28, 2025

Ai Deepfake Senator Amy Klobuchar Appears To Criticize Sydney Sweeney In Fabricated Ad

Aug 28, 2025 -

Transfer News Arsenal Liverpool And Chelseas Latest Targets Hincapie Isak Garnacho

Aug 28, 2025

Transfer News Arsenal Liverpool And Chelseas Latest Targets Hincapie Isak Garnacho

Aug 28, 2025 -

7 Month Olds Parents Face Murder Charges In First Court Appearance Since Arrest

Aug 28, 2025

7 Month Olds Parents Face Murder Charges In First Court Appearance Since Arrest

Aug 28, 2025 -

Court Hears Man Approached Girls In Epping Expressed Desire For Child

Aug 28, 2025

Court Hears Man Approached Girls In Epping Expressed Desire For Child

Aug 28, 2025 -

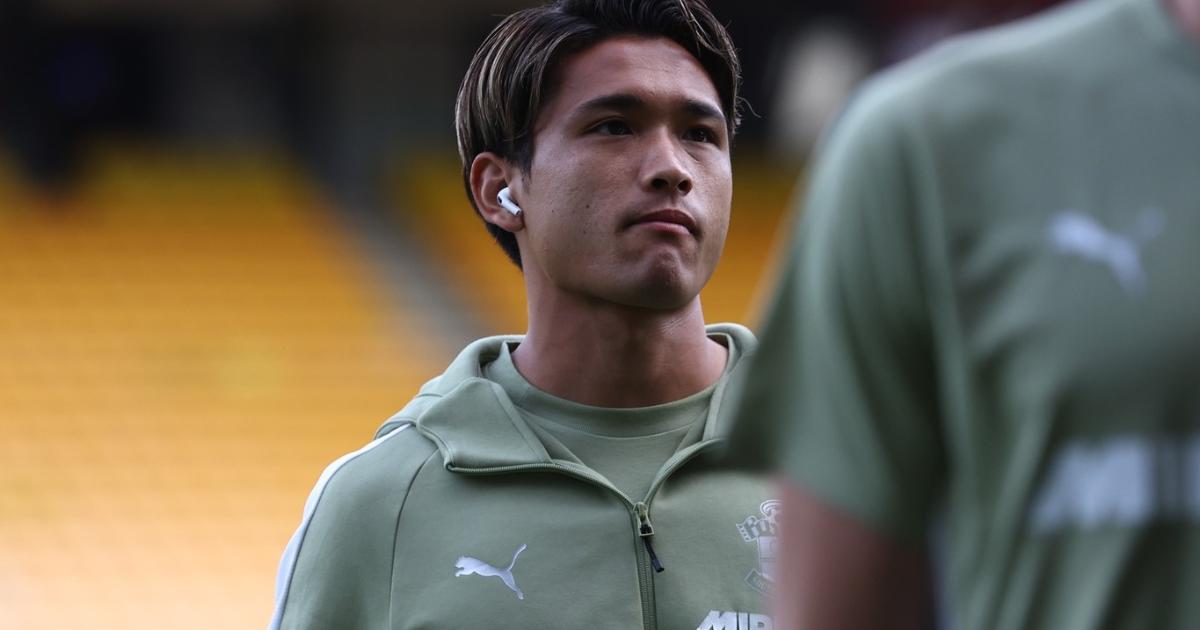

Carabao Cup Result Southampton Thrash Norwich 3 0

Aug 28, 2025

Carabao Cup Result Southampton Thrash Norwich 3 0

Aug 28, 2025

Latest Posts

-

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025

Wanted A Baby Mans Statement To Epping Girls Results In Court Case

Aug 28, 2025 -

Dexter Original Sins Shocking Cancellation After Season 2 Renewal

Aug 28, 2025

Dexter Original Sins Shocking Cancellation After Season 2 Renewal

Aug 28, 2025 -

Trumps Tariffs And The National Debt Separating Fact From Fiction

Aug 28, 2025

Trumps Tariffs And The National Debt Separating Fact From Fiction

Aug 28, 2025 -

Taylor Swift And Travis Kelces Relationship Is Marriage On The Cards

Aug 28, 2025

Taylor Swift And Travis Kelces Relationship Is Marriage On The Cards

Aug 28, 2025 -

Matsukis Growth At Southampton Manager Defends Young Players Progress

Aug 28, 2025

Matsukis Growth At Southampton Manager Defends Young Players Progress

Aug 28, 2025