The High Cost Of Higher Education: Are Student Loans A Debt Trap?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The High Cost of Higher Education: Are Student Loans a Debt Trap?

The American dream often includes a college degree, but the rising cost of higher education is turning that dream into a financial nightmare for many. With tuition fees, room and board, and other expenses skyrocketing, student loans have become a ubiquitous part of the higher education landscape. But are these loans a necessary stepping stone to success, or a dangerous debt trap that shackles graduates for years, even decades, to come?

The simple answer is: it's complicated. While a college degree can significantly boost earning potential, the cost of obtaining that degree is increasingly outpacing its return on investment. This leaves many graduates struggling to repay their loans, impacting their ability to buy homes, start families, and achieve other key life milestones.

The Crushing Weight of Student Loan Debt:

The sheer scale of student loan debt in the United States is staggering. Millions of Americans are burdened with tens of thousands, even hundreds of thousands, of dollars in student loan debt. This debt is impacting not only individuals but the entire economy, hindering economic growth and contributing to financial instability.

- Rising Tuition Costs: College tuition has been increasing at a rate far exceeding inflation for decades. This makes it increasingly difficult for students to afford college without taking on significant debt.

- Limited Financial Aid: While financial aid programs exist, they often fall short of covering the full cost of attendance, leaving students with substantial gaps to fill with loans.

- Aggressive Lending Practices: Some lenders employ aggressive tactics, pushing students into loans they may not fully understand or can realistically afford to repay.

Is There a Way Out of the Debt Trap?

The good news is that there are resources and strategies available to help manage and potentially reduce student loan debt.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size, making repayment more manageable. You can explore options like the Income-Driven Repayment (IDR) plan offered through the federal government. [Link to relevant government website].

- Loan Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment.

- Student Loan Forgiveness Programs: Certain professions, such as teaching and public service, may qualify for student loan forgiveness programs. Researching these options is crucial. [Link to relevant government website for loan forgiveness programs]

- Financial Literacy: Understanding personal finance and budgeting is paramount. Many free resources are available online to help you manage your finances effectively. [Link to a reputable financial literacy resource].

Preventing Future Debt Traps:

Preventing future students from falling into the same trap requires a multifaceted approach.

- Increased Government Funding for Higher Education: Increased funding for grants and scholarships could alleviate the reliance on loans.

- Transparency in College Costs: Greater transparency regarding college costs and financial aid opportunities can empower students to make informed decisions.

- Emphasis on Career Services: Colleges need to invest more in career services to help students find jobs that align with their education and earning potential.

The Bottom Line:

The high cost of higher education and the resulting student loan debt crisis is a complex issue with significant consequences. While a college degree remains valuable, it's crucial to approach higher education with a realistic understanding of the financial implications. Careful planning, responsible borrowing, and awareness of available resources are essential to navigating the challenging path to higher education without falling into a debilitating debt trap. The future of higher education depends on addressing this issue head-on, ensuring that the pursuit of knowledge doesn't lead to lifelong financial hardship.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The High Cost Of Higher Education: Are Student Loans A Debt Trap?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solve Nyt Connections Sports Puzzle 346 September 4th

Sep 05, 2025

Solve Nyt Connections Sports Puzzle 346 September 4th

Sep 05, 2025 -

William Bill S Foriska A Life Remembered Obituary And Service Details

Sep 05, 2025

William Bill S Foriska A Life Remembered Obituary And Service Details

Sep 05, 2025 -

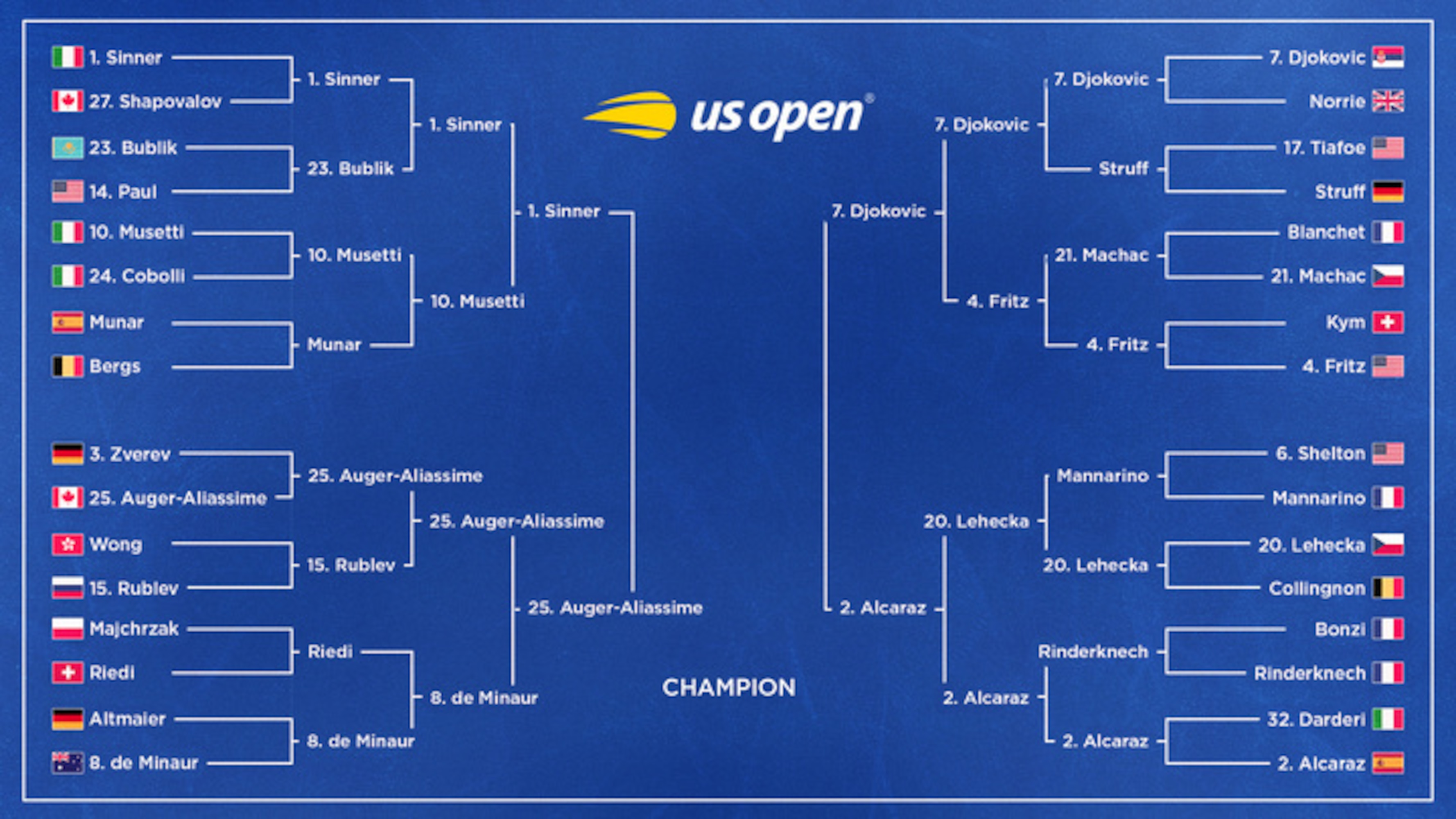

2025 Us Open Mens Semifinal Breakdown Potential For Upsets

Sep 05, 2025

2025 Us Open Mens Semifinal Breakdown Potential For Upsets

Sep 05, 2025 -

Unexpected Success A Quinceanera Story Of Perseverance And Joy

Sep 05, 2025

Unexpected Success A Quinceanera Story Of Perseverance And Joy

Sep 05, 2025 -

30 Years Of Xena Warrior Princess A Look Back At The Iconic Series

Sep 05, 2025

30 Years Of Xena Warrior Princess A Look Back At The Iconic Series

Sep 05, 2025