Tax Cuts Take Center Stage: Trump Admin's Strategy For Selling Its Legislative Agenda

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

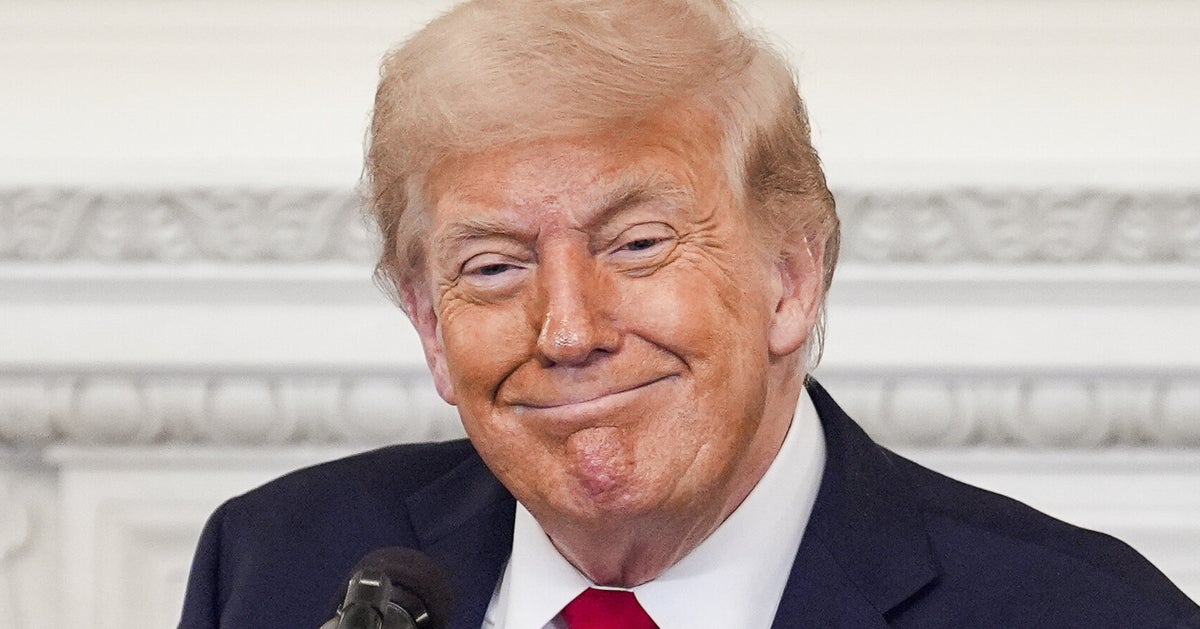

Tax Cuts Take Center Stage: Trump Admin's Strategy for Selling its Legislative Agenda

The Trump administration's ambitious tax cut plan, enacted in late 2017, wasn't just about lowering tax rates; it was a masterclass in political messaging and legislative strategy. Understanding how the administration sold this landmark legislation offers valuable insight into the art of influencing public opinion and navigating the complexities of the American political landscape. This article delves into the key strategies employed to secure passage and garner public support for the Tax Cuts and Jobs Act.

A Carefully Orchestrated Narrative:

The administration's success wasn't accidental. They meticulously crafted a narrative that framed the tax cuts as a boon for the middle class, job creators, and the American economy as a whole. This involved several key components:

- Focusing on Simplicity: The administration emphasized the simplicity of the tax code changes, claiming it would lead to easier filing for average Americans. This resonated with a public often frustrated by the complexity of the existing system. While the actual impact on individual tax burdens varied significantly, the message of simplification was effective.

- Highlighting Economic Growth: A central argument revolved around the potential for increased economic growth spurred by the tax cuts. The administration projected significant job creation and increased wages, painting a picture of a revitalized American economy. While the actual economic impact remains a subject of ongoing debate among economists, the promise of prosperity was a powerful selling point.

- Targeting Key Demographics: The messaging was tailored to specific demographics. For example, the administration highlighted the benefits for small businesses and entrepreneurs, appealing to a crucial segment of the Republican base. Similarly, they emphasized the child tax credit expansion, aiming to garner support from families.

- Reframing the Debate: The administration proactively countered criticisms by reframing the narrative. Concerns about increased national debt were dismissed as short-sighted, while arguments about tax cuts disproportionately benefiting the wealthy were countered by emphasizing the "trickle-down" economic effects.

The Role of Public Relations and Media:

The administration’s strategy extended beyond simple legislative maneuvering. A robust public relations campaign played a significant role in shaping public perception:

- Direct Engagement: President Trump himself frequently used social media and rallies to promote the tax cuts, bypassing traditional media outlets and directly engaging with his supporters. This fostered a sense of immediacy and authenticity.

- Targeted Messaging: Different messaging strategies were employed for different media outlets. Conservative media outlets were heavily utilized to spread the administration's message, while efforts were made to engage more moderate outlets, although with less success.

- Repetition and Reinforcement: The administration consistently reiterated its core message across various platforms, reinforcing the key arguments and ensuring maximum exposure. This created a sense of familiarity and solidified the narrative in the public consciousness.

Long-Term Effects and Ongoing Debate:

The long-term consequences of the 2017 tax cuts remain a subject of ongoing debate. While some argue they stimulated economic growth and benefited American workers, others point to the increased national debt and the disproportionate benefits accruing to the wealthy. Examining the economic data and analyzing the political ramifications remains a crucial endeavor for understanding the impact of this significant legislative undertaking.

Conclusion:

The Trump administration’s successful implementation of its tax cut agenda provides a valuable case study in political strategy. Their meticulous messaging, targeted outreach, and shrewd use of public relations significantly influenced public opinion and contributed to the passage of a landmark piece of legislation. Analyzing this strategy offers critical insights into the intersection of policy, politics, and public perception. Further research is needed to fully assess the long-term economic and social effects of this legislation. Learn more about the intricacies of tax policy by exploring resources from the [link to a reputable source on tax policy, e.g., Tax Policy Center].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Cuts Take Center Stage: Trump Admin's Strategy For Selling Its Legislative Agenda. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Al Wild Card Battle Strength Of Schedule Decides Yankees Vs Rangers Fate

Aug 23, 2025

Al Wild Card Battle Strength Of Schedule Decides Yankees Vs Rangers Fate

Aug 23, 2025 -

Gold Fifa Trophy Trumps Possession Sparks Debate After Soccer Champs Receive Replica

Aug 23, 2025

Gold Fifa Trophy Trumps Possession Sparks Debate After Soccer Champs Receive Replica

Aug 23, 2025 -

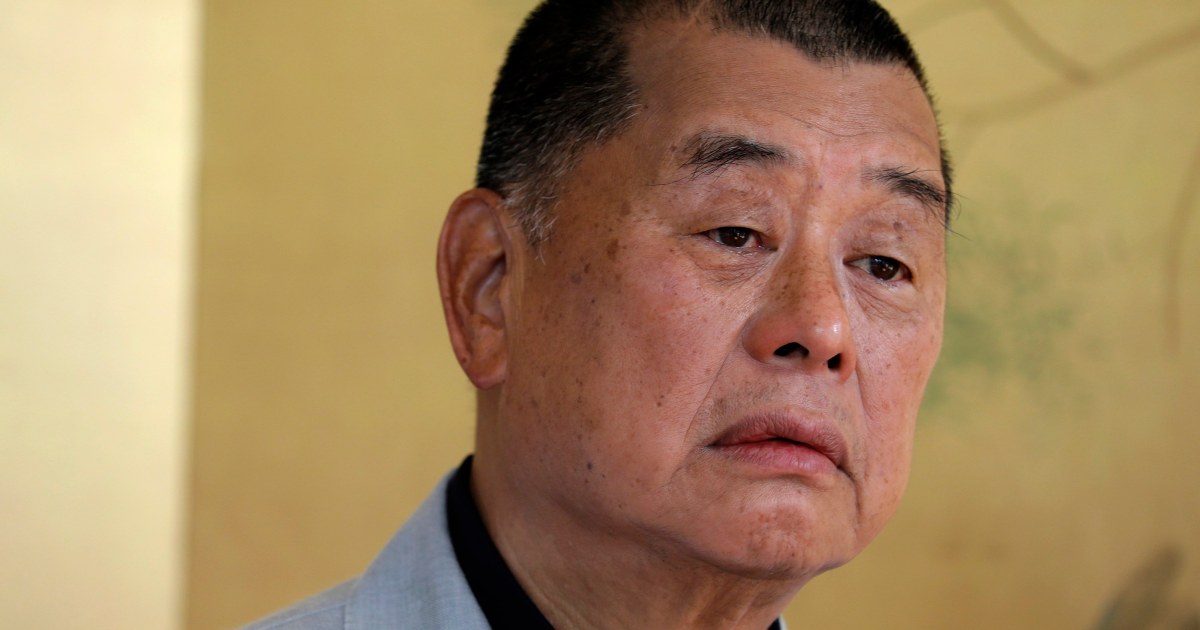

Free Speech At Stake High Profile Hong Kong Trial For Activist Jimmy Lai

Aug 23, 2025

Free Speech At Stake High Profile Hong Kong Trial For Activist Jimmy Lai

Aug 23, 2025 -

Road To Ufc 4 Episode 5 And 6 In Depth Fighter Preview And Predictions

Aug 23, 2025

Road To Ufc 4 Episode 5 And 6 In Depth Fighter Preview And Predictions

Aug 23, 2025 -

Ys Road To Glory A Ufc Contender Series Preview

Aug 23, 2025

Ys Road To Glory A Ufc Contender Series Preview

Aug 23, 2025

Latest Posts

-

Highlander Movie Reboot Gillan And Cavill Lead The Cast

Aug 23, 2025

Highlander Movie Reboot Gillan And Cavill Lead The Cast

Aug 23, 2025 -

Orlando Weather Forecast Stormy Weekend Predicted For Central Florida

Aug 23, 2025

Orlando Weather Forecast Stormy Weekend Predicted For Central Florida

Aug 23, 2025 -

Proposed Ukraine Land Concessions A Dangerous Gambit

Aug 23, 2025

Proposed Ukraine Land Concessions A Dangerous Gambit

Aug 23, 2025 -

2025 Nascar On Nbc Meet The Announcers Covering The Races

Aug 23, 2025

2025 Nascar On Nbc Meet The Announcers Covering The Races

Aug 23, 2025 -

Hypersonic Missile Technology A Growing Gap Between East And West

Aug 23, 2025

Hypersonic Missile Technology A Growing Gap Between East And West

Aug 23, 2025