Tax Cuts As The Key: Trump Admin's Strategy To Sell Its Sweeping Legislative Agenda

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Cuts as the Key: Trump Admin's Strategy to Sell Its Sweeping Legislative Agenda

The Trump administration's ambitious legislative agenda faced an uphill battle from the outset. To overcome opposition and garner public support, a central strategy emerged: tax cuts. This wasn't just about lowering rates; it was a sophisticated political and economic strategy designed to sell a broader, often controversial, policy platform. But did it work? Let's delve into the details.

The Power of Tax Cuts as a Political Tool

The 2017 Tax Cuts and Jobs Act (TCJA) served as the cornerstone of the Trump administration's legislative sales pitch. The administration framed the cuts, which significantly reduced corporate and individual income tax rates, as a powerful economic stimulus. The promised benefits included:

- Job creation: Lower corporate taxes were touted to incentivize businesses to invest more, leading to increased hiring and economic growth.

- Increased wages: The administration argued that businesses would pass savings on to employees through higher wages.

- Economic growth: The overall effect, it was claimed, would be a significant boost to the US economy.

This narrative, heavily promoted through media appearances and public addresses, aimed to overshadow the more contentious aspects of the administration's agenda, such as deregulation and immigration policies. By focusing on the immediate and tangible benefit of lower taxes, the administration hoped to sway public opinion.

Did the Strategy Succeed? A Mixed Bag

The impact of the TCJA remains a subject of ongoing debate amongst economists. While some studies have shown positive impacts on economic growth and investment, others point to a lack of significant wage increases and concerns about increased income inequality. [Link to a reputable economic analysis of the TCJA].

The political success of the strategy is equally complex. While the tax cuts were popular with many voters, particularly businesses and higher-income earners, they failed to garner universal support and were met with significant criticism from opposition parties who argued the cuts disproportionately benefited the wealthy and increased the national debt. [Link to an article discussing political opposition to the TCJA].

Beyond Economic Arguments: The Narrative of "Success"

The Trump administration skillfully crafted a narrative around the tax cuts, framing them as a symbol of success and economic rejuvenation. This narrative went beyond economic data, focusing on feelings of prosperity and national strength. This strategy aimed to build public confidence in the administration's overall agenda, regardless of the specific economic outcomes of the tax cuts themselves.

The Long-Term Implications

The long-term effects of the TCJA are still unfolding. The increased national debt resulting from the cuts poses a significant challenge for future administrations. Moreover, the debate over the true economic impact continues, with economists offering differing perspectives and analyses. [Link to a relevant article on the long-term effects of the TCJA].

Conclusion: A Strategic Masterclass or a Pyrrhic Victory?

The Trump administration's use of tax cuts to sell its legislative agenda was a bold, albeit controversial, strategy. Whether it was a resounding success or a ultimately failed gamble remains a matter of interpretation. However, it serves as a case study in the complex interplay between economic policy, political strategy, and public perception. The lasting impact of the TCJA, both economically and politically, will continue to be debated and analyzed for years to come. What are your thoughts on the strategy's effectiveness? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Cuts As The Key: Trump Admin's Strategy To Sell Its Sweeping Legislative Agenda. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

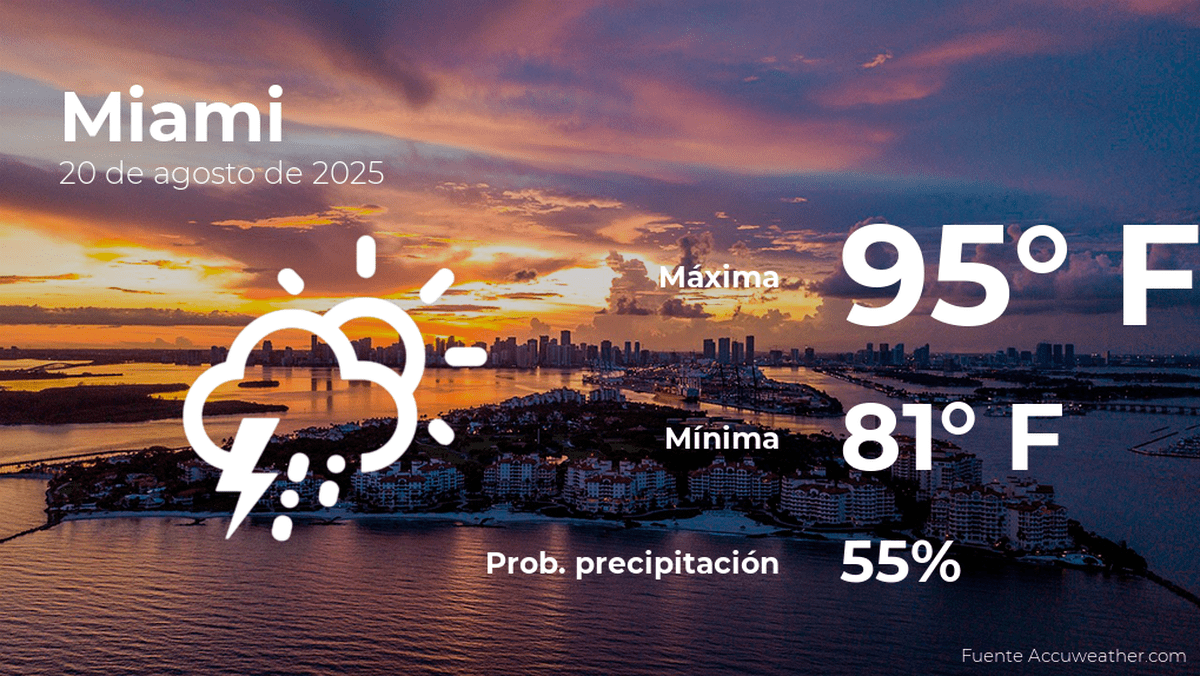

Prediccion Meteorologica Miami 20 De Agosto Miercoles

Aug 22, 2025

Prediccion Meteorologica Miami 20 De Agosto Miercoles

Aug 22, 2025 -

Cnn Data Americans Abandon Trump Over Crucial Issue

Aug 22, 2025

Cnn Data Americans Abandon Trump Over Crucial Issue

Aug 22, 2025 -

Did Walters Hire An Attorney After His Tv Incident

Aug 22, 2025

Did Walters Hire An Attorney After His Tv Incident

Aug 22, 2025 -

Tri State Area Flood Warning Heavy Rain And First Alert Weather Day Forecast

Aug 22, 2025

Tri State Area Flood Warning Heavy Rain And First Alert Weather Day Forecast

Aug 22, 2025 -

Police Arrest 14 Year Old Girl In Woolton Hall Fire Investigation

Aug 22, 2025

Police Arrest 14 Year Old Girl In Woolton Hall Fire Investigation

Aug 22, 2025

Latest Posts

-

Clima En Miami Hoy Y Proximos Dias Prevision Meteorologica Completa

Aug 22, 2025

Clima En Miami Hoy Y Proximos Dias Prevision Meteorologica Completa

Aug 22, 2025 -

Legal Action Against Toddler Milk Companies Parents Fight Back

Aug 22, 2025

Legal Action Against Toddler Milk Companies Parents Fight Back

Aug 22, 2025 -

Exposed The Cowboy Builder Who Stole Thousands And Avoided Prosecution

Aug 22, 2025

Exposed The Cowboy Builder Who Stole Thousands And Avoided Prosecution

Aug 22, 2025 -

Jennifer Aniston And Courteney Coxs Double Date Fuels Friendship Speculation

Aug 22, 2025

Jennifer Aniston And Courteney Coxs Double Date Fuels Friendship Speculation

Aug 22, 2025 -

Ukraine Conflict China Monitors Peace Initiatives

Aug 22, 2025

Ukraine Conflict China Monitors Peace Initiatives

Aug 22, 2025