Tax Cuts As The Cornerstone: Trump Admin's Strategy For Selling Its Sweeping Legislative Agenda

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Cuts as the Cornerstone: Trump Admin's Strategy for Selling its Sweeping Legislative Agenda

The Trump administration's ambitious legislative agenda, unveiled in the early days of 2017, faced an uphill battle from the outset. Gaining congressional support for sweeping changes across multiple sectors required a potent selling point – and the administration found it in the promise of significant tax cuts. This strategy, while controversial, proved remarkably effective in pushing through landmark legislation. But how did they do it, and what were the long-term consequences?

The Allure of Lower Taxes:

The core of the Trump administration's legislative strategy centered on the appeal of lower taxes for individuals and corporations. The Tax Cuts and Jobs Act of 2017 (TCJA) became the flagship achievement, promising to stimulate economic growth through reduced tax burdens. The administration framed the cuts as a win-win: businesses would invest more, leading to job creation and higher wages, while individuals would enjoy more disposable income, boosting consumer spending. This narrative resonated with a significant portion of the electorate and provided a powerful argument for lawmakers hesitant to support the broader agenda.

Beyond Tax Cuts: A Broader Legislative Push:

While tax cuts formed the central pillar, the administration cleverly linked them to other legislative priorities. The promise of economic growth fueled by the TCJA was used to justify spending on infrastructure, deregulation, and other key policy initiatives. This interconnected strategy aimed to create a domino effect, where the success of one initiative would bolster support for others.

Selling the Narrative:

The administration employed a multi-pronged approach to sell its narrative:

- Direct Messaging: President Trump himself frequently touted the benefits of the tax cuts, using rallies and social media to reach a broad audience.

- Economic Forecasting: The administration, along with supportive economists, released projections forecasting robust economic growth as a direct result of the TCJA. While these projections were later criticized for over-optimism, they played a crucial role in the initial selling process.

- Targeted Messaging to Specific Groups: Different aspects of the tax cuts were highlighted to appeal to different segments of the population, including businesses, individuals, and specific industries.

Criticism and Controversy:

The TCJA wasn't without its critics. Opponents argued that the tax cuts disproportionately benefited corporations and the wealthy, while increasing the national debt. Concerns were also raised about the potential for increased income inequality and the long-term sustainability of the tax cuts. These criticisms sparked intense debate and highlighted the complexities of the administration's economic strategy.

Long-Term Impacts:

The long-term consequences of the Trump administration's tax cut strategy are still unfolding. While the economy experienced a period of growth following the passage of the TCJA, the extent to which this growth can be directly attributed to the tax cuts remains a subject of ongoing debate among economists. [Link to a relevant academic study on the TCJA's economic impact]. Furthermore, the increased national debt resulting from the tax cuts presents a significant challenge for future administrations.

Conclusion:

The Trump administration's use of tax cuts as a cornerstone for its legislative agenda provides a compelling case study in political strategy. While the long-term effects remain a topic of ongoing discussion, the success of the TCJA demonstrates the power of a clearly articulated, economically focused message in driving through ambitious legislative goals. The strategy, however, also highlights the importance of considering both short-term political gains and the potential for long-term economic and social consequences. Understanding this delicate balance is crucial for future policymakers.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Cuts As The Cornerstone: Trump Admin's Strategy For Selling Its Sweeping Legislative Agenda. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

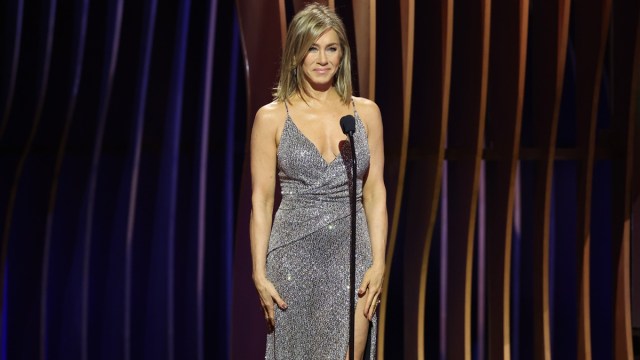

New Couple Alert Jennifer Anistons Relationship With Jim Curtis Revealed In Cute Video

Aug 23, 2025

New Couple Alert Jennifer Anistons Relationship With Jim Curtis Revealed In Cute Video

Aug 23, 2025 -

El Tiempo En Miami Consulta El Pronostico Y Planifica Tu Salida

Aug 23, 2025

El Tiempo En Miami Consulta El Pronostico Y Planifica Tu Salida

Aug 23, 2025 -

Jennifer Anistons Relationship A Besties Perspective

Aug 23, 2025

Jennifer Anistons Relationship A Besties Perspective

Aug 23, 2025 -

Can Cristiano Ronaldo Deliver Al Nassrs First Major Win

Aug 23, 2025

Can Cristiano Ronaldo Deliver Al Nassrs First Major Win

Aug 23, 2025 -

Nyc Flood Warning Heavy Rain And Potential Flooding On The Way

Aug 23, 2025

Nyc Flood Warning Heavy Rain And Potential Flooding On The Way

Aug 23, 2025

Latest Posts

-

Rhs Students Garner Top Honors At State And National Competitions

Aug 23, 2025

Rhs Students Garner Top Honors At State And National Competitions

Aug 23, 2025 -

Premier League Predictions Full Matchday 2 Preview And Betting Tips

Aug 23, 2025

Premier League Predictions Full Matchday 2 Preview And Betting Tips

Aug 23, 2025 -

Cracker Barrels Redesigned Logo A Controversial Update

Aug 23, 2025

Cracker Barrels Redesigned Logo A Controversial Update

Aug 23, 2025 -

Premier League Predictions Chelseas Pressure On Potter And Jones Knows 9 1 Treble

Aug 23, 2025

Premier League Predictions Chelseas Pressure On Potter And Jones Knows 9 1 Treble

Aug 23, 2025 -

Over 1000 Katy Isd Students Awarded College Board National Recognition

Aug 23, 2025

Over 1000 Katy Isd Students Awarded College Board National Recognition

Aug 23, 2025