Tax Authorities Intensify Audits: Public Anxiety Rises

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Authorities Intensify Audits: Public Anxiety Rises

The nation's tax authorities are cracking down, leading to a surge in audits and a corresponding wave of public anxiety. Increased scrutiny across various income brackets has left many taxpayers feeling uneasy and uncertain about their tax obligations. This heightened enforcement comes amidst a backdrop of government budget constraints and a renewed focus on tax compliance.

The Rise in Audit Notifications

Reports indicate a significant increase in the number of audit notifications issued in recent months. While the precise figures vary depending on the region and specific tax agency, anecdotal evidence from tax professionals and concerned citizens paints a clear picture: audits are becoming more frequent and more rigorous. This isn't just targeting high-income earners; middle- and low-income individuals are also experiencing an uptick in scrutiny. This widespread impact is fueling public anxiety and prompting many to seek professional tax advice.

Reasons Behind the Intensified Scrutiny

Several factors are contributing to this intensified audit activity:

- Government Budget Shortfalls: Governments often turn to increased tax enforcement as a means of boosting revenue during periods of fiscal constraint. This proactive approach aims to recoup lost tax revenue through thorough audits.

- Advances in Data Analytics: Tax authorities are leveraging advanced data analytics and artificial intelligence to identify potential discrepancies and inconsistencies in tax returns with greater efficiency. This technology allows for the detection of patterns and anomalies that might have previously gone unnoticed.

- Increased Focus on Tax Evasion: A renewed focus on combating tax evasion and promoting tax fairness is driving the increased audit activity. This crackdown is intended to send a clear message that tax evasion will not be tolerated.

- Changes in Tax Laws: Recent changes to tax laws and regulations can increase the complexity of tax compliance, potentially leading to unintentional errors and an increased likelihood of audits. Staying updated on these changes is crucial.

How to Minimize Your Audit Risk

While no one can guarantee avoiding an audit entirely, taking proactive steps can significantly reduce your risk:

- Maintain Accurate Records: Keep meticulous records of all income, expenses, and deductions. Digital record-keeping can streamline this process and make it easier to provide documentation if needed.

- Seek Professional Advice: Consulting a qualified tax professional can ensure your tax returns are accurate and compliant with all applicable laws and regulations. They can also help you navigate the complexities of tax codes and minimize your risk.

- Understand Tax Laws: Familiarize yourself with the relevant tax laws and regulations. While this may seem daunting, understanding the basics can go a long way in preventing errors. The (or your country's equivalent) offers valuable resources.

- File on Time: Late filing is a major red flag for tax authorities. Always file your tax return before the deadline.

The Psychological Impact

Beyond the financial implications, the increased audit activity is causing significant stress and anxiety among taxpayers. The uncertainty surrounding an audit, the potential for penalties, and the complex process itself can be overwhelming. Many are seeking support from mental health professionals to cope with the stress.

Looking Ahead

The intensification of tax audits is likely to continue in the near future. Taxpayers should proactively manage their tax obligations, maintain accurate records, and seek professional help when needed. Understanding the reasons behind the increased scrutiny and taking steps to minimize your risk can help alleviate some of the associated anxiety and uncertainty. Staying informed about tax law changes and utilizing available resources is key to navigating this increasingly complex landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Authorities Intensify Audits: Public Anxiety Rises. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kansas Governor Declares State Of Emergency Harvey County Gas Leak Crisis

Aug 31, 2025

Kansas Governor Declares State Of Emergency Harvey County Gas Leak Crisis

Aug 31, 2025 -

Bruce Willis Health Update Emma Heming Willis Powerful Message On Caregiving And Support

Aug 31, 2025

Bruce Willis Health Update Emma Heming Willis Powerful Message On Caregiving And Support

Aug 31, 2025 -

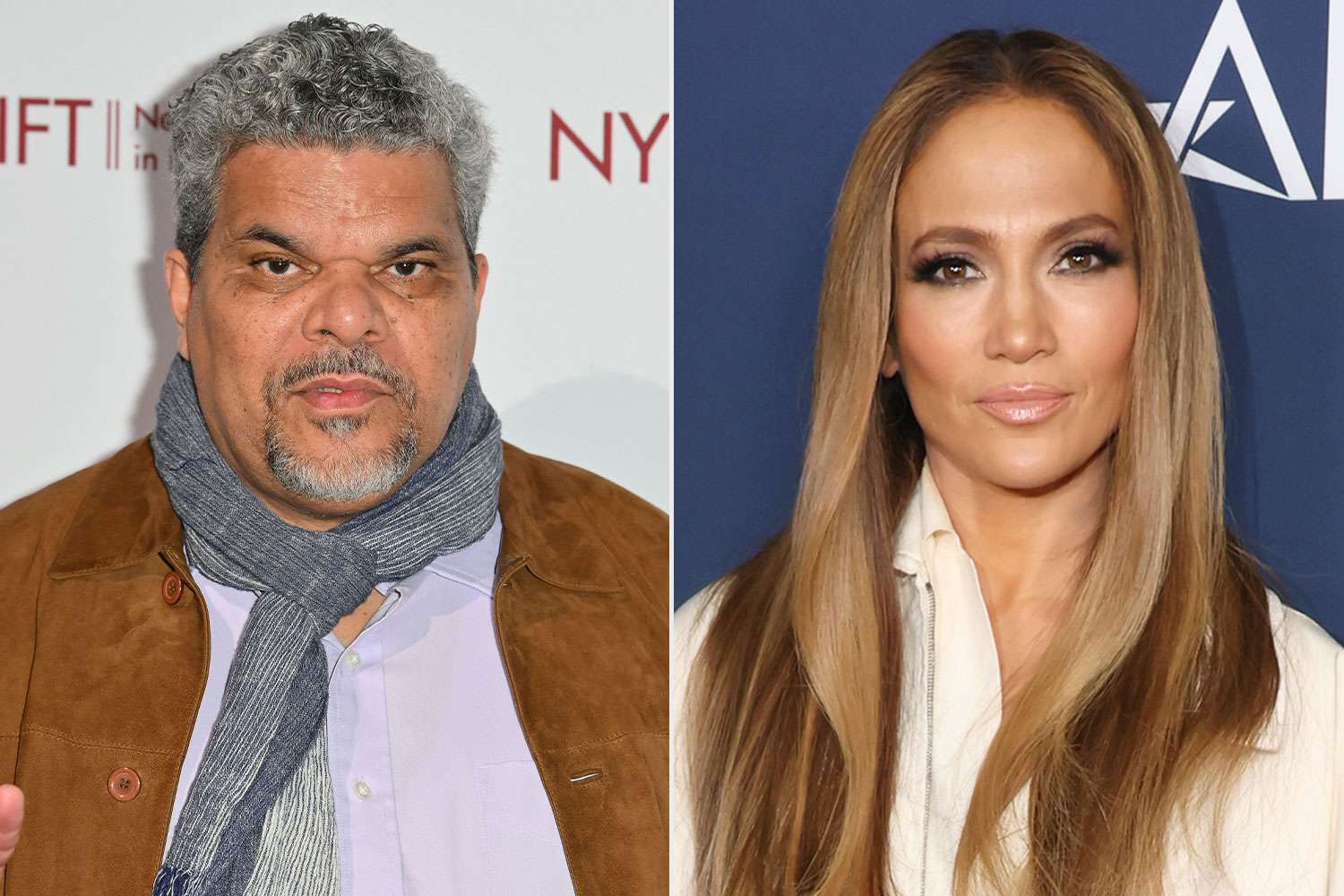

Viral Interview Luis Guzmans Unexpected Take On Working With Jennifer Lopez

Aug 31, 2025

Viral Interview Luis Guzmans Unexpected Take On Working With Jennifer Lopez

Aug 31, 2025 -

Top Fashion Moments 2025 Venice Film Festival Style

Aug 31, 2025

Top Fashion Moments 2025 Venice Film Festival Style

Aug 31, 2025 -

Red Carpet Ready Analyzing The Best Looks From The 2025 Venice Film Festival

Aug 31, 2025

Red Carpet Ready Analyzing The Best Looks From The 2025 Venice Film Festival

Aug 31, 2025

Latest Posts

-

Doubt Cast On Karoline Leavitts My Own Two Eyes Account Of Trumps Support

Sep 01, 2025

Doubt Cast On Karoline Leavitts My Own Two Eyes Account Of Trumps Support

Sep 01, 2025 -

Eviction Battle Showmans Long Fight For Family Home

Sep 01, 2025

Eviction Battle Showmans Long Fight For Family Home

Sep 01, 2025 -

Singapore Airlines Academy And Aia Singapore Develop Comprehensive Talent Development Initiative

Sep 01, 2025

Singapore Airlines Academy And Aia Singapore Develop Comprehensive Talent Development Initiative

Sep 01, 2025 -

Renfrow Returns To Panthers Roster Coker Lands On Ir

Sep 01, 2025

Renfrow Returns To Panthers Roster Coker Lands On Ir

Sep 01, 2025 -

Jason Sudeikis Ex Keeley Hazell On Ted Lasso Role I Felt Like I D Been Punched

Sep 01, 2025

Jason Sudeikis Ex Keeley Hazell On Ted Lasso Role I Felt Like I D Been Punched

Sep 01, 2025