Synopsys Revenue Falls Short Of Forecasts: Impact On Stock Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Synopsys Revenue Falls Short of Forecasts: Stock Price Takes a Hit

Synopsys, Inc. (SNPS), a leading provider of electronic design automation (EDA) software and semiconductor intellectual property (IP), reported weaker-than-expected second-quarter fiscal 2024 earnings, sending ripples through the tech sector and impacting its stock price. The news underscores the current challenges faced by semiconductor companies amid a global economic slowdown and softening demand for chips.

The company announced revenue of $1.53 billion, falling short of analysts' consensus estimate of $1.56 billion. While this represents a year-over-year increase, the shortfall triggered immediate concerns among investors. The miss was attributed to several factors, including a slowdown in bookings, particularly in its Verification Group, a key segment contributing significantly to Synopsys' overall revenue.

What Drove the Revenue Miss?

Several contributing factors contributed to Synopsys' disappointing Q2 results:

-

Weakening Semiconductor Demand: The global semiconductor market is experiencing a slowdown, driven by factors like macroeconomic uncertainty, inventory adjustments by major chip manufacturers, and reduced consumer spending. This directly impacts the demand for Synopsys' EDA software and IP, essential tools used in chip design.

-

Geopolitical Uncertainty: The ongoing geopolitical tensions, particularly the US-China relationship, create further uncertainty for the semiconductor industry. This instability can impact investment decisions and overall market growth, influencing Synopsys' performance.

-

Increased Competition: The EDA market is becoming increasingly competitive, with both established players and emerging startups vying for market share. Synopsys faces pressure to maintain its technological edge and offer competitive pricing to retain its customer base.

Impact on Synopsys Stock Price:

Following the announcement, Synopsys' stock price experienced a significant decline. Investors reacted negatively to the missed revenue expectations, reflecting concerns about the company's future growth prospects in the current market environment. The stock price drop highlights the market's sensitivity to even minor deviations from anticipated performance in the technology sector. This underscores the importance of accurate forecasting and consistent delivery of results for companies in this volatile market.

Looking Ahead: Synopsys' Outlook and Future Strategies

While the Q2 results were disappointing, Synopsys maintained a relatively optimistic outlook for the remainder of the fiscal year. The company emphasized its strong long-term growth potential and highlighted its continued investment in research and development to maintain its technological leadership. Strategic acquisitions and partnerships could also play a crucial role in bolstering its market position and driving future growth. However, the company's ability to navigate the current economic headwinds and adapt to shifting market dynamics will be key to its success.

Investors and analysts will be closely watching Synopsys' performance in the coming quarters to assess the company's ability to regain momentum and meet revised expectations. The company's future success will depend on its ability to effectively address the challenges presented by weakening semiconductor demand, geopolitical uncertainty, and intensified competition.

Further Reading: For more in-depth analysis of the semiconductor industry, you may find resources like the Semiconductor Industry Association (SIA) website helpful. [Link to SIA website]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Synopsys Revenue Falls Short Of Forecasts: Impact On Stock Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Another Government Fall In France What Now For The French Presidency

Sep 11, 2025

Another Government Fall In France What Now For The French Presidency

Sep 11, 2025 -

New Pokemon Legends Arceus Trailer Showcases Mega Malamar

Sep 11, 2025

New Pokemon Legends Arceus Trailer Showcases Mega Malamar

Sep 11, 2025 -

Banksys Latest Artwork High Court Appearance Stirs London

Sep 11, 2025

Banksys Latest Artwork High Court Appearance Stirs London

Sep 11, 2025 -

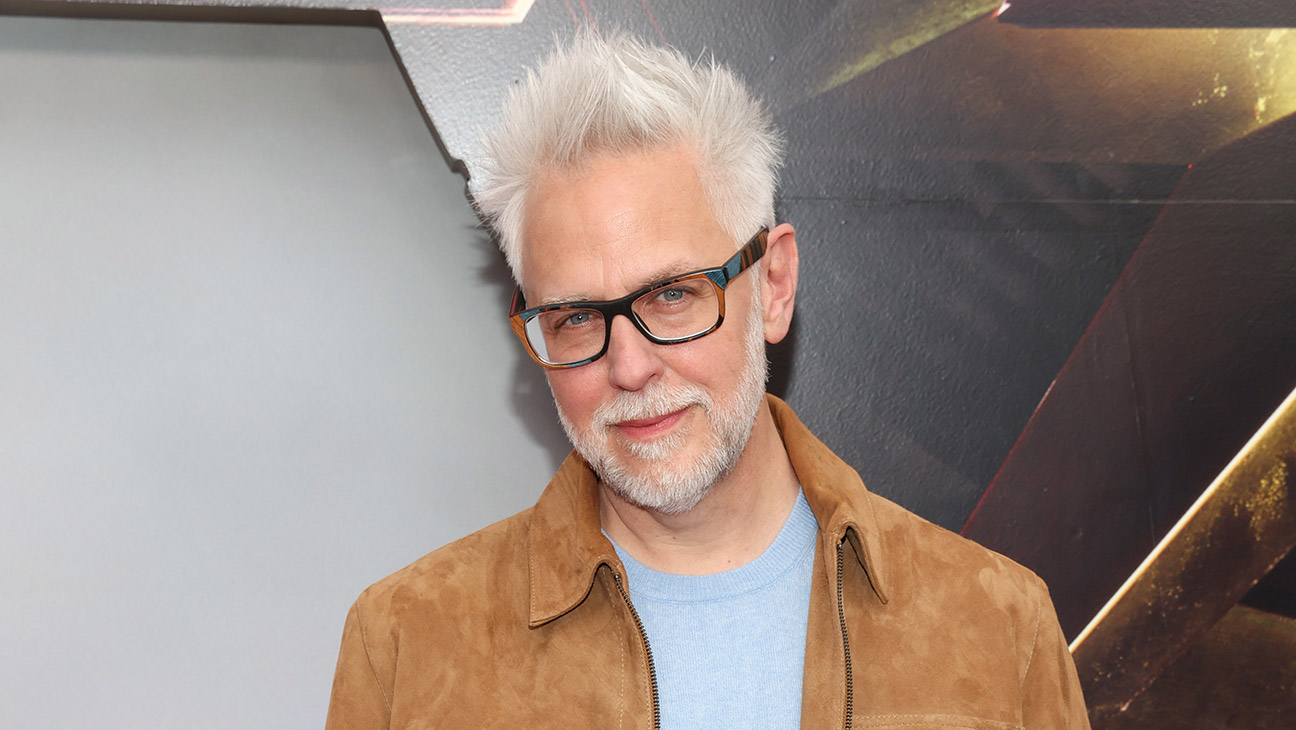

Supermans Future James Gunns Man Of Tomorrow Plans Revealed

Sep 11, 2025

Supermans Future James Gunns Man Of Tomorrow Plans Revealed

Sep 11, 2025 -

The Evolving Career Of Alex Winter Adulthood And Beyond

Sep 11, 2025

The Evolving Career Of Alex Winter Adulthood And Beyond

Sep 11, 2025

Latest Posts

-

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025 -

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025 -

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025 -

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025 -

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025