"Suited Not Booted": The Impact On Property Taxes Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Suited Not Booted: Understanding the Impact of "Suited Not Booted" on Your Property Taxes

The phrase "suited not booted" might sound like a line from a quirky movie, but in the world of property taxes, it represents a significant shift in assessment practices. This new approach, gaining traction in various jurisdictions, is changing how property values are determined and, consequently, impacting what homeowners pay in taxes. This article breaks down the "suited not booted" methodology, explaining its implications and how it affects your property tax bill.

What Does "Suited Not Booted" Actually Mean?

Traditionally, property assessments relied heavily on drive-by appraisals – the "booted" approach. Assessors would quickly drive past properties, making estimations based on external appearances alone. This often led to inaccurate valuations, overlooking crucial interior features and failing to account for market fluctuations accurately.

"Suited not booted," on the other hand, represents a more thorough and detailed assessment process. It emphasizes in-person inspections ("suited") by trained assessors, who meticulously examine both the interior and exterior of properties. This involves a more comprehensive analysis of:

- Square footage: Accurate measurements are crucial for determining property value.

- Interior features: High-end finishes, updated kitchens and bathrooms, and unique architectural details significantly influence value.

- Exterior condition: Roofing, landscaping, and overall maintenance are factored into the assessment.

- Comparable sales: Recent sales of similar properties in the neighborhood are used to benchmark the valuation.

The Impact on Your Property Taxes:

The shift towards "suited not booted" assessments can have a two-sided impact on property taxes:

-

Increased accuracy: The more thorough inspection process generally leads to more accurate property valuations. This means properties are assessed more fairly, reflecting their true market value. For homeowners whose properties were previously undervalued, this could result in a higher tax bill. However, this is balanced by the improved fairness of the system.

-

Potential for tax increases (or decreases): While aiming for accuracy, the transition may lead to some tax increases for certain homeowners whose properties were previously undervalued using the "booted" method. Conversely, homeowners whose properties were overvalued might see their tax bills decrease. It's crucial to understand that this isn't necessarily a negative change; it's a move towards a fairer system.

How to Prepare for "Suited Not Booted" Assessments:

- Review your property records: Ensure the information held by your local assessor's office is accurate and up-to-date. Any discrepancies could lead to inaccurate valuations.

- Document improvements: Keep detailed records of any home improvements or renovations you've made. This documentation can support your property's assessed value.

- Understand your rights: Familiarize yourself with the appeals process for property tax assessments in your jurisdiction. If you believe your assessment is inaccurate, you have the right to appeal.

Navigating the Change:

The transition to "suited not booted" assessments is a positive step towards a more equitable property tax system. While it might lead to some initial adjustments in tax bills, the long-term benefits of improved accuracy and fairness outweigh the short-term inconveniences. Staying informed and proactive can help homeowners navigate this shift effectively.

Learn More:

For more information on property tax assessments in your area, contact your local assessor's office. You can typically find their contact information on your county or municipality's website. Understanding the process and your rights is crucial for ensuring you pay a fair share of property taxes. Staying informed about changes in assessment methodology is crucial for responsible homeownership.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on "Suited Not Booted": The Impact On Property Taxes Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Michigan Lottery Daily 3 And Daily 4 Results For August 17th 2025

Aug 21, 2025

Michigan Lottery Daily 3 And Daily 4 Results For August 17th 2025

Aug 21, 2025 -

Is An Arctic Vacation Really Cool A Realistic Look At Polar Travel

Aug 21, 2025

Is An Arctic Vacation Really Cool A Realistic Look At Polar Travel

Aug 21, 2025 -

Trump Zelensky Meeting A Look At The Fashion And Diplomacy

Aug 21, 2025

Trump Zelensky Meeting A Look At The Fashion And Diplomacy

Aug 21, 2025 -

Minnesota Vikings Cheerleaders Inclusion Sparks Debate

Aug 21, 2025

Minnesota Vikings Cheerleaders Inclusion Sparks Debate

Aug 21, 2025 -

Navigating Results Day Stress Management Techniques For Neurodivergent Students

Aug 21, 2025

Navigating Results Day Stress Management Techniques For Neurodivergent Students

Aug 21, 2025

Latest Posts

-

Country Star Bill Anderson Injured Forces Grand Ole Opry Show Cancellation

Aug 21, 2025

Country Star Bill Anderson Injured Forces Grand Ole Opry Show Cancellation

Aug 21, 2025 -

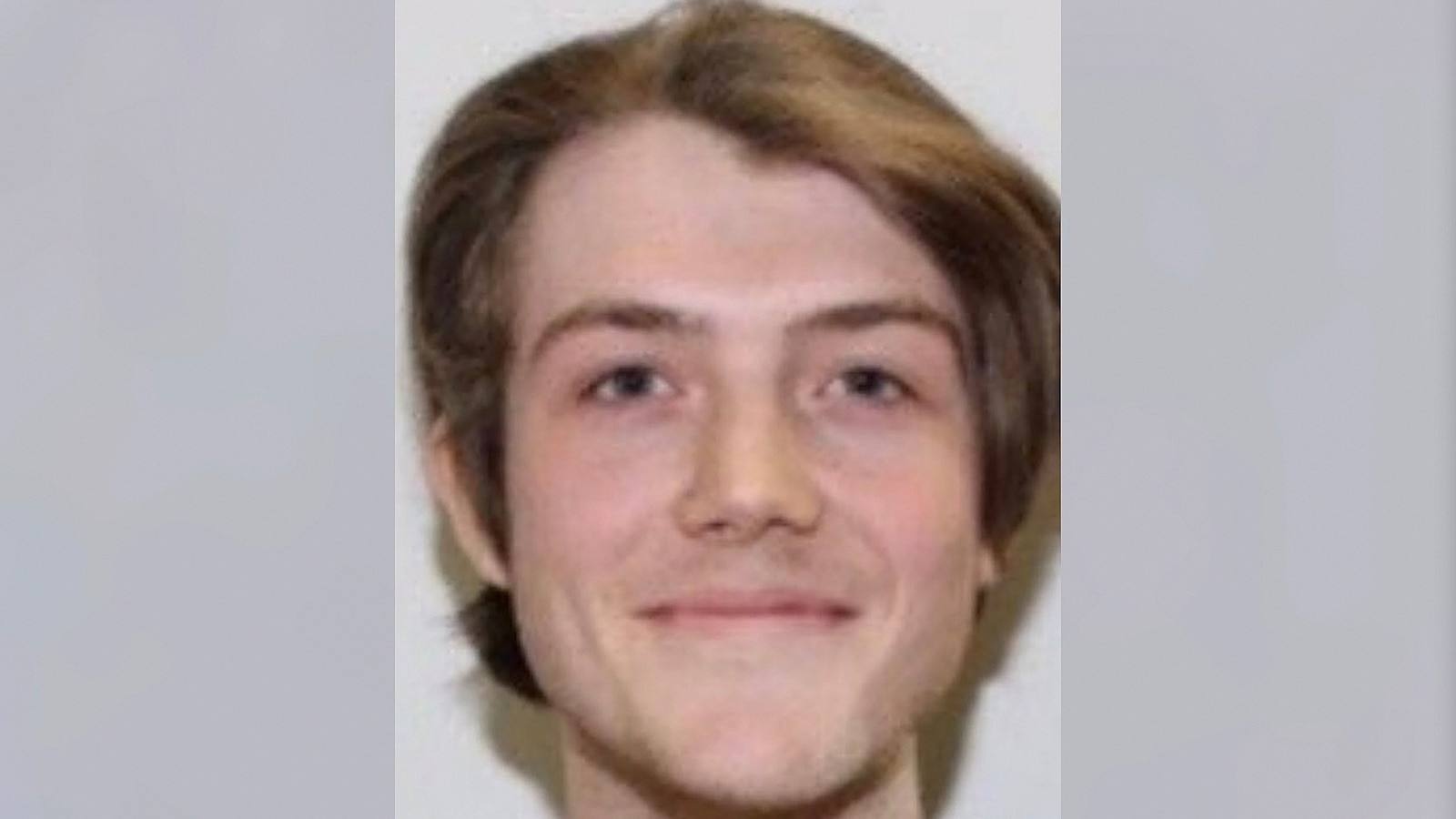

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025 -

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025 -

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025 -

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025