"Suited Not Booted": Deciphering The Latest Property Tax News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Suited Not Booted: Deciphering the Latest Property Tax News

Property taxes. The words alone can send shivers down the spine of even the most seasoned homeowner. But understanding the latest changes and navigating the often-complex world of property tax assessments is crucial to protecting your financial well-being. This article cuts through the jargon and delivers the key takeaways from recent property tax news, helping you stay informed and, hopefully, save money.

What's the Buzz? Recent Changes in Property Tax Assessments

Recent news cycles have been filled with updates regarding property tax assessments, leaving many homeowners confused and concerned. The headlines often focus on dramatic increases, but the reality is far more nuanced. Understanding the underlying factors is critical. These factors often include:

-

Reassessments: Many municipalities are conducting reassessments of property values, often driven by rising market prices. This can lead to higher tax bills, but it also means that properties have increased in value, potentially benefiting homeowners in the long run (e.g., when selling).

-

Tax Rate Changes: Local governments may adjust tax rates, impacting the final tax bill even if your property assessment remains the same. This can be due to budget changes, infrastructure projects, or other municipal decisions.

-

Exemptions and Appeals: It's crucial to understand what exemptions you might be eligible for, such as those for seniors, veterans, or disabled individuals. Knowing your rights regarding appealing a property tax assessment is equally important.

Navigating the Complexities: Key Terms to Know

Understanding the terminology used in property tax discussions is essential for effective advocacy. Here are a few key terms to keep in mind:

-

Assessed Value: The value assigned to your property by the local government for tax purposes. This is often different from the market value.

-

Mill Rate: A tax rate expressed in mills (1/1000 of a dollar) per dollar of assessed value. This is a key factor in calculating your property tax bill.

-

Tax Levy: The total amount of taxes collected by a local government.

-

Appeal Process: The procedure for challenging your property tax assessment if you believe it's inaccurate. Understanding deadlines and required documentation is crucial.

How to Protect Yourself:

Staying informed is the best defense against unexpected property tax increases. Here are some actionable steps you can take:

-

Monitor Assessments Regularly: Check your property tax assessment online periodically to ensure accuracy.

-

Understand Your Local Laws: Familiarize yourself with the property tax laws and procedures in your area.

-

Explore Exemptions: Research available exemptions that could reduce your tax burden.

-

Consider Professional Help: If you're facing significant challenges or believe your assessment is inaccurate, consider seeking assistance from a property tax attorney or consultant.

Looking Ahead: Future Trends in Property Taxation

Predicting future trends in property taxation is challenging, but staying informed about local government budgets and economic conditions can help you anticipate potential changes. Following local news sources and attending town hall meetings can be invaluable in staying ahead of the curve.

Conclusion: Stay Informed and Proactive

The world of property taxes can be complex, but being informed and proactive can significantly impact your financial well-being. By understanding the latest news, key terms, and your rights, you can navigate this landscape with greater confidence and protect your investment. Remember to regularly check your assessment and explore all available options for reducing your tax burden. Don't be "booted" – be "suited" for success in managing your property taxes!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on "Suited Not Booted": Deciphering The Latest Property Tax News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netflixs The Leading Man John Cena And Kevin Hart Headline New Action Comedy

Aug 20, 2025

Netflixs The Leading Man John Cena And Kevin Hart Headline New Action Comedy

Aug 20, 2025 -

Mlb News Carlos Rodons 13th Win Five Strikeouts

Aug 20, 2025

Mlb News Carlos Rodons 13th Win Five Strikeouts

Aug 20, 2025 -

Ditch The Car Take A Dip The Swiss Swim Commute

Aug 20, 2025

Ditch The Car Take A Dip The Swiss Swim Commute

Aug 20, 2025 -

Mega Millions Lottery August 19th Winning Numbers And 216 M Jackpot Update

Aug 20, 2025

Mega Millions Lottery August 19th Winning Numbers And 216 M Jackpot Update

Aug 20, 2025 -

Teetotalers Rejoice Restaurant Offers Uks First Extensive Water Menu

Aug 20, 2025

Teetotalers Rejoice Restaurant Offers Uks First Extensive Water Menu

Aug 20, 2025

Latest Posts

-

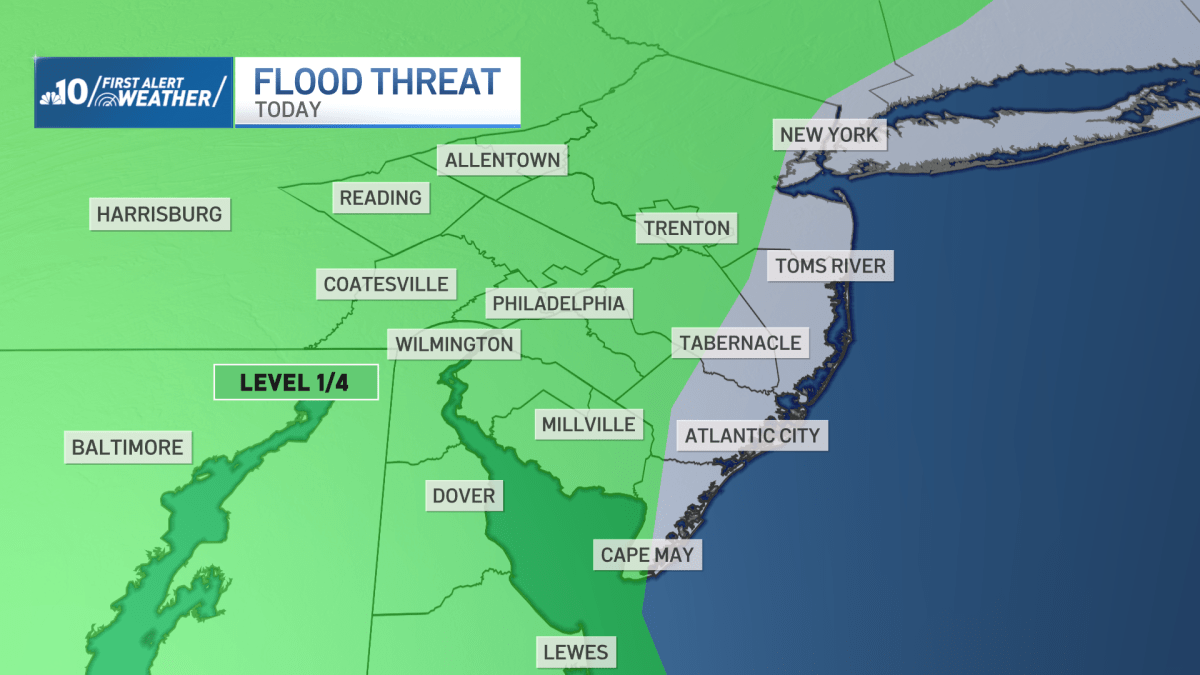

Powerful Storms Unleash Downpours And Widespread Flooding In Philadelphia

Aug 20, 2025

Powerful Storms Unleash Downpours And Widespread Flooding In Philadelphia

Aug 20, 2025 -

Rodons Stellar Outing Five Ks Power Yankees To 13th Win

Aug 20, 2025

Rodons Stellar Outing Five Ks Power Yankees To 13th Win

Aug 20, 2025 -

Resolution Reached Uk And Us Settle Apple Privacy Dispute

Aug 20, 2025

Resolution Reached Uk And Us Settle Apple Privacy Dispute

Aug 20, 2025 -

Cleveland Guardians Arizona Project Fallout

Aug 20, 2025

Cleveland Guardians Arizona Project Fallout

Aug 20, 2025 -

Cleveland Guardians Prospect Parker Messick Set For Big League Start

Aug 20, 2025

Cleveland Guardians Prospect Parker Messick Set For Big League Start

Aug 20, 2025