Student Loan Debt: Crushing The American Dream?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Student Loan Debt: Crushing the American Dream?

The American Dream – a concept deeply rooted in the pursuit of homeownership, financial stability, and upward mobility – is facing a formidable challenge: crippling student loan debt. For millions of Americans, the pursuit of higher education, once a pathway to prosperity, has become a precarious financial tightrope walk, leaving many questioning whether the dream is achievable at all. This article explores the escalating student loan crisis and its impact on the nation's economic future.

The Mounting Burden of Student Loans

The total amount of student loan debt in the United States now surpasses $1.7 trillion, exceeding both credit card and auto loan debt. This staggering figure represents a significant burden on individual borrowers and the economy as a whole. The average student loan debt for the class of 2022 is estimated to be around $37,000, a number that continues to rise annually. This debt isn't just affecting recent graduates; many older borrowers are also struggling to manage their payments, delaying major life milestones like homeownership and starting a family.

Consequences of Unmanageable Debt

The ramifications of this debt crisis are far-reaching:

- Delayed Homeownership: The high cost of student loans significantly impacts a young person's ability to save for a down payment and secure a mortgage. This delays or prevents homeownership, a cornerstone of the American Dream for many generations.

- Reduced Spending & Economic Growth: With a large portion of their income dedicated to loan repayments, borrowers have less disposable income to spend on goods and services, impacting overall economic growth.

- Mental Health Strain: The constant pressure of student loan debt contributes to significant stress and anxiety, negatively impacting mental health and overall well-being.

- Impact on Entrepreneurship: The fear of further debt often discourages young graduates from pursuing entrepreneurial ventures, hindering innovation and job creation.

- Limited Career Choices: Graduates may be forced to accept lower-paying jobs to manage their debt, limiting career advancement opportunities.

Potential Solutions and Policy Changes

Addressing this crisis requires a multifaceted approach:

- Increased Funding for Public Colleges and Universities: Lowering tuition costs through increased state and federal funding would directly address the root cause of the problem.

- Income-Driven Repayment Plans: Expanding and improving income-driven repayment plans ensures that loan payments are manageable based on individual earnings. The Biden administration's recent efforts to expand these plans are a step in the right direction. [Link to relevant government website]

- Loan Forgiveness Programs: While controversial, targeted loan forgiveness programs can provide immediate relief to struggling borrowers. However, the long-term economic implications of such programs need careful consideration.

- Financial Literacy Initiatives: Educating students and families about responsible borrowing and financial planning can help prevent future debt crises.

Moving Forward: Redefining the American Dream

The student loan debt crisis presents a serious challenge to the American Dream. However, through a combination of policy changes, increased financial literacy, and a broader societal shift in perspectives on higher education costs, it is possible to create a more equitable and accessible path to financial success for future generations. The conversation needs to move beyond simply managing the debt and focus on preventing its accumulation in the first place. This requires a national dialogue involving policymakers, educators, and students themselves to create a sustainable solution for the future.

Call to Action: Stay informed about student loan debt legislation and advocate for policies that support accessible and affordable higher education. [Link to relevant advocacy organization]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Student Loan Debt: Crushing The American Dream?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

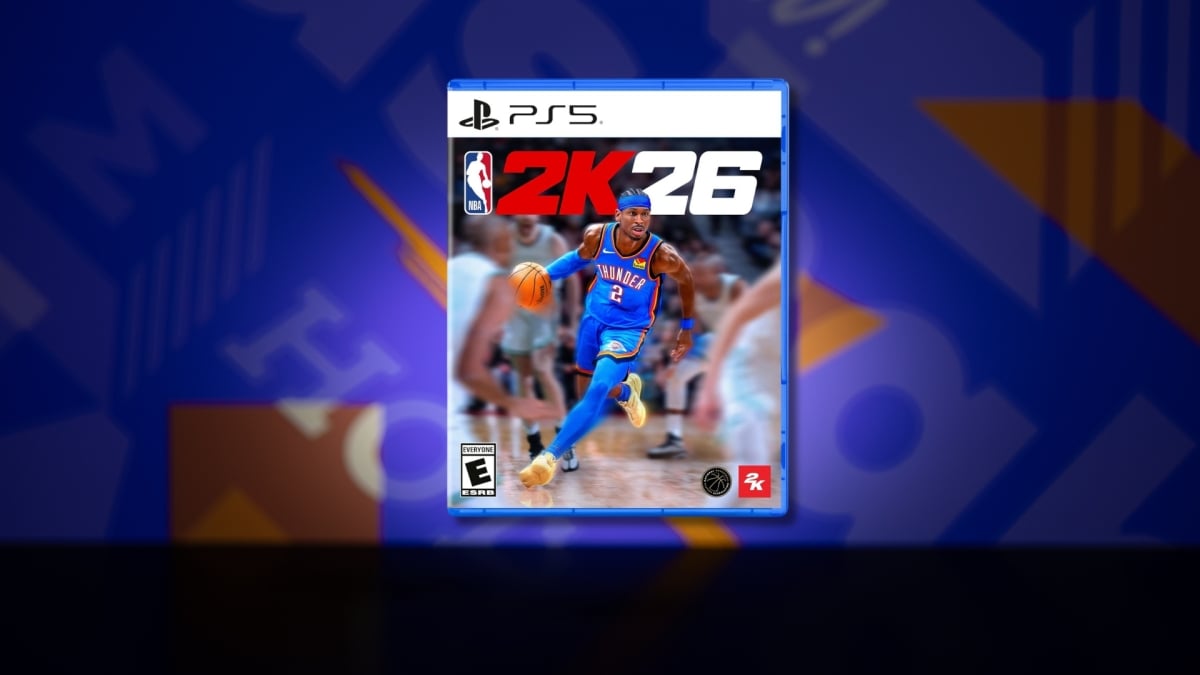

Get Ahead Of The Game Nba 2 K26 Early Access Release Date And Guide

Sep 04, 2025

Get Ahead Of The Game Nba 2 K26 Early Access Release Date And Guide

Sep 04, 2025 -

30th Anniversary Reflecting On The Legacy Of Xena Warrior Princess

Sep 04, 2025

30th Anniversary Reflecting On The Legacy Of Xena Warrior Princess

Sep 04, 2025 -

U S Consumer Price Index Cpi Increase In June Analysis And Outlook

Sep 04, 2025

U S Consumer Price Index Cpi Increase In June Analysis And Outlook

Sep 04, 2025 -

Government Restructure And Labours Immigration Policy Key Developments

Sep 04, 2025

Government Restructure And Labours Immigration Policy Key Developments

Sep 04, 2025 -

Wednesday Season 2 Part 2 Cast Episodes And Release Information

Sep 04, 2025

Wednesday Season 2 Part 2 Cast Episodes And Release Information

Sep 04, 2025

Latest Posts

-

Brother Weases Lasting Legacy On Rochester Radio

Sep 06, 2025

Brother Weases Lasting Legacy On Rochester Radio

Sep 06, 2025 -

Buckingham Palace Confirms Death Of Duchess Of Kent At Age 92

Sep 06, 2025

Buckingham Palace Confirms Death Of Duchess Of Kent At Age 92

Sep 06, 2025 -

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025 -

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025 -

The End Of An Era Brother Weases Farewell To Rochester Radio

Sep 06, 2025

The End Of An Era Brother Weases Farewell To Rochester Radio

Sep 06, 2025