Student Loan Bubble On The Brink: Preparing For Potential Market Fallout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Student Loan Bubble on the Brink: Preparing for Potential Market Fallout

The looming student loan debt crisis in the United States is no longer a whisper; it's a roar echoing through the halls of Congress and across countless kitchen tables. With trillions of dollars in outstanding student loan debt and a payment pause set to expire, many experts are warning of a potential market fallout that could ripple through the economy. Is a student loan bubble about to burst? And what can individuals and the market do to prepare?

The Ticking Time Bomb: Unprecedented Debt Levels

The sheer scale of student loan debt in the US is staggering. Over $1.7 trillion is currently outstanding, surpassing even credit card debt. This unprecedented level of debt has been fueled by rising tuition costs, easy access to loans, and a growing emphasis on higher education as a prerequisite for economic success. However, the current economic climate, marked by inflation and uncertainty, is putting immense pressure on borrowers.

The Payment Pause: A Temporary Reprieve?

The COVID-19 pandemic brought a temporary reprieve in the form of a payment pause on federal student loans. While this provided crucial breathing room for many borrowers, the looming resumption of payments casts a long shadow. Millions of borrowers are unprepared for the return of monthly payments, potentially leading to a wave of defaults and delinquencies. This is particularly concerning given the already strained financial positions of many young adults burdened by student loan debt.

Potential Market Fallout: A Cascade of Consequences

The potential consequences of a student loan bubble bursting are far-reaching:

- Increased Delinquencies and Defaults: A surge in defaults could negatively impact credit scores, hindering borrowers' ability to access credit for mortgages, car loans, and other essential financial products.

- Economic Slowdown: Reduced consumer spending due to debt burden could contribute to an economic slowdown, impacting businesses and employment.

- Market Volatility: Uncertainty surrounding the student loan market could trigger volatility in financial markets, affecting investor confidence.

- Political Pressure: The crisis will undoubtedly intensify political pressure to address the issue, potentially leading to significant policy changes and legislative action.

Preparing for the Fallout: Strategies for Individuals and the Market

While the future remains uncertain, proactive measures can help mitigate the potential fallout:

For Individuals:

- Budgeting and Financial Planning: Create a realistic budget that incorporates student loan payments. Explore options like income-driven repayment plans to manage monthly expenses.

- Debt Consolidation: Consider consolidating multiple loans into a single loan with a lower interest rate.

- Financial Literacy: Improve your understanding of personal finance to make informed decisions about your debt. Many free resources are available online. [Link to a reputable financial literacy website]

- Seeking Professional Advice: Consult with a financial advisor to develop a personalized debt management strategy.

For the Market:

- Diversification: Investors should diversify their portfolios to mitigate the risk associated with potential student loan market volatility.

- Risk Assessment: Financial institutions need to carefully assess the risk associated with student loan portfolios.

- Regulatory Oversight: Stronger regulatory oversight is needed to prevent future crises and protect borrowers.

The Road Ahead: A Call for Action

The student loan crisis demands immediate attention. A collaborative effort involving policymakers, lenders, and borrowers is crucial to navigate this challenging situation. Ignoring the problem will only exacerbate the potential fallout and create lasting economic damage. The time for proactive measures is now. What steps do you think are necessary to address this looming crisis? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Student Loan Bubble On The Brink: Preparing For Potential Market Fallout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gaza City Attacks Intensify Mass Exodus Of Families And Children

Sep 04, 2025

Gaza City Attacks Intensify Mass Exodus Of Families And Children

Sep 04, 2025 -

Eth Smart Contract Security Understanding The Latest Malware Threat

Sep 04, 2025

Eth Smart Contract Security Understanding The Latest Malware Threat

Sep 04, 2025 -

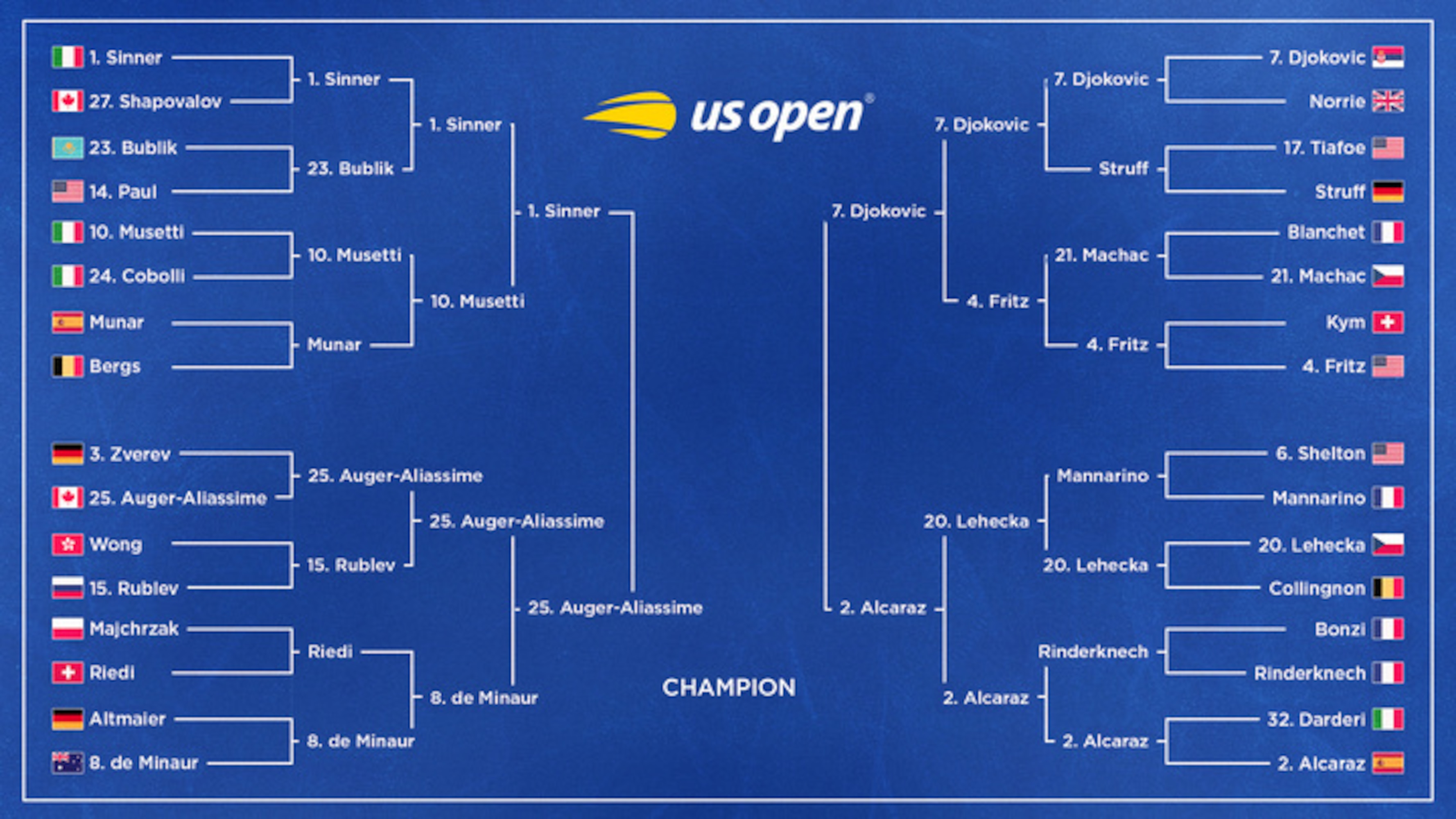

Us Open 2025 Analyzing The Mens Semifinal Draw And Top Contenders

Sep 04, 2025

Us Open 2025 Analyzing The Mens Semifinal Draw And Top Contenders

Sep 04, 2025 -

Under 16s New Restrictions On Energy Drink Sales

Sep 04, 2025

Under 16s New Restrictions On Energy Drink Sales

Sep 04, 2025 -

Is Nba 2 K26 Worth The Hype An Ongoing Review

Sep 04, 2025

Is Nba 2 K26 Worth The Hype An Ongoing Review

Sep 04, 2025