Student Loan Bubble: Expert Warns Of Impending Crisis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Student Loan Bubble: Expert Warns of Impending Crisis

The weight of student loan debt is crushing millions, and a leading economist is sounding the alarm: we're on the brink of a full-blown student loan crisis. This isn't just about individual hardship; it's a systemic issue with potentially devastating consequences for the entire US economy.

The Looming Crisis: More Than Just Missed Payments

The current student loan debt in the United States surpasses $1.7 trillion – a staggering figure that surpasses even credit card debt. While the recent pause on federal student loan repayments provided temporary relief, the looming resumption of payments has experts deeply concerned. Dr. Anya Sharma, a renowned economist specializing in financial markets, warns that the upcoming resumption isn't simply a matter of millions restarting payments; it signals a potential avalanche of defaults.

"This isn't just about individuals struggling to make payments," Dr. Sharma explains in a recent interview. "The sheer scale of this debt poses a significant risk to the entire financial system. We're talking about a potential domino effect, with ripple effects across the economy."

Factors Fueling the Bubble:

Several factors contribute to this burgeoning crisis:

- Rising Tuition Costs: The relentless increase in tuition fees at colleges and universities across the nation has outpaced inflation for decades. This makes higher education increasingly inaccessible without significant borrowing, fueling the debt burden.

- Limited Income Growth: Wage stagnation and the rising cost of living mean many graduates struggle to repay their loans, even with well-paying jobs. This is particularly true for those who pursued degrees in fields with lower earning potential.

- Predatory Lending Practices: While regulations exist, some argue that they are insufficient to curb predatory lending practices that target vulnerable students. This includes high-interest rates and misleading loan terms.

- The Pandemic's Impact: The COVID-19 pandemic exacerbated existing financial vulnerabilities, leaving many graduates even more ill-equipped to handle their loan repayments.

What Happens Next? Potential Consequences:

A widespread student loan default could have severe repercussions:

- Economic Slowdown: Reduced consumer spending due to debt burdens could significantly impact economic growth.

- Increased Inequality: The burden of student loan debt disproportionately affects low-income and minority borrowers, further exacerbating existing inequalities.

- Impact on the Housing Market: Difficulty in repaying loans could hinder homeownership for many young adults, impacting the housing market.

- Political Instability: The economic and social fallout could lead to increased political instability and social unrest.

Possible Solutions and Mitigation Strategies:

While the situation appears dire, there are potential solutions to mitigate the crisis:

- Debt Forgiveness Programs: While controversial, targeted debt forgiveness programs could provide immediate relief to struggling borrowers. However, the long-term financial implications of such programs require careful consideration. [Link to article discussing debt forgiveness proposals]

- Income-Driven Repayment Plans: Expanding and improving income-driven repayment plans could ensure that loan repayments are manageable for borrowers based on their income.

- Tuition Reform: Addressing the root cause of the problem – escalating tuition costs – through government regulation and increased funding for public universities is crucial for long-term solutions. [Link to article on tuition reform initiatives]

- Financial Literacy Programs: Improving financial literacy among students can help them make informed borrowing decisions and manage their debt effectively.

Conclusion: Urgent Action Needed

The student loan bubble is a ticking time bomb. Ignoring the issue will only exacerbate its consequences. Immediate and decisive action from policymakers, lenders, and educational institutions is crucial to prevent a full-blown economic crisis. The future of a generation, and the stability of the US economy, depends on it. What steps do you think are necessary to address this growing problem? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Student Loan Bubble: Expert Warns Of Impending Crisis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Democrats Seek Answers As Trump Prepares Aggressive Fall Campaign

Sep 04, 2025

Democrats Seek Answers As Trump Prepares Aggressive Fall Campaign

Sep 04, 2025 -

Inaccessible Parliament Mp Demands Improved Accessibility For Disabled

Sep 04, 2025

Inaccessible Parliament Mp Demands Improved Accessibility For Disabled

Sep 04, 2025 -

Is A Student Loan Crisis Imminent Insights From A Funding Expert

Sep 04, 2025

Is A Student Loan Crisis Imminent Insights From A Funding Expert

Sep 04, 2025 -

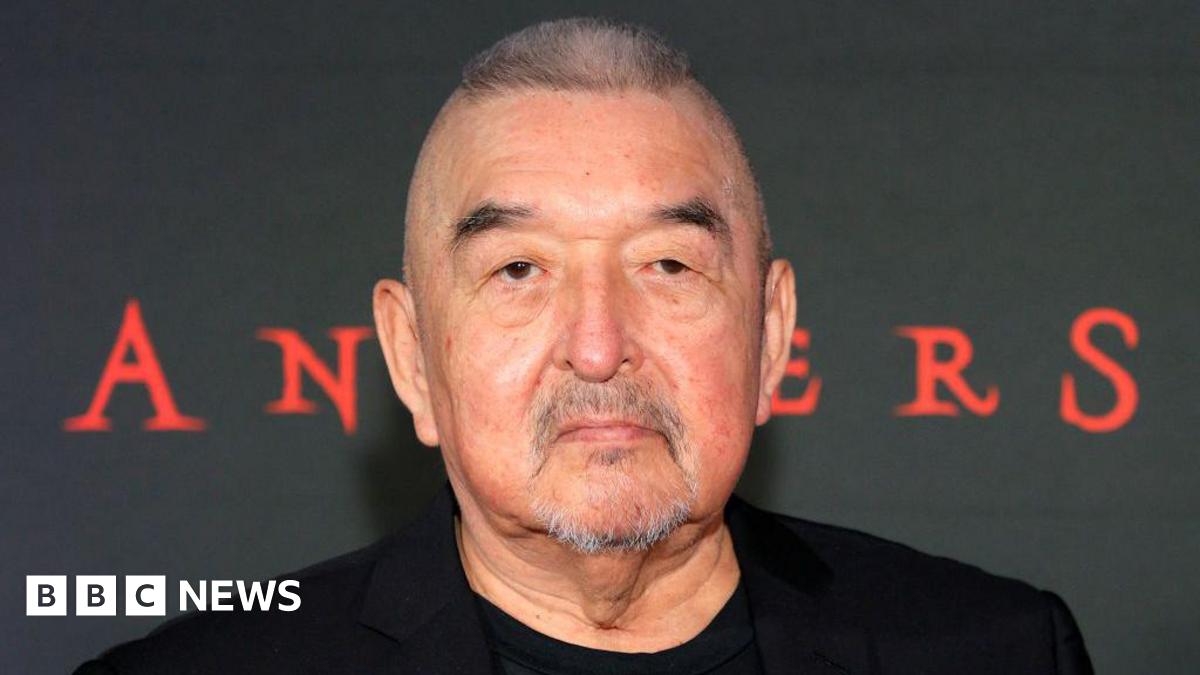

Remembering Graham Greene Dances With Wolves Star Passes Away

Sep 04, 2025

Remembering Graham Greene Dances With Wolves Star Passes Away

Sep 04, 2025 -

1 3 Billion Powerball Jackpot Tonights Drawing Could Make History

Sep 04, 2025

1 3 Billion Powerball Jackpot Tonights Drawing Could Make History

Sep 04, 2025