Student Funding Expert Warns: The Student Loan Bubble Is About To Pop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Student Funding Expert Warns: The Student Loan Bubble is About to Pop

The looming crisis in student loan debt is bigger than you think. A leading expert in student funding is sounding the alarm, predicting a significant crisis in the near future. Are you prepared for the potential fallout?

For years, the rising cost of higher education has been a concern, fueled by increasingly accessible student loans. This easy access, however, has created a massive bubble, and according to Dr. Anya Sharma, a renowned economist specializing in student finance, it's on the verge of bursting. Her recent report, published in the Journal of Higher Education Finance, paints a stark picture of the impending crisis.

The Ticking Time Bomb: Unmanageable Debt Levels

Dr. Sharma's research highlights the unsustainable levels of student loan debt accumulated by millions. The average student loan debt in the US now surpasses $37,000, a figure that continues to climb annually. This burden is crippling graduates, delaying major life milestones like homeownership, marriage, and starting families. Many are struggling to even meet basic living expenses, forcing them into a cycle of debt that's difficult to escape.

"The current system is fundamentally flawed," Dr. Sharma explains in a recent interview. "The ease with which students can access loans, coupled with rising tuition costs, has created a perfect storm. We're witnessing a generation burdened by debt, hindering their economic potential and long-term prosperity."

The Warning Signs: Are You at Risk?

Several key indicators point towards an impending crisis:

- Rising Default Rates: Student loan defaults are increasing at an alarming rate, suggesting many borrowers are struggling to repay their loans.

- Stagnant Wages: Wage growth hasn't kept pace with the rising cost of education, leaving graduates with significantly more debt relative to their earning potential.

- Limited Government Support: While some government programs exist to help struggling borrowers, they often fall short of addressing the scale of the problem.

- Increasing Private Loan Burden: The reliance on private student loans, often with higher interest rates and less flexible repayment options, exacerbates the financial strain on borrowers.

What Can You Do? Protecting Yourself from the Fallout

While the situation appears grim, there are steps you can take to mitigate the risk:

- Careful Budgeting and Planning: Before taking out student loans, create a detailed budget to understand the long-term financial implications.

- Explore Affordable Education Options: Consider community colleges, online courses, and vocational training as alternatives to expensive four-year universities.

- Maximize Scholarships and Grants: Aggressively pursue scholarships and grants to minimize your reliance on loans.

- Seek Professional Financial Advice: Consult a financial advisor to develop a personalized repayment plan.

The student loan bubble is a complex issue with far-reaching consequences. Dr. Sharma's warnings serve as a critical wake-up call for students, parents, and policymakers alike. It's time for proactive measures to address this looming crisis before it's too late. Learn more about managing student loan debt by visiting the . Understanding your options and planning carefully is crucial in navigating this challenging financial landscape. Don't wait until it's too late; take control of your financial future today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Student Funding Expert Warns: The Student Loan Bubble Is About To Pop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

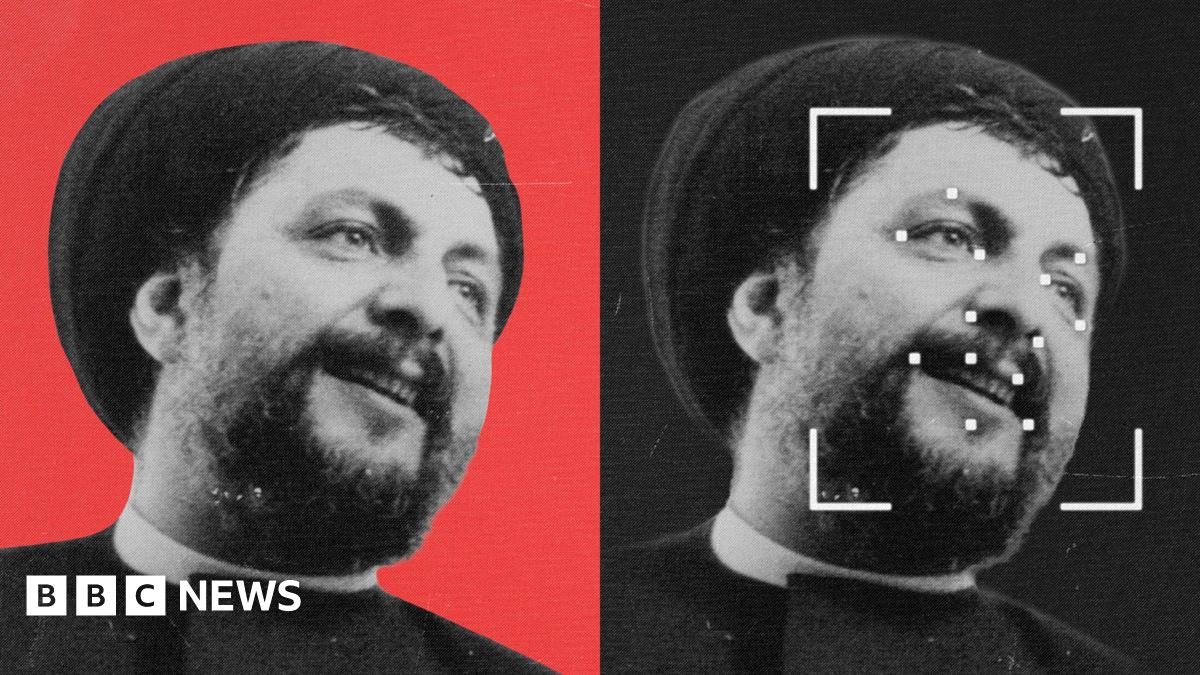

New Development In Musa Al Sadr Case Body Identified In Libyan Mortuary

Sep 04, 2025

New Development In Musa Al Sadr Case Body Identified In Libyan Mortuary

Sep 04, 2025 -

Traditional Turkish Oil Wrestling A Grappling Spectacle

Sep 04, 2025

Traditional Turkish Oil Wrestling A Grappling Spectacle

Sep 04, 2025 -

Heart Health Metrics Predicting Your Lifespan

Sep 04, 2025

Heart Health Metrics Predicting Your Lifespan

Sep 04, 2025 -

An In Depth Look At The Life And Work Of Michael K Pete Mehalic

Sep 04, 2025

An In Depth Look At The Life And Work Of Michael K Pete Mehalic

Sep 04, 2025 -

Musa Al Sadr Case Libyan Mortuary Discovery Offers Clues After 50 Years

Sep 04, 2025

Musa Al Sadr Case Libyan Mortuary Discovery Offers Clues After 50 Years

Sep 04, 2025

Riba Stirling Prize Nomination The Restoration Of Big Bens Elizabeth Tower

Riba Stirling Prize Nomination The Restoration Of Big Bens Elizabeth Tower

Zaderzhanie Aglai Tarasovoy V Domodedovo Chto Proizoshlo

Zaderzhanie Aglai Tarasovoy V Domodedovo Chto Proizoshlo

After A Car Accident Six Essential Actions To Take

After A Car Accident Six Essential Actions To Take

Remembering Brother Wease His Impact On Rochester Radio

Remembering Brother Wease His Impact On Rochester Radio