Social Security's Future Uncertain: Congress Must Act To Avert 2034 Benefit Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's Future Uncertain: Congress Must Act to Avert 2034 Benefit Reductions

The looming crisis: America's Social Security system, a vital lifeline for millions of retirees and disabled Americans, faces a critical juncture. Unless Congress acts decisively, significant benefit reductions are projected to begin in 2034. This potential cutback isn't a distant threat; it's a rapidly approaching reality demanding immediate attention from lawmakers and the public alike.

The Social Security Administration (SSA) has consistently warned about the impending shortfall in the system's trust funds. These funds, which pay out benefits to eligible recipients, are projected to be depleted by 2034. At that point, the SSA will only be able to pay approximately 80% of scheduled benefits – a drastic cut that would severely impact the financial security of millions.

Understanding the problem: The core issue lies in the changing demographics of the United States. The ratio of workers contributing to Social Security to retirees receiving benefits is shrinking. As the baby boomer generation enters retirement, the burden on the system increases dramatically. Simultaneously, life expectancy has risen, meaning individuals are drawing benefits for a longer period. These factors, combined with relatively stagnant payroll tax rates, create a perfect storm threatening the long-term solvency of Social Security.

Potential Solutions: A Multifaceted Approach

Congress has several options to address this impending crisis, and finding a viable solution requires a comprehensive approach:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits is one potential solution. This would extend the time workers contribute to the system before drawing benefits.

- Increasing the Taxable Wage Base: Currently, Social Security taxes only apply to earnings up to a certain limit. Raising this limit would broaden the tax base and increase revenue.

- Adjusting Benefit Formulas: Re-evaluating the current benefit formulas could help ensure the system's sustainability. This may involve adjusting calculations to reflect changing economic conditions and life expectancies.

- Cutting Benefits (The Least Desirable Option): While drastic benefit cuts are projected if no action is taken, this remains the least desirable option, potentially devastating for millions of vulnerable retirees.

The Urgency of Congressional Action

The longer Congress delays addressing this issue, the more drastic the necessary solutions will become. Waiting until the trust funds are depleted will force lawmakers to implement even more severe cuts to benefits or other drastic measures. This inaction risks leaving millions of seniors and disabled Americans facing financial hardship.

What You Can Do:

Staying informed is crucial. Contact your representatives in Congress and urge them to prioritize Social Security reform. Understand the various proposed solutions and advocate for those you believe are the most equitable and effective. The future of Social Security depends on our collective action. Learn more about Social Security's financial status by visiting the official . Your voice matters in shaping the future of this vital program.

Keywords: Social Security, Social Security benefits, retirement, retirement benefits, 2034, Congress, benefit reductions, Social Security reform, SSA, Social Security Administration, payroll tax, trust funds, full retirement age, taxable wage base, demographic changes, financial security, seniors, retirees, disabled Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's Future Uncertain: Congress Must Act To Avert 2034 Benefit Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

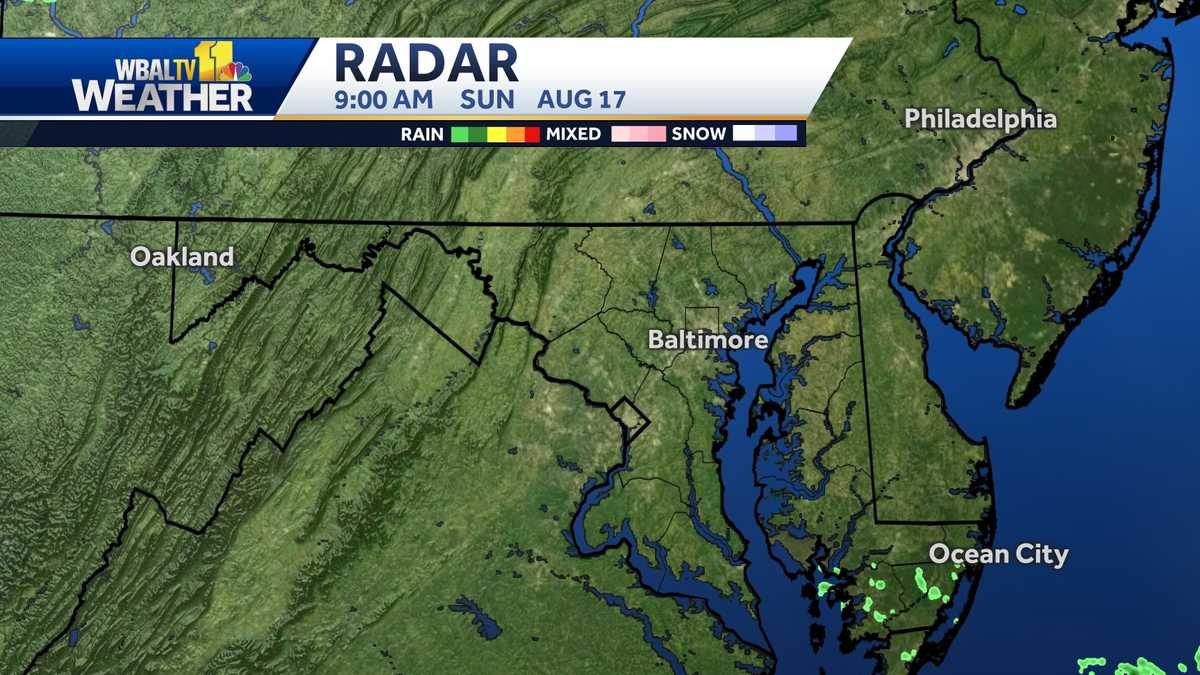

Second Line Of Storms To Hit Maryland Overnight

Jun 20, 2025

Second Line Of Storms To Hit Maryland Overnight

Jun 20, 2025 -

Nba Finals Game 6 Recap Oklahoma Citys Path To Victory Indianas Fight For Game 7

Jun 20, 2025

Nba Finals Game 6 Recap Oklahoma Citys Path To Victory Indianas Fight For Game 7

Jun 20, 2025 -

Heated Exchange Carlson Presses Cruz On Iran Strategy During Cnn Interview

Jun 20, 2025

Heated Exchange Carlson Presses Cruz On Iran Strategy During Cnn Interview

Jun 20, 2025 -

Democratic Senators Express Concerns Over Fettermans Public Statements

Jun 20, 2025

Democratic Senators Express Concerns Over Fettermans Public Statements

Jun 20, 2025 -

Wednesdays Game A Crushing Blow For The New York Liberty

Jun 20, 2025

Wednesdays Game A Crushing Blow For The New York Liberty

Jun 20, 2025

Latest Posts

-

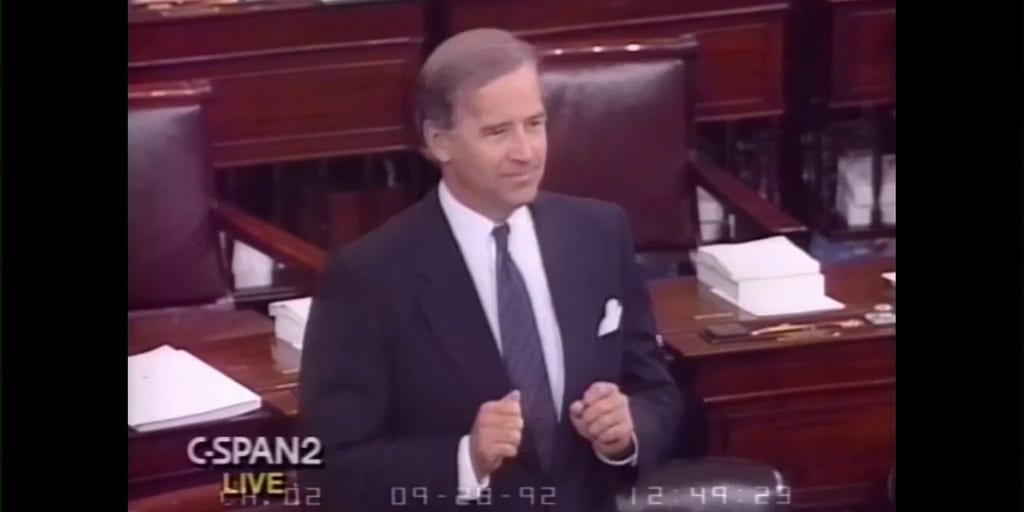

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025